The far-flung South Pacific Tax Farm of New Zealand is regarded as a bolt-hole for billionaires, a safe haven for capital and an ideal moated laboratory to test technologies. But, New Zealand is also a crisis-ridden society, beset with a housing affordability crisis, a poverty crisis and a debt crisis – among many others.

The far-flung South Pacific Tax Farm of New Zealand is regarded as a bolt-hole for billionaires, a safe haven for capital and an ideal moated laboratory to test technologies. But, New Zealand is also a crisis-ridden society, beset with a housing affordability crisis, a poverty crisis and a debt crisis – among many others.

Here – for the very first time – the phenomena of Auckland as a Global City, the curious recurrence of Thirteen in the housing crisis data, the bankers’ stealthy debt enslavement system and the epic $250 trillion global credit bubble, are explored as crisis mechanisms.

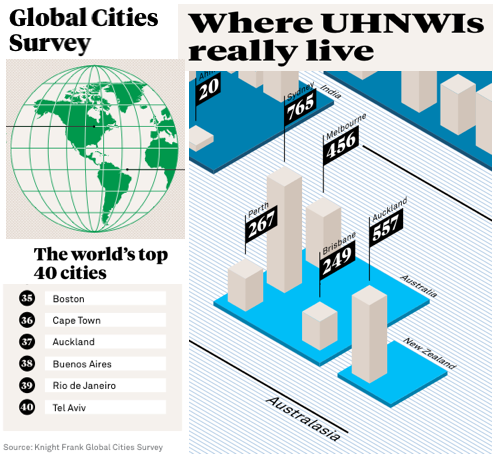

Auckland: A World City for the ‘Have-Mores’

At a time when The Economist magazine reports New Zealand is ranked as the most unaffordable place to live in the world,[1] New Zealand’s total debt also topped half a trillion dollars.[2]

New Zealand’s housing unaffordability ranking is the result of a drive for wealth accumulation and a search for bolt-holes, led by a Neo-Colonialist Sect of Rich-Listers – both foreign and domestic.[3] Neo-Colonialism is the hidden construction of vast monopolistic transnational consortiums owned by super-wealthy people who are positioned atop the Transnational Capitalist Class to control whole economies.[4] The Rich-Listers’ avarice has embroiled Auckland City in a ‘Global Cities Movement’ project, wherein such world-cities are serviced by public debt-funded infrastructure, Neo-Colonial institutions favouring high capital mobility, and large pools of excess labour to support the huge geographically dispersed transnational corporations that seek to accumulate capital faster and faster.[5] Structural pressures are intensified to construct huge cities in a Neo-Colonial Capitalist system – where fast capital flows and systemic unemployment are in-built. Such structural pressures serve the aggressive logic of yield-seeking capital that drives wealth accumulators to keep zombie capital ‘alive’ with new growth opportunities. Consequently, New Zealand is a crisis-ridden society beset with a ‘Shock Doctrine’ economic warfare framework.[6]

Housing Unaffordability as a Brotherly Crisis Mechanism of Change

The data on Auckland’s house prices shows the bubble inflated at an exponential rate of 7% per year over a decade.[21] In the 10-year period between August 2006 and August 2016, the ‘City of Sails’ recorded a jump in average house prices from $500,000 to $1,000,000. This jump means that the doubling in value of Auckland’s house market bubble is at a rate that fits perfectly the mathematical phenomena known as the ‘doubling time’.[22] Applying the doubling time concept at the 7% annual growth rate, Auckland’s average house price would double again in just 5 years, reaching $2m in August 2021, and $8m in May 2025 – if all underlying factors remained constant.

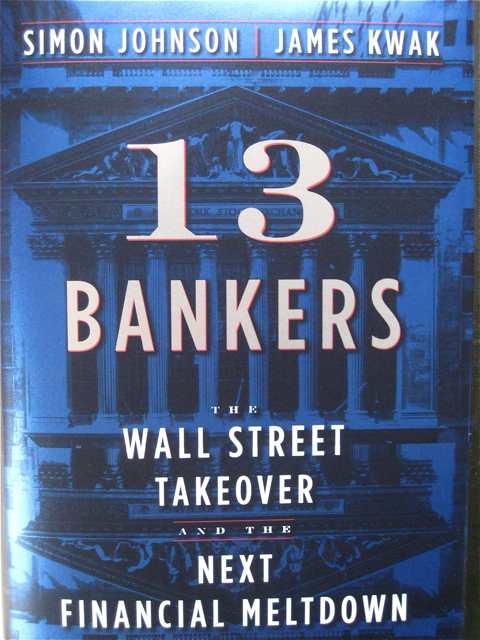

The housing affordability crisis occurs amid a housing supply crisis. To alleviate the housing shortage, an ‘Auckland Housing Accord’ was signed between the Auckland Supercity Council and the New Zealand Central Government in October 2013, that set a target for building 39,000 houses over 3 years, or an average of 13,000 houses per year.[9] The Auckland Council’s ‘Housing Action Plan’ also set this arbitrary target of 13,000 houses to be built every year for 30 years, or 390,000 houses, evidently to meet estimates of Auckland population growth.[10] Here, a curious recurring phenomenon emerges. The number 13 is embedded in the housing crisis, signaling ‘unity’ and ‘fraternal love’ among a brotherhood.[11]

The planting of Thirteen and its multiples as mundane data into events, signifies the presence of an oligarchic Brotherhood that are advancing a game together – as weird as it sounds.[12] (This occult practice was embedded in New Zealand during the colonial era).[13] Because oligarchs are super-rich people who can only exist in societies of extreme material inequality, they use their enormous economic resources to steer the political trajectory of whole societies for self-preservation – as scholar Jeffrey Winters argues compellingly in his book, Oligarchy.[14] Furthermore, oligarchs thrive in crises-ridden societies and it is ‘they’ that are the root cause of multiple crises.[15] Thus, the real reason that former Prime Minister John Key would not admit that New Zealand had a housing crisis,[16] and why he avoided addressing the child poverty crisis[17] – which has embroiled one third of New Zealand children, or 300,000 tamariki[18] – was because he is a member of the New Zealand’s Neo-Colonial Civil Oligarchy.[19] As crisis expert Paul ’t Hart wrote in the Journal of Contingencies and Crisis Management in 1993, crisis actors who can control the ritualized symbolic actions in the midst of a crisis can constrain its meanings and gain from the calamity.[20]

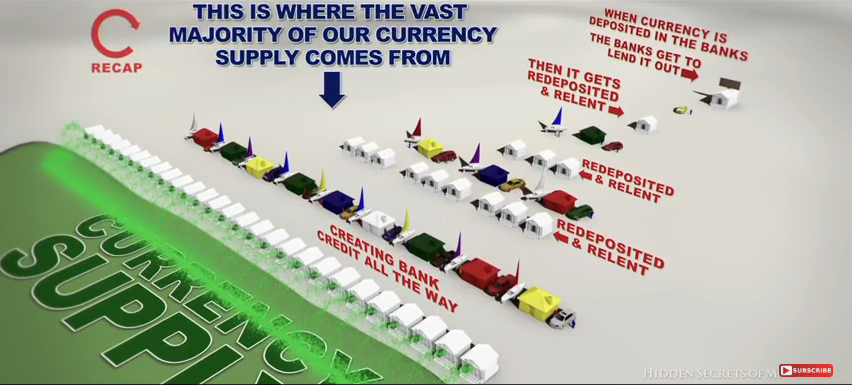

Debt Enslavement: The Secrets of Conjuring Zombie Capital

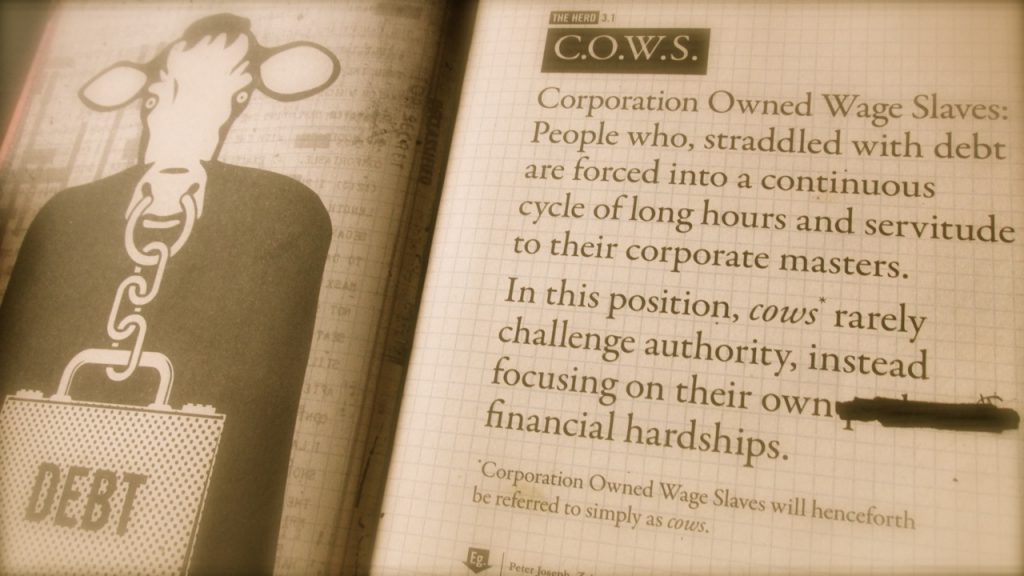

As brainwashed Tax Herds, we have been tricked to think that banks simply loan out the deposits of other savers. However, banks use most of the money they receive to buy interest-bearing treasury securities, corporate bonds and other financial instruments.[23] Indeed, the dirty secret of banking is that bank ‘loans’ are actually manufactured credit funds borrowed into existence.[24] Through their structural alignments, the world’s largely unseen dynastic bankers ensure that actual cash is scarce. This scarcity compels families and businesses and governments to ‘borrow’ the bankers’ manufactured credit to build homes, enterprises or hospitals, respectively, and compete for scarce cash to ‘repay’ the privately conjured credit [25]

A Make-over of the Great Boom-Bust-Bailout Formula

The next global financial crisis will likely be a triple crash as investors scurry out of traditional assets such as stocks, real estate, and corporate and government bonds.[31] Most currencies are heavily burdened with debt ‘owed’ to super-wealthy oligarchs. The key symptoms of an impending currency collapse or ‘debt decay’ are the prolific speculative bubbles across numerous asset classes, as James Rickards pointed out in Currency Wars: The Making of the Next Global Crisis.[32] The US Federal Reserve’s recent ratcheting up of credit rates is a rework of the pre-Global Financial Crisis playbook to puncture over-inflated assets.[33] As multiple market booms bust simultaneously, banks and other financial institutions will rapidly become insolvent amid asset deflation.

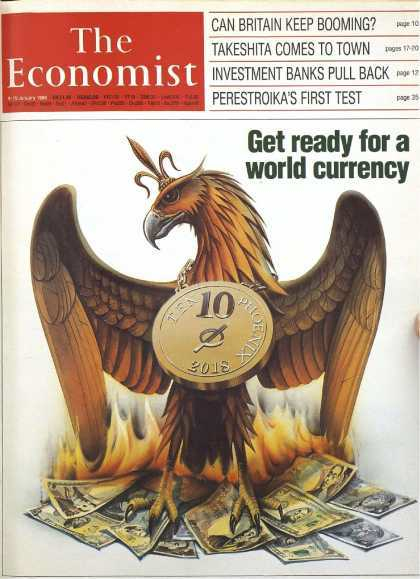

The global super-class has expanded the cheap central bank credit since the Global Financial Crisis (GFC) of 2007-2008, to advance the Neo-Colonial Game. The race is on between and within rival oligarchic-elite coalitions to control the world’s resources, infrastructure and new technologies. The Neo-Colonialists’ end-game is to capitalize on controlled collapses of bubbles, such as the $250 trillion credit and $1.5 quadrillion derivatives markets.[38] A global bust is a mathematical certainty. While one wing of the Zombie Phoenix intends to seize control of the underlying assets in epic foreclosures, mergers, state asset privatizations and bank auctions[39] – the other wing will attempt to roll-out a privacy-destroying, centralized digital global currency.

The Neo-Colonialists’ end-game is to capitalize on the global bubbles of $250 trillion in credit and $1.5 quadrillion in derivatives – amid an engineered financial collapse. While one wing of the Zombie Phoenix intends to seize control of the underlying assets in epic foreclosures, mergers, state asset privatizations and bank auctions – the other wing will attempt to roll-out a privacy-destroying, centralized digital global currency.[40]

[Editor’s Note: The practice of embedding events with the number 13  to symbolize a financial oligarchy, was first expressed by Simon Johnson and James Kwak in their book, 13 Bankers. It is more explicitly explored in, “It’s the Financial Oligarchy, Stupid“. The appearances of number 13 in institutional data does not necessarily mean that the nominal head of the institution is a member of the Fraternity, or that everyone who reproduces such data belongs to the Brotherhood].

to symbolize a financial oligarchy, was first expressed by Simon Johnson and James Kwak in their book, 13 Bankers. It is more explicitly explored in, “It’s the Financial Oligarchy, Stupid“. The appearances of number 13 in institutional data does not necessarily mean that the nominal head of the institution is a member of the Fraternity, or that everyone who reproduces such data belongs to the Brotherhood].

Part 1: New Zealand as a Crisis-Ridden Theme Park

Part 2: New Zealand as an Economic War Zone

Part 3: A Secret Brotherhood in GodZone 13

Source References:

[1] Caley Callahan. (10/03/2017). New Zealand housing most unaffordable in the world – The Economist. http://www.newshub.co.nz/home/money/2017/03/new-zealand-housing-most-unaffordable-in-the-world-the-economist.html; The Economist (Mar 11th 2017).https://www.economist.com/blogs/graphicdetail/2017/03/daily-chart-6; THE DATA TEAM. (Mar 9th 2017). Global house prices. Retrieved from: https://www.economist.com/blogs/graphicdetail/2017/03/daily-chart-6

[2] Liam Dann 10 Jun, 2017 Nation of Debt: Half a trillion dollars and still rising http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11873204; National Debt Clocks – New Zealand. http://www.nationaldebtclocks.org/debtclock/newzealand

[3] Doomsday Prep for the Super-Rich – The New Yorker www.newyorker.com/magazine/2017/01/30/doomsday-prep-for-the-super-rich; Anita Balakrishnan. (25 Jan 2017). Silicon Valley’s main envoy to the Trump administration just reportedly became a New Zealand citizen. Retrieved from: http://www.cnbc.com/2017/01/25/thiel-trump-tech-envoy-became-new-zealand-citizen-rrpoty.html

[4] Palan, R., Murphy, R., & Chavagneux, C. (2010). Tax Havens: How Globalization Really Works. Ithaca, NY: Cornell University Press.; Carroll, W. K. (2010). The Making of a Transnational Capitalist Class: Corporate Power in the 21st Century. London: Zed Books; Peter Phillips and Kimberly Soeiro. (August 14, 2012). The Global 1%: Exposing the Transnational Ruling Class. Global Research. Retrieved from: http://www.globalresearch.ca/the-global-1-exposing-the-transnational-ruling-class/32356; Phillips, Peter & Osborne, Brady (2013, September 13). Exposing the Financial Core of the Transnational Capitalist Class. Global Research. Retrieved from http://www.globalresearch.ca/exposing-the-financial-core-of-the-transnational-capitalist-class/5349617; Kwame Nkurumah. (1965). Neo-Colonialism: The Last Stage of Imperialism.

[5] Saskia Sassen (2005). The Global City: introducing a Concept. Brown Journal of World Affairs. https www.saskiasassen.com/pdfs/publications/the-global-city brown.pdf; Robinson, W. I. (2004). A theory of global capitalism: Production, class, and state in a transnational world. Baltimore, MD: John Hopkins University Press; de Angelis, M. (2001, May). Global capital, abstract labour, and the fractal panopticon. The Commoner. Retrieved from: http://www.commoner.org.uk/fractalpanopt.pdf

[6] Barry, Alistair. (2002). In a Land of Plenty: The Story of Unemployment in New Zealand. [Motion Picture]. Vanguard Films. Retrieved from http://www.nzonscreen.com/title/in-a-land-of-plenty-2002 [In 5-part video segments]; Barry, Alistair. (1995). Someone Else’s Country. [Motion Picture]. Vanguard Films. Retrieved from http://www.nzonscreen.com/title/someone-elses-country-1996; Klein, Naomi. (2007). The Shock Doctrine: The Rise of Disaster Capitalism. Camberwell, Australia: Penguin Books; Whitecross, M & Winterbottom, A. (Directors) & Eaton, A. (Producer). The Shock Doctrine 2009 [Motion picture] Retrieved from https://www.youtube.com/watch?v=v6yceBTf_Vs

[7] Knight Frank (2015). The Wealth Report, p28-31. Retrieved from: content.knightfrank.com/research/83/documents/en/wealth-report-2015-2716.pdf

[8] 11 August 2016 Vision for City Set for Green Light” Unitary Plan New Zealand Herald, p. 3.

[9] Simon Collins, Anne Gibson (Nov 6, 2015). 102 houses built out of target of 39,000. http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11540789; May 10, 2013 Auckland housing: 39,000 new homes in three years. Retrieved from: http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10882827; CHARLES ANDERSON (10 May 2013). New accord to boost Auckland housing.

[10] David Norman. (17 August 2015). Outlook for Auckland residential construction. How many dwellings should we be building, and can we? p.2. Westpac Institutional Bank. Retrieved from: https://www.westpac.co.nz/assets/Business/Economic-Updates/2015/Bulletins-2015/Outlook-for-Auckland-residential-construction-August-2015.pdf; Brian Rudman. (31 July 2013). Foreigner ban won’t build one new home. Retrieved from: www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10905702; Harcourts. (27 May 2016). Vision needed to plan for housing needs. http://content.harcourts.co.nz/news/vision-needed-to-plan-for-housing-needs

[11] Aleister Crowley. (1986). Liber 777, xxv; “An Essay Upon Numbers”. In: Israel Regardie (Ed.). (1994). 777 and Other Qabalistic Writings of Aleister Crowley, p.29. York Beach, Maine; USA: Samuel Wesier Inc.; W. Wynn Westcott. (1911). Numbers: Their Occult Power and Mystic Virtues, p.109.

[12] W. Wynn Westcott, Numbers: Their Occult Power and Mystic Virtues; Aleister Crowley, Liber 777.

[13] Steve ‘Snoopman’ Edwards. (25 April 2017). “The Masonic New Zealand Wars: Freemasonry as a Secret Mechanism of Imperial Conquest During the ‘Native Troubles’ “. Snoopman News. Retrieved from: https://snoopman.net.nz/2017/04/25/the-masonic-new-zealand-wars/

[14] Winters, J. A. (2011). Oligarchy. New York: Cambridge University Press.

[15] Webster Griffin Tarpley. (n.d.). Against Oligarchy. Retrieved from: tarpley.net/online-books/against-oligarchy/

[16] SAM SACHDEVA. (May 24 2016). John Key says no Auckland housing crisis, but 76 per cent of voters want more action. Retrieved from http://www.stuff.co.nz/business/industries/80320513/john-key-defends-govt-housing-action-rules-out-misplaced-housebuilding-programme

[17] JO MOIR. (October 3 2016). Government won’t commit to a poverty target because it’s too ‘difficult’ – John Key. Retrieved from http://www.stuff.co.nz/national/politics/84893766/government-wont-commit-to-a-poverty-target-because-its-too-difficult–john-key

[18] Child Poverty Action Group. (10 October 2016). UN report on child poverty shows urgent action needed. http://www.cpag.org.nz/news/media-release-un-report-on-child-poverty/; Christina Campbell (13 December 2016). Children’s commissioner ‘shaken’ by extent of child poverty in NZ. http://www.newstalkzb.co.nz/news/national/childrens-commissioner-shaken-by-extent-of-child-poverty-in-nz/

[19] NBR Rich List 2016. The National Business Review Rich List Index. Ranked Alphabetically, p. 12, 57. National Business Review; Graham Adams. (15 March, 2016). Is John Key the finest actor of his generation? Retrieved from http://www.noted.co.nz/currently/politics/opinion-is-john-key-the-finest-actor-of-his-generation/

[20] ’t Hart, P. (1993). Symbols, rituals and power: The lost dimensions of crisis management. Journal of Contingencies and Crisis Management, 1, 36-50. Retrieved from http://www.wiley.com/bw/journal.asp?ref=0966-0879

[21] RNZ. (6 September 2016). Auckland’s average house value tops $1 million. onhttp://www.radionz.co.nz/news/national/312665/auckland’s-average-house-value-tops-$1-million; SUSAN EDMUNDS AND SAM SACHDEVA. (September 6 2016). Auckland’s $1m average house price ‘scandalous’ – Labour http://www.stuff.co.nz/business/83951548/qv-stats-confirm-1m-average-for-auckland-but-growth-may-be-slowing

[22] Al Bartlett. English transcript of Arithmetic, Population and Energy – a talk by Al Bartlett. Retrieved from http://www.albartlett.org/presentations/arithmetic_population_energy_transcript_english.html

[23] Rowbotham, M. (1998). The Grip of Death: A Study of Modern Money, Debt Slavery and Destructive Economics, p. 4, 26. Charlbury, England: Jon Carpenter.

[24] Mike Maloney. (2013). The Biggest Scam in the History of the World – Mike Maloney Ep 4. Retrieved from: https://www.youtube.com/watch?v=iFDe5kUUyT0; Ross Ashcroft. (2012). Four Horsemen; The Global Financial Crisi Renegade Films. Retrieved from: https://www.youtube.com/watch?v=5fbvquHSPJU

[25] Mike Maloney. (2013). “The Biggest Scam In The History Of Mankind (Documentary) – Hidden Secrets of Money 4”. Retrieved from https://www.youtube.com/watch?v=iFDe5kUUyT0; SEE ALSO: “The Secret Of Oz” – The Truth Behind The Modern Financial System, And The Money-Political Complex” at: http://www.zerohedge.com/article/secret-oz-truth-behind-modern-financial-system-and-money-political-complex; Paul Grignon (2009). Money As Debt – Full Length Documentary. Retrieved from

https://www.youtube.com/watch?v=jqvKjsIxT_8;

[26] Rowbothman. (1998: 26). See also: An overview of the functions of money, and how money and credit are created in the NZ economy, examining the roles of the Reserve Bank and private sector banks. http://www.interest.co.nz/opinion/77033/overview-functions-money-and-how-money-and-credit-are-created-nz-economy-examining

[27] Ott, M. (1982, May). Money, credit and velocity. Review, Federal Reserve Bank of St. Louis, p. 25.

[28] Greenspan. (1998: 247). As cited in: Allen, R. E. (1999). Financial crises and recession in the global economy, p. 87. Cheltenham, Glos, UK: Edward Elgar.

[29] Hutchinson, F. (1998). What Everyone Really Wants To Know About Money. Charlbury, England: Jon Carpenter; Stefan Molyneux. (2010). Human Farming: The Story of Your Enslavement https://www.youtube.com/watch?v=Xbp6umQT58A

[30] How Banks Create Money. Retrieved from http://positivemoney.org/how-money-works/how-banks-create-money/

[31] Tyler Durden. (May 17, 2017). ‘The Everything Bubble’: Why The Coming Collapse Will Be Even Worse Than The Last. ZeroHedge Retrieved from http://www.zerohedge.com/news/2017-05-17/everything-bubble-why-coming-collapse-will-be-even-worst-last

[32] Rickards, J. (2011). Currency Wars: The Making of the Next Global Crisis. New York: Portfolio/Penguin.

[33] Tyler Durden. (Mar 16, 2017). 12 Reasons Why The Fed Just Made The Biggest Economic Mistake Since The Last Financial Crisis. ZeroHedge. http://www.zerohedge.com/news/2017-03-16/12-reasons-why-fed-just-made-biggest-economic-mistake-last-financial-crisis; Ferguson, C. (Director). (2011). Inside Job [Motion picture]. United States: Sony Pictures Classics. Retrieved from http://documentarylovers.com/film/inside-job/

[34] Rothkopf, D. (2008). Superclass: The Global Power Elite and the World They are Making. London, England: Little, Brown; Carroll, W. K. (2010). The Making of a Transnational Capitalist Class: Corporate Power in the 21st Century. London: Zed Books.

[35] Ross Ashcroft. (2012). Four Horsemen http://truththeory.com/2013/09/21/four-horsemen-movie/; Ferguson, C. (Director). (2011). Inside Job [Motion picture]. United States: Sony Pictures Classics. Retrieved from http://documentarylovers.com/film/inside-job/

[36] Ellen Brown. (December 1, 2014). New G20 Rules: Cyprus-style Bail-ins to Hit Depositors AND Pensioners http://ellenbrown.com/2014/12/01/new-rules-cyprus-style-bail-ins-to-hit-deposits-and-pensions/

[37] Ellen Brown. (March 21, 2013) A Safe and a Shotgun or Publicly-owned Banks? The Battle of Cyprus. Retrieved from http://ellenbrown.com/2013/03/21/a-safe-and-a-shotgun-or-public-sector-banks-the-battle-of-cyprus/; Snoopman. (October 26, 2015). The Great Financial Wrecking Ball: How Western banks plan to confiscate savers’ deposits. https://snoopman.net.nz/2015/10/26/the-great-financial-wrecking-ball-how-western-banks-plan-to-confiscate-savers-deposits/#_edn2

[38] Michael Snyder ( February 27th, 2017). March 2017: The End Of A 100 Year Global Debt Super Cycle Is Way Overdue. The Economic Collapse Blog. http://theeconomiccollapseblog.com/archives/march-2017-the-end-of-a-100-year-global-debt-super-cycle-is-way-overdue; Tyler Durden. (Jan 4, 2017) Global Debt Hits 325% Of World GDP, Rises To Record $217 Trillion. http://www.zerohedge.com/news/2017-01-04/global-debt-hits-325-world-gdp-rises-record-217-trillion

[39] Tyler Durden. (Jun 28, 2017). The Federal Reserve Is A Saboteur – And The “Experts” Are Oblivious. ZeroHedge. http://www.zerohedge.com/news/2017-06-28/federal-reserve-saboteur-and-experts-are-oblivious

[40] Get Ready for the Phoenix. Economist (01/9/1988), Vol. 306, pp 9-10.