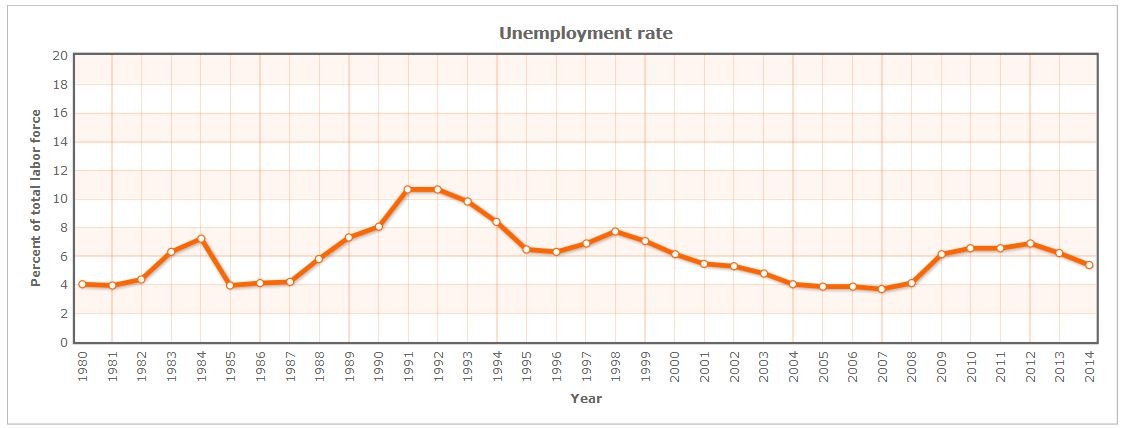

Successive New Zealand governments have stealthily maintained what is now a 35 year-old state policy of structural unemployment. From mid-1984 onward, the Lange-Labour and then the Bolger-National governments pursued this secret state policy to keep the level of people out of work at around 6% of the labour force. Because huge pools of unemployed people create the visible spectacle of poverty, it works as a coercive mechanism to keep wages and salaries low to satisfy big businesses investors, as Alister Barry’s 2002 documentary, In a Land of Plenty: The Story of Unemployment in New Zealand revealed. The Neo-Colonial Crown’s maintenance of joblessness is designed to weaken pay-bargaining power thereby working as a coercive downward pressure on a major production cost – labour – and therefore, keep profits margins up.

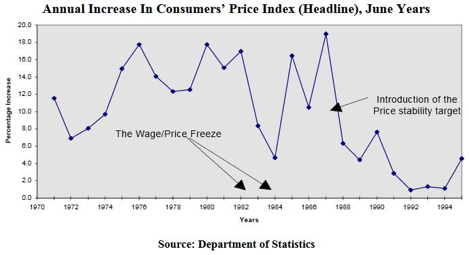

Despite the Arden Labour–led coalition’s 2018 Policy Target Agreement with the Reserve Bank to achieve ‘maximum sustainable employment’, while still attempting to maintain stable inflation in the cost of living, this initiative will have a subterfuge effect – of trying to please everyone – while being largely ineffective in its overt goal. This new Policy Target Agreement leaves the broader Shock Doctrine economic warfare framework intact. The first Policy Target Agreement explicitly set forth an inflation-targeting goal of keeping the general prices of goods, as measured by the Consumer Price Index, between 0-2% and was legislated in the 1989 Reserve Bank Act. It was sold to the public as a necessary move to get control of inflation, without saying that the Reserve Bank had colluded with the banking cartel it oversees, to maintain high interest rates in the 1980s in order to scuttle jobs en masse. Widespread job destruction was exploited as a vicious means to drive down cost-side inflation, while the rich could still make wealth amid a share-market and commercial property boom.

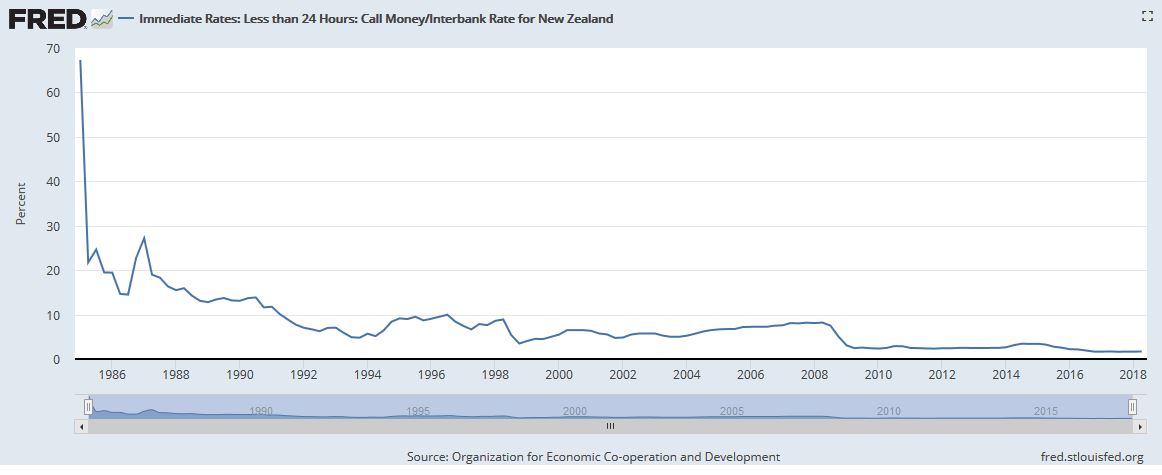

This investigation proves the banking cartels’ collective control and influence over economic activity, and therefore political institutions, is exerted through interest rates, which is the fee that banks charge for continued supply of credit – the lifeblood of a Neo-Colonial economy. Through the use of charts, statistics and other cited documentary sources, The Snoopman demonstrates the relationship between the inflation rate, the wholesale interest rate and the control of cash and credit supply and how these economic indicators are actually manipulated to control the unemployment rate. A pattern is revealed with three examples to show that international and domestic bankers use the overnight inter-bank lending rate market as a transmission mechanism to issue ‘ransom notes’ to state managers.

These Nightly Ransom Note Rituals are the market’s way of voting for its political-economic policy preferences, setting the wholesale lending rate, or the Reserve Bank’s wholesale interest fee, and for regulating the level of unemployment through the cost of credit on new and existing loans, which moderates economic activity. Together these hidden transmission mechanisms maintain a low-wage economy. The reward for the Neo-Colonial capitalists working cohesively as colluding cartels is access to cheap credit, which fuels residential and commercial and rural property speculation and drives up assets values for the super-rich.

The Snoopman, 19 November 2018 (updated 12 Nov 2019)

Creating Structural Unemployment: The hidden links between high interest rates, corporatizing the public sector and wild West South Pacific finance

Snapshot: The NZ Government corporatized the state sector while the Reserve Bank maintained high interest rates – to inflict industrial-scale job destruction.

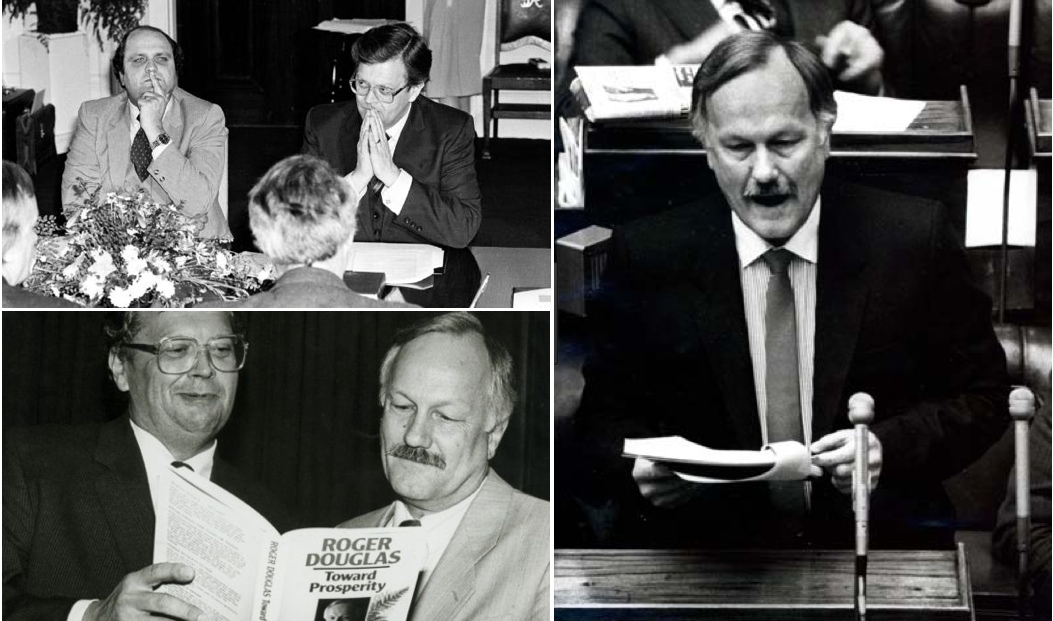

Following the political-financial coup of the Lange Labour Government in 1984, the head of the Treasury, Finance Minister Roger Douglas moved to phase one of the planned shock treatments. Controls on prices, wages, credit, dividends, foreign exchange and out-bound capital were lifted. Not surprisingly, the inflation rate, or the measure of the cost of living, soon rebounded to 16% from its Wage/Price Freeze suppressed value of 5% per annum in mid-1984 when Labour became government, and peaked at 19% in June 1987 and then dropped by 6% in two months at the end of 1987 following the October 1987 Sharemarket Crash.[1] The double-digit inflation sent prices upward, including the costs of mortgages, rent, food and other essentials. This situation exposed struggling business owners, low-waged workers and beneficiaries on fixed incomes to the most strife. Ironically, the Bank of New Zealand, which had recklessly ‘lent’ to fuel speculative the sharemarket boom, received a $600million bail-out.[2]

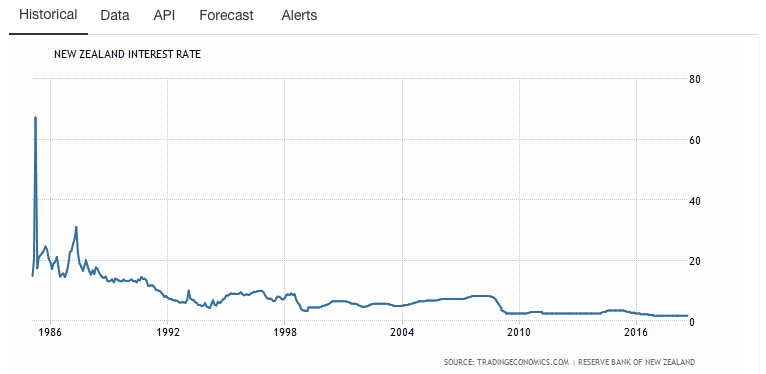

From mid-1984 through to the 1987 Sharemarket Crash, the Reserve Bank kept the wholesale lending rate, as measured by 30 day bank bill yields at between 20% to 30% per annum most of the time, with short periods where it dipped below 20%. This 30 day bank bill yields were primary indicator for interest rate charged for the wholesale credit supplied to banks trading in New Zealand, until the Official Cash Rate (OCR) was introduced on March 17 1999. The Reserve Bank’s purpose was to inflict pain, knowing that by keeping wholesale ‘lending’ rates high, businesses would lay-off workers, or go bankrupt amid strains on household budgets.

Former Reserve Bank director Suzanne Snively (1985-1992),[3] stated in Alister Barry’s documentary, In a Land of Plenty – The Story of Unemployment in New Zealand:

Former Reserve Bank director Suzanne Snively (1985-1992),[3] stated in Alister Barry’s documentary, In a Land of Plenty – The Story of Unemployment in New Zealand:

“It was a manageable thing for the Reserve Bank to initially use employment and unemployment as a way to get wages down. It was easier that any other means of getting inflation down. So they used it.” [4]

“The theory is that when unemployment is low, there’s always skill shortages and workers have the ability to demand higher wages, and to secure higher wages because the employers are competing amongst each other for scarce labour. And that pushes up costs and employers then recover those costs in terms of higher prices. And, so unemployment is quite a vicious, but effective way of dampening wage pressure and of, therefore, controlling prices.”

In the two months following the stocks bust of October 1987, the inflation rate dropped by 6% because many businesses either laid-off workers, went bankrupt, or succumbed to mergers, amid a general downturn, broken business contracts, and a tempering of spending. The Reserve Bank allowed a sustained drop of the wholesale ‘lending’ rate below the 20% barrier with this fall in inflation. This wholesale credit rate – as measured by the 30-day Bank Bill yields – did not ‘permanently’ penetrate the 10% barrier until one day before the reading of the July 30 1991 budget – when three key measures were in place and in print.

The first measure was the passage of the Employment Contracts Act of May 15 1991 that provided a mechanism to establish individual employment contracts to end collective bargaining in workplaces and hand more bargaining chips to big businesses. The second two measures were delivered in a July 30 1991 budget to the House of Representatives – frivolously dubbed the ‘Mother of All Budgets’. The Bolger National Government made deep cuts to Welfare payments and entitlements – including state home-ownership support assistance and commenced a sell-off of the state’s mortgage portfolio. The 1991 Budget also introduced user pays fees for schools and hospitals.

For its part, the Labour-led New Zealand Government (1984-1990) pursued more shock therapies in addition to freeing up controls on the financial system that would be within the purview of the Reserve Bank and the Treasury. Ironically, given the political party’s name, the Lange-Labour Government inflicted the pain of callous industrial-scale job cuts to the public sector. The Labour Government did so with a blitzkrieg strategy to overwhelm and gain submission of whole sectors of society – in collusion with key big business beneficiaries.

The Lange-Labour Government removed subsidies that insulated the farming sector, tariffs on imports that sheltered domestic producers from cheaper-produced products made overseas and statutory approval thresholds for foreign investment were progressively raised, thereby paving the way for foreign capital to buy up New Zealand businesses. Moreover, the Labour Government corporatized public sector commercial trading entities, infrastructure and services, meaning business models were applied to the public sector under the rubric of introducing efficiencies, but with the covert intention of inflicting mass lay-offs and readying them for privatization, called ‘state asset sales’ to create a toll-booth economy.

In this epic strategic sabotage of industry, between 1987 and 1995, tens of thousands of New Zealanders lost their jobs. In the public sector, 62,100 people were sacked by the state, while in the private sector, manufacturing employment dropped by 30%.[5] In 1983, the unemployment rate was 6% of the workforce and peaked at 16 percent in December 1992.[6]

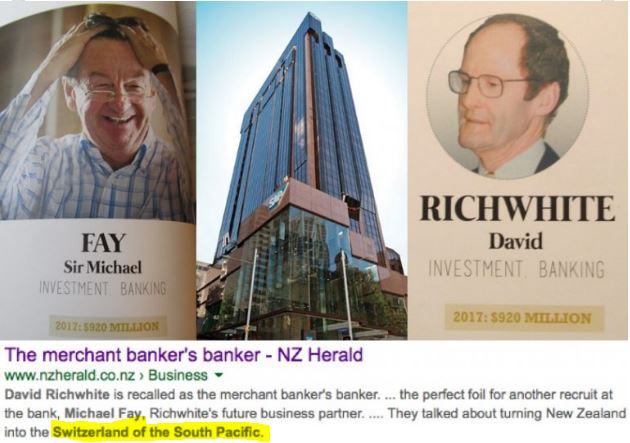

The goal of this financial coercion was to force the new Lange Labour Government to move to phase one of a financial and economic warfare package that was ultimately intended to transform New Zealand into a ‘Switzerland of the South Pacific’ Utopia. The predicament that all Governments face is known as the ‘policy trilemma’ – as Bryan and Rafferty outlined in their book, Capitalism with Derivatives.

In this scenario, governments cannot simultaneously pursue the following three broad policy agendas: (1) sustain the wealth that accrues to the workforce; (2) facilitate vast, fast international movements of capital; and (3) manage exchange rate stability. At most, only two of these three ‘policies’ can be maintained.[7] Wellington’s political elites of the time fell in with the technocratic elites in Treasury, the Reserve Bank, domestic and foreign think-tanks – whom had all bought into the will of super-wealthy international bankers – by prioritizing high international capital mobility.

Once capital controls were lifted ‘haphazardly’ – actually by callous design – exchange rate volatility became a financial weapon for speculative attacks on the New Zealand currency – as it had become increasingly frequent around the world throughout the 1970s.[8] Wherever the ‘free market’ economic framework was deployed, labour became the ‘swing mechanism’ of the ‘policy trilemma’ – like a pendulum. The goal was to eventually stabilize unemployment after a lengthy shock therapy period. (In New Zealand, an average level of 6% unemployment was set, as the historical data shows). This way, central banks such as New Zealand’s Reserve Bank could be expected to attempt to maintain a stable currency amid high international capital flows.

Monopoly Money: Cash, credit, and interest

Snapshot: The Reserve Bank, Treasury and banks set interest rates to stimulate or cool the economy, thereby maintaining persistent structural unemployment.

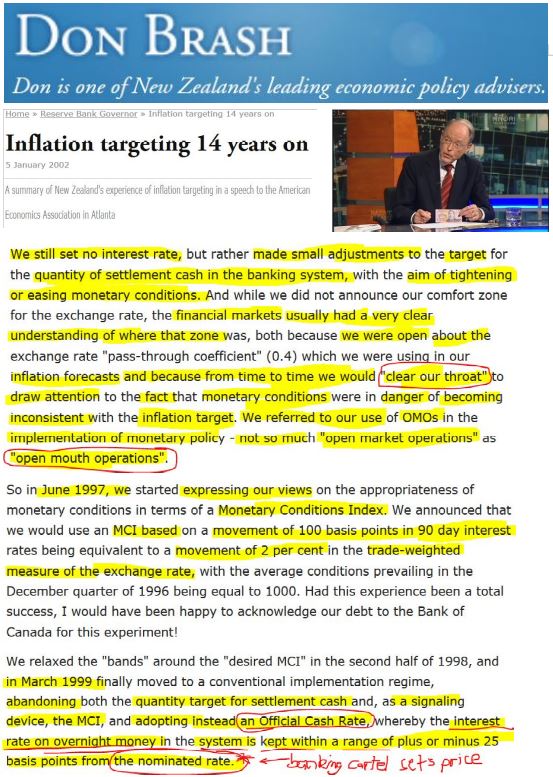

For its part, the Reserve Bank of New Zealand initially made small changes to the quantity of ‘settlement cash’ in the banking system – with the goal to tighten or ease the supply of currency, or cash with which to settle transactions. As time went on, the Reserve Bank took a ‘quantitative approach’ that involved holding the liquidity in the banking system stable, which was evidently an easy task because of the free float of the NZ dollar and easy capital flows to fund Treasury bond sales to finance Government fiscal deficit spending – according to former Reserve Bank Governor, Don Brash.[9]

The Reserve Bank calibrated the wholesale interest rate for credit supplied to the New Zealand economy, and the international and domestic banking cartel follow suit by setting the overnight inter-bank lending rate within a tight band close to the Official Cash Rate (OCR) to settle their transactions.

In practice, this wholesale interest rate usually matches the overnight inter-bank lending rate, meaning the Reserve Bank takes its cues from the international and domestic banks about the wholesale fee charged for credit, euphemistically termed ‘interest’. Brash stated that from time to time he would perform “open mouth operations” via the news media to draw attention to monetary conditions endangering the inflation rate target.

Brash recalled that to express Reserve Bank’s preferences for financial conditions, he would hold another press conference about a week to ten days later to essentially say ‘that’s about right’ to ‘the market’ – which gave the appearance to the public and the news media that the Reserve Bank did not know what it was doing.

These implied threats were enough to adjust the supply of scarce ‘settlement cash’ resulting in an easing or tightening of monetary conditions, in conjunction with a monetary policy tax on deposits to discourage banks holding too much cash. In this way, the supply of credit would shrink or expand, and the fee for not withdrawing that supply – interest – would fluctuate in price, thereby heating and cooling economic activity on the basis of the ‘loan’ approvals or declines, and their costs.[10]

In a January 2002 speech to the American Economics Association conference, Atlanta, former Reserve Bank Governor Don Brash recalled an anecdote about a labour union boss apparently capitulating to the new inflation targeting regime back in late 1990. Evidently, the president of New Zealand Council of Trade Unions, Ken Douglas, wrote an opinion piece stating that since the Reserve Bank was focused on low inflation, then unions would have to revise their wage demands to avert rises in unemployment. In this speech, Brash makes the connection between maintaining low inflation – by keeping wage increases to a minimum – and restricting unemployment.

This means that Ken Douglas understood the link between the Reserve Bank setting an inflation target, which the banks would take as a cue to set their wholesale interest rates among each other, as a mechanism for controlling the level of wholesale credit available in the economy for new business loans. Higher interest rates would mean less loans granted, because many applicant’s business proposals would not be able to afford the higher credit costs, and more enterprises would fail, and therefore, there would be less job creation and more job destruction. And, in turn, the consequences were that the banks’ manufactured loan funds could be restricted with higher interest rates. This would curtail employment growth if unions increased wage demands, but if the unions submitted, there would be job growth in a low-wage economy.

Together, these adjustments to liquidity in the banking system and the shock therapies exacted by successive New Zealand governments continued to help the Reserve Bank achieve their revised 1-3% cost inflation target that, in turn, supplies wealthy investors with cheap credit. Access to cheap credit means the rich and super-rich are free to pursue maximum asset wealth ‘creation’ in an economic environment now characterized by asymmetric inflation, where the ‘flattened’ costs for labour are most starkly contrasted with high prices for essentials such as food, power, fuel and housing.

Because all industries are dominated by a small handful of New Zealand Rich-Lister-owned franchises, or foreign-quartered transnational consortia – and supported by industry lobby groups, including producer boards – such cartelized markets are free to set high prices that ‘earn’ exorbitant investors profits.

The extraction of exorbitant profits over and above production costs and modest returns for investment, actually represent extortion fees for not withdrawing supply. With cheap credit as a reward for keeping cost-side inflation of wages and salaries suppressed, the ‘property rights’ of the rich are protected. In other words, cost-side inflation is tightly controlled while speculative booms are encouraged, because wealth-side inflation grows wealth for the rich. In short, ‘property rights’ of the rich are code for asset wealth protection.

In the documentary, In a Land of Plenty: The Story of Unemployment in New Zealand, trade union economist Peter Harris (1976-1999) explained the emphasis to control inflation, or rising costs, in order to protect the asset portfolio’s of the rich this way:

“I would see that stable prices is part of your regime for entrenching property rights. Because you can ascribe property rights, but if the value of that property is unstable, the rights themselves are unstable. So, price stability has to be seen as part of the policy agenda that is directed at defining and entrenching property rights and an exchange mechanism of those rights. That’s what we call ‘a market’.”

“I would see that stable prices is part of your regime for entrenching property rights. Because you can ascribe property rights, but if the value of that property is unstable, the rights themselves are unstable. So, price stability has to be seen as part of the policy agenda that is directed at defining and entrenching property rights and an exchange mechanism of those rights. That’s what we call ‘a market’.”

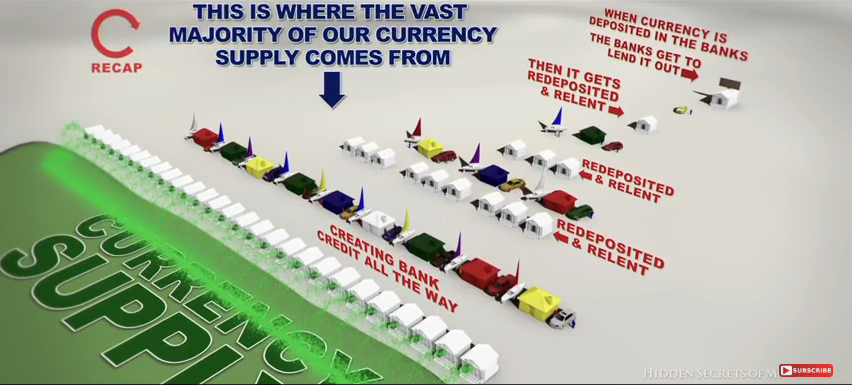

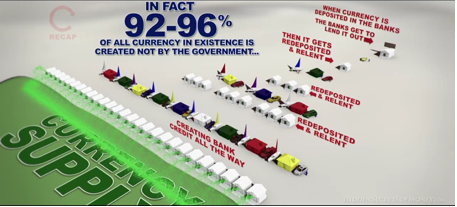

Therefore, the cartelized banking industry maintains a structural scarcity over cash, with the active participation of the New Zealand Crown through the Reserve Bank and the Treasury. Cash only constitutes about 1-3 per cent of the total, meaning the other 97-99 per cent of the currency supply is borrowed into existence as transaction specific credit. Indeed, the dirty secret of banking is that bank ‘loans’ are actually manufactured credit funds borrowed into existence and this manufactured credit is the single major source of currency expansion in New Zealand, as senior economic analyst at the Reserve Bank of New Zealand, Gillian Lawrence, explained in a Reserve Bank bulletin, entitled “The Reserve Bank, private sector banks and the creation of money and credit” published in 2008. Lawrence stated:

“By far the largest share of money – 80 percent or more, depending on the measure – is created by private sector institutions. For simplicity, we use ‘bank’ to refer to any institution that creates money or credit.”

Particularly, as many New Zealanders are forced to compete in a low-wage economy for the scarce cash to ‘repay’ the conjured credit. This competition is intensified because the interest component is not created along with the principle amount of credit funds borrowed into existence. Consequently, each generation is compelled to sell homes and businesses at ever higher values just to break even because of the interest! In other words, the Crown is actively involved in the supervision of a cartel that restrains trade through the restriction of supply of an essential resource – cash. This restriction on the cash would otherwise be unnecessary in a de-cartelized, positive money economy.lx

Applied Game Theory: Three Nightly Ransom Note Rituals

Snapshot: Interest rates are, in fact, fees that transnational banking cartels charge for not withdrawing supply of credit funds and to signal threats and promises to state managers.

The float of the New Zealand dollar on 4 March 1985 gave the international and domestic banking fraternities – euphemistically termed ‘speculators’ – the opportunity to send the Reserve Bank’s wholesale lending rate (the overnight inter-bank lending rate) shooting up to a Banana Republic rate of 265% on March 8.[11] (The ‘speculators’ were helped by the Reserve Bank, who had conveniently abdicated its supervisory function inside banks’ dealing rooms in early 1985).[12]

The speculative spikes averaged out to an all time high for the ‘cash rate’ at 67% for March 1985. By 29 March, the ‘30 Day Bank Yields’ had come down to 21.5%, and fluctuated between 20% and 30% through 1985-1987 and finally came down below 20% after the October 1987 Sharemarket Crash because this collapse in stock prices caused a curtailment in spending and a 6% drop in the inflation at the end of 1987.

The Treasury’s original justification for loosening control of the exchange rate mechanisms was that it claimed that it would protect the currency from speculation, but because further ‘monetarist’ measures extended to lifting on controls in most areas of banking, finance and property, the Treasury’s actions said otherwise. Rather than sound ‘Economic Management’ Treasury had deliberately created the conditions for Neo-Colonial capitalists to focus on exploiting speculative market mechanisms, to maximize short-term capital accumulation or profit.[13]

The hostile attacks on the ‘cost’ of wholesale credit during March 1985 coincided with the end of the first financial year since the Lange Labour Government had won power. The spike in interest in this month shows that ‘the market’ – were in effect sending a coercive ‘price signal’ to ‘stay the course’. Like a ransom note, this ‘price signal’ was an extortionist act perpetrated by international bankers whom telegraphed that they required the Reserve Bank to keep interest rates high, so that the credit rates could be used as an automated transmission mechanism to drive unemployment upward. In effect, the encoded message in this financial data was telegraphing to ‘move on to phase two of the shock therapies’, that would involve prolonging high interest rates to cause the strategic sabotage of industry through business down-sizing, closures and mass worker lay-offs.

Because the high interest rates would mean higher mortgage costs, rents and credit card bills, consumer spending across the economy would fall and amid plummeting sales businesses would be compelled to make workers redundant or go bankrupt fast.

Yet, throughout Douglas’s time as Finance Minister, his annual budgets for 1984-1988 emphasized measures that would maintain low inflation and this would in turn reduce ‘price distortions’ in the market. Therefore, a lower inflation rate – the rhetoric went – would enhance competition, feed growth and provide more jobs and revenue for the government to reduce its deficit.

During this time, the ‘economic missionaries’ in Treasury asserted that inflation clouds the price signals between consumers and producers causing inefficiencies resulting from supply and demand imbalances.[14] Inflation thereby increased the overall costs of the economy’s production, so it undermined the capacity for exports to earn receipts from the global ‘free’ market.[15]

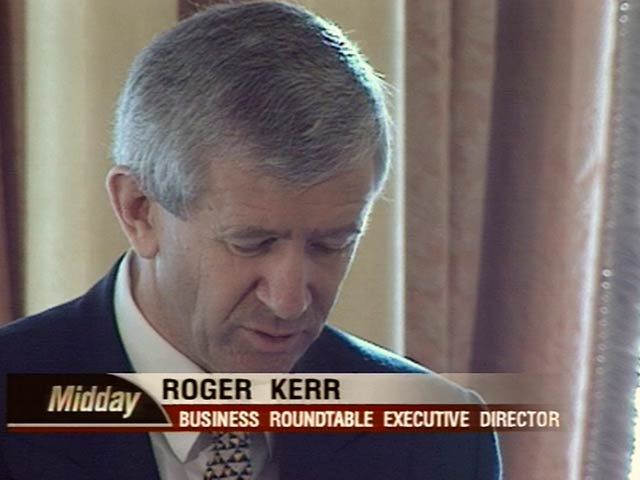

However, the New Zealand Reserve Bank, Treasury, the Labour Caucus and the New Zealand Business Round-Table failed to fully disclose to the New Zealand public that a covert strategy of economic warfare had been embarked upon – supposedly to ‘combat’ high inflation. While it is true that the wealthy hate high general inflation – because it attacks the monetary value of their investments and increases costs to their businesses – the wealthy will tolerate it if they are making super-returns elsewhere, such as in property and stock market speculating.

Between 1984 and 1987, the pace of capital accumulation for investors and speculators was rapid and reflected in the share-market price index, which grew 140 percent, thereby outpacing the general inflation rate. The main reason the general inflation rate dropped by 6 percent in two months at the end of 1987 was because the share-market crashed on October 19.[16]

In other words, the relatively high interest rates would eventually drive down inflation as businesses went broke, or laid-off workers. Meanwhile, well-resourced big businesses could access cheaper international credit to exploit the share-market and commercial property market booms as a means for asset portfolios to inflate rapidly. Therefore, Treasury, the Reserve Bank and the Douglas ‘Treasury Troika’ comprising Finance Minister Roger Douglas, and his associates David Caygill and Richard Prebble, avoided explaining this vicious scenario that was in essence an asymmetric inflation paradigm.

Despite strong pro-Labour support through the party’s hierarchy, there was no effective worker protection in the Labour Relations Act passed on May 27 1987, which required unions to have a membership of no less than 1000 people.[17] This contributed to the number of unions halving in the three-year period between 1986 and 1989 from 254 down to 112, but also resulted in union amalgamations that saw the newly formed Council of Trade Unions (CTU) in 1987, acquiesce to the ‘Neo-Liberal’ paradigm. Its president, Ken Douglas mimicked Roger Douglas’ rhetoric when he claimed it would benefit its members if it could pursue “common interest defined by the need to develop a flexible, innovative and efficient industrial relations system”.[18]

Then, the State Services Act, passed in 1988, scripted by the quintessential technocratic policy wonk, Deputy Prime Minister Geoffrey Palmer, handed the corporatized State Owned Enterprises (SOEs) a private sector model that gave the CEOs control over the workers in their employ.[19] Lay-offs swept through the private sector, the rollout of short-term contracts followed and unemployment climbed steadily. Meanwhile, in phase three of this epic rort, the ‘Treasury Troika’ of Douglas, Caygill and Prebble, readied 13 state assets for sale in cahoots with other accomplices in the Neo-Colonial Free Market Sect – without a general elect mandate. With these measures either completed or in the pipeline, unemployment rose and New Zealand wholesale credit rate fell incrementally.

After six years of the Labour Government in power, many unions either collapsed or their power was eroded, despite the fact that as a broad interest group, they were significant in bringing a party into government, only to find its Lange Cabinet had a class warfare policy agenda.[20] Protests across New Zealand, big and small, were either ignored, disdainfully ridiculed, or treated as an exclusionary blackballing exercise by Government, the Business Roundtable and big businesses.

Tellingly, when James Bolger’s National Party won power in 1990, his new government was faced with a financial crisis too. The privatized Bank of New Zealand asked for a second welfare hand-out in the form of a huge bailout $620 million, with Fay Richwhite stumping up an additional $100 million for a cheap 30% stake. The BNZ claimed it needed to avoid collapse.[21]

The Secretary of the Treasury and Centre for Independent Studies member Graham Scott sounded a warning of a fiscal deficit that claimed could blowout to an arbitrary figure of $5.2 billion (a multiple of the prime number 13), which slyly signaled the Fraternity was advancing the game via the modus operandi of crisis. In her 1996 book, Revolution: New Zealand From Fortress to Free Market, Marcia Russell wryly observed:

“It was like a re-run of 1984 with different actors.”[22]

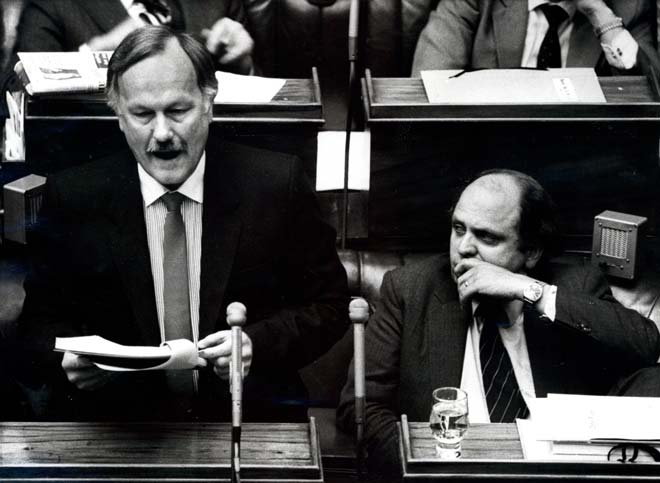

Where the Labour Government had hit the National’s core constituency first, the farming sector with the sudden shock cutting tariffs on imported produce, the new National Finance Minister Ruth Richardson wasted no time attacking the sacred cows that the Labour Government would not kill – welfare reform and employment contracts.

When Finance Minister Ruth Richardson delivered her ‘Mother of All Budgets’ speech in the Parliamentary-debating chamber in 30 July 1991, she stipulated deep cuts to welfare payments. The unemployment benefit was cut from $144 to $130 a week. As a multiple of 13, $130 stood to signify ‘unity’ to advance the game with the banking fraternity. As such, Richardson’s budget speech was a Hostage Posting Ritual. The National Government had already announced reductions to the Welfare State budgets six days before Christmas in 1990, and it included across-the-board cuts to social welfare benefits that were written prior to the election by Treasury and National’s Minister of Finance, Ruth Richardson.

Minister of Social Welfare, Jenny Shipley explained the logic that the government needed to “create the gap between work and welfare”. In the process the gap between the poor and the rich got bigger too, as taxes for high income earners and businesses were cut too, and while the number of people living in poverty had reached nearly 600,000 or 16.3 percent of the population in 1992/93.

Significantly, the ‘30 day Bank Yields’ finally fell below 10% one day before Finance Minister Ruth Richardson performed her ‘Mother of All Budgets’ Hostage Posting Ritual in the Parliament on 30 July 1991. This ‘permanent’ penetration through the 10% threshold demonstrated ‘the market’ voted approval for deep cuts to welfare payments, the end of the state’s home-ownership support programmes, and the passage of the Employment Contracts Act, which was designed to drive down wages and therefore cost-side inflation. The deep cuts to welfare payments would ensure that Treasury could prioritize debt servicing to private ‘creditors’ who buy Treasury bonds and securities. Among the government’s creditors is the transnational banking cartel.

The Bolger National Government (1990-1993) also sold off a large proportion of the Housing Corporation New Zealand’s mortgage portfolio, and incrementally introduced market-based rents across the Housing New Zealand rental portfolio. These moves served the ‘Switzerland of the South Pacific’ plan to create a top strata of wealthy people, while making New Zealand an unaffordable place to live for most — including Māori (as then-Finance Minister Roger Douglas had bragged at a private dinner in December 1986). Therefore, this threshold through the 10% barrier for wholesale credit costs demonstrates the precision with which the international banks — working as a price fixing cartel — could regulate the economic growth, and inflict ‘discretionary idleness’ through ‘strategic sabotage of industry’.

By using the debating chamber to announce major cuts to welfare benefits, changes to employment law, and new user-pays requirements in hospitals and schools were all announced, without explaining how international and domestic credit and interest rates worked as mechanisms for the transmission of structural unemployment, Finance Minister Ruth Richardson’s ‘Mother of All Budgets’ speech was vicious subterfuge.[23]

By December 1994, 13 state-owned enterprises were sold for a mere $13 billion: New Zealand Steel, Petrocorp, Development Finance Corporation, Rural Bank, the National Film Unit, the Government Post Office, Telecom, Housing Corporation, Forest Corporation, the Bank of New Zealand, New Zealand Rail, Export Guarantee Corporation, and Government Computing Services.[24] By December 1996, firms linked to the Business Roundtable accumulated $12.542 billion of the $15.322 billion privatized assets, including Fletcher Challenge, which bought one-fifth.

The stunning sell-off of state assets, including New Zealand Rail, Telecom, ForestCorp, Electricorp and the BNZ – represented an epic transfer of wealth upward and outbound, while their workforces were decimated. For instance, between 1987 and 1990, Roundtablers Alan Gibbs and John Fernyhough sacked 4,473 employees or 63% of ForestCorp’s workforce, in preparation for privatization. Between 1987 and 1996, the Roundtablers chairing Telecom’s board, Ron Trotter and Peter Shirtcliffe, oversaw the sacking of 15,900 workers, or 65% of the workforce. Between 1987 and 1991, the Roundtablers of Electricorp’s board, John Fernyhough, Rod Deane, and Roger Kerr, sacked 2270 workers, or 38% of the workforce. Between 1987 and 1991, NZ Railways sacked 9,000 workers, or 60% of its workforce. Therefore, deep cuts to employment were inflicted despite no one voting for (or against) such an eventuality because it was not tabled openly as an election platform.

New Zealand Rail was sold in 1993 for a mere $328 million to the Tranz Rail consortium comprised of Wisconsin Central Transport, Berkshire Partners, Fay Richwhite and founder of the Huka Lodge, Alex van Heeren. At the time of sale, it was debt-free because the government had injected $1.3 billion tax dollars into its balance sheet.[25] NZ Railways indebtedness of $1.2 billion by 1989 was used as propaganda to say the state corporation was inefficient under government management. What was omitted was the fact that Booz Allen Hamilton’s report in 1983 advised the Muldoon Ministry to invest in the rail network and restructure under a corporatized business model amid a ‘deregulation’ of the transport industry. Some of its inefficiencies were in-built capacities of engineering, labour training, and absorption of workers during economic slumps.

Merchant bank Fay Richwhite advised the Bolger National Government on selling New Zealand Rail, and bought 32% of the shares with its investment vehicle Midavia. The Securities Commission investigated Midavia for insider trading for acting on a tip from David Richwhite and this case dragged on until finally parties associated with Fay Richwhite settled for $20 million in 2007 without admitting liability, while Berkshire Fund and one of its executives paid $7.4 million. The Tranz Rail consortium later cashed-up its stake making $370 million in profit. Tranz Rail subsequently sold the asset-stripped rail operation to the Melbourne-based consortium Toll Group in 2003, and in 2008, the New Zealand Government bought back the poorly maintained rail infrastructure, plant and machinery for $665 million. Financial analyst Brian Gaynor estimated in 2008 that New Zealand Tax Slaves had been forced to spend $4 billion since 1990 on the rail network with debt write-offs, equity injections, asset buy-backs, subsidies, grants and track expenditure.[26]

Meanwhile, when Ronald Trotter was Chairman of the State Owned Enterprise Steering Committee, he also became Chairman of Telecom (1987-1990), to prepare the state-owned telecommunications company for privatization after it was split off from the New Zealand Post Office. In September 1990, the New Zealand Government sold Telecom for $4.25 billion to Ameritech (45 per cent), Bell Atlantic (45 per cent), Michael Fay and David Richwhite (5 per cent) and Alan Gibbs and Trevor Farmer (5 per cent).[27] Opinion polls at the time showed that 75% to 90% of people surveyed were strongly opposed to the sale of Telecom, as Colin James reported.[28]

In four years, Telecom’s profits more than doubled to $528 million in 1994, at which time most of its 90 percent dividend was exported to its predominantly foreign-based owners, Ameritech and Bell Atlantic.[29] In 1997, when the initial investors sold their stakes in Telecom, it was estimated that Ameritech and Bell Atlantic’s original combined investment of $3.8 billion would have made them a combined profit of $11.5 billion.[30] Gibbs – who became a director along with David Richwhite when Telecom was privatized – described his investment in Telecom as “the greatest coup of my business career”. Gibbs brought in Bell Atlantic and Ameritech and he and Fay Richwhite together ‘earned’ $100 million in brokering fees to organize the trade with Ameritech and Bell Atlantic and themselves. The once-Telecom director bragged later that the deal only required a down payment of $20 million, which was covered by the merchant banking fee, and the settlement could be made three years later, by which time the shares would likely have sky rocketed.[31]

Merchant bankers Michael Fay ($920m) and former Business Roundtable vice-chair David Richwhite ($920m), who as partners of Fay Richwhite infamy, looted an estimated $800 million from Telecom ($600m) and Tranz Rail ($200m) for their orbit of corporate raiders in the first five years of operation as privatized toll-booths.[32] Alan Gibbs ($555m), who founded the ultra-right wing think-tank, the New Zealand Centre for Political Research, made $300 million for his orbit of investors between 1992 and 1997 by looting the former state-owned enterprises – Telecom and Tranz Rail.[33]

But, Alan Gibbs and his crony cohort of the Neo-Colonial Free Market Sect did not limit themselves to asset stripping to just two toll-booths. Between 1987 and 1990, Gibbs was Chairman of the NZ Forestry Corporation that was the corporatized makeover of the old New Zealand Forest Service. His fellow Roundtabler, John Fernyhough, was director from 1987 to 1994. After sacking 4,473 workers between 1987 and 1990, with his co-director, Gibbs oversaw the sell-off of much of ForestCorp’s machinery too. The Forestry Corporation of New Zealand or ForestCorp was sold in 1996 for $1.6 billion to Fletcher Challenge (37.5%), Brierley Investments (25%), and Citifor Inc (37.5%).

When Electricorp was headed by the Roundtablers – John Fernyhough (1986-1993), CEO Rod Deane (1987-1994), and Roger Kerr (1987-1994) – they made ‘consumers’ grow Electricorp’s market value by extracting exorbitant profits. Those profits grew from $196 million in 1988 to $404 million for the 1990-91 year.[34] However, when the trio announced plans to increase power prices by 20% over ten years, a backlash from the ‘publicforce’ caused the government to limit the Roundtablers’ enthusiasm for ‘marketforces’ – and the three disgruntled men soon quit. Also on Electricorp’s board was equally ubiquitous Alan Gibbs.

In 1992, the Bank of New Zealand was sold for $1.4 billion, or 80 cents a share, to National Australia Bank, compared with the BNZ’s estimated current value of about $7 billion. The Bank of New Zealand was bailed out twice, to the tune of $1.32 billion tax dollars to cover its credit manufacturing exposure to the property markets in New Zealand and Australia that slumped following the 1987 Sharemarket Crash.[35] In the second bail-out, Fay Richwhite stumped up $100 million for a 30% stake.

The Roundtable Shock Therapists

Snapshot: In 1984, the Labour Government was captured in a silent coup to facilitate a sabotage of NZ by the Mont Pèlerin Society, the Business Roundtable & the CFR.

Ostensibly, the Neo-Colonial Crown-Reserve Bank-Treasury-Business Roundtable Nexus inflicted a hidden structural unemployment policy in the 1980s and 1990s to drive down cost-side inflation. This persistent structural unemployment policy persists today, despite tweaks to the revamped Policy Target Agreement (a sanitized name that hides it vicious purpose). Therefore, persistent structural unemployment was established through mass public and private job destruction. The Reserve Bank’s inflation-targeting policy works by setting the interest rate, directly or indirectly, for wholesale credit supplied to the economy from international and domestic banks. It is a key policy component for maintaining structural unemployment.

The overt purpose of controlling interest rates is to stimulate or cool ‘lending’ relative to economic activity so that cost-side inflation stays within an agreed target of 1 to 3%. The covert purpose is to manage a Shock Doctrine policy that I call asymmetric inflation, which encourages asset price inflation by supplying cheap credit to fund house flipping, a landlord vulture culture and an uneven boom for the top 1%. This in turn produces crony capitalist class cohesion – as long as the vampiric prosperity for the rich continues to siphon upward off the host population.

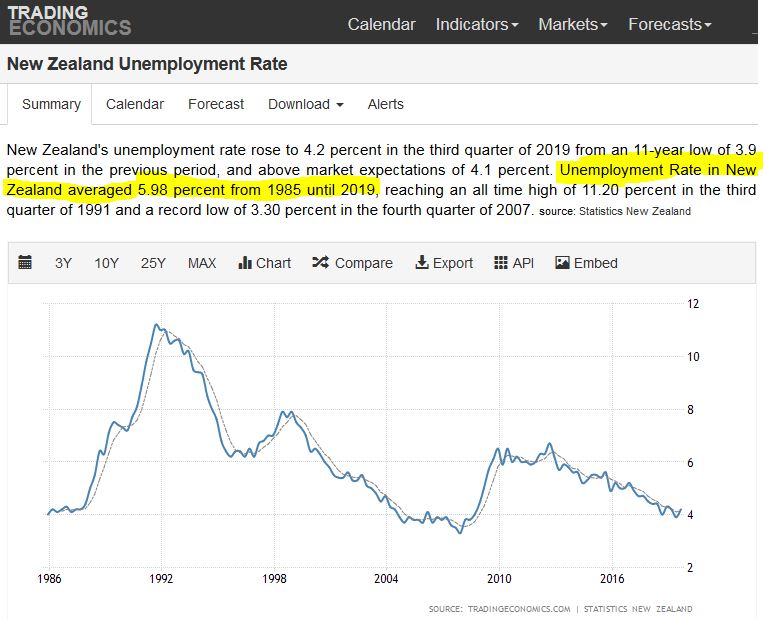

To this end, pro-corporate groups such as the Employers and Manufacturers Association exist to lobby to keep wages and salaries suppressed.[36] The inflation-targeting policy works as a mechanism of transmission for reproducing persistent structural unemployment. NZ’s unemployment rate -which had had been only 1% in 1971 before the Oil Price Shocks were inflicted – has averaged 6% from 1983 to 2014. In the past five years the NZ Government has bragged that the unemployment rate has been dropping and the national figure said to be currently 4%.

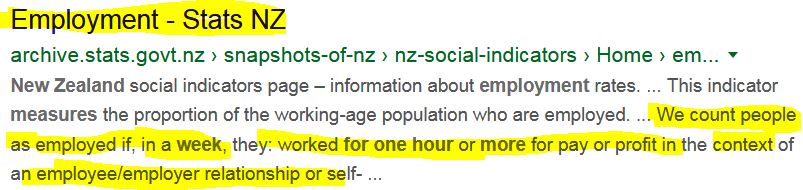

However, in 2014 the New Zealand Government adopted a OECD Labor Force standard of counting as little as one hour a week as being employed. The NZ Government therefore, hides the true figure behind statistical smoke and mirrors as a forms of screening actions to contrive ignorance about the root cause: its ongoing structural unemployment policy.

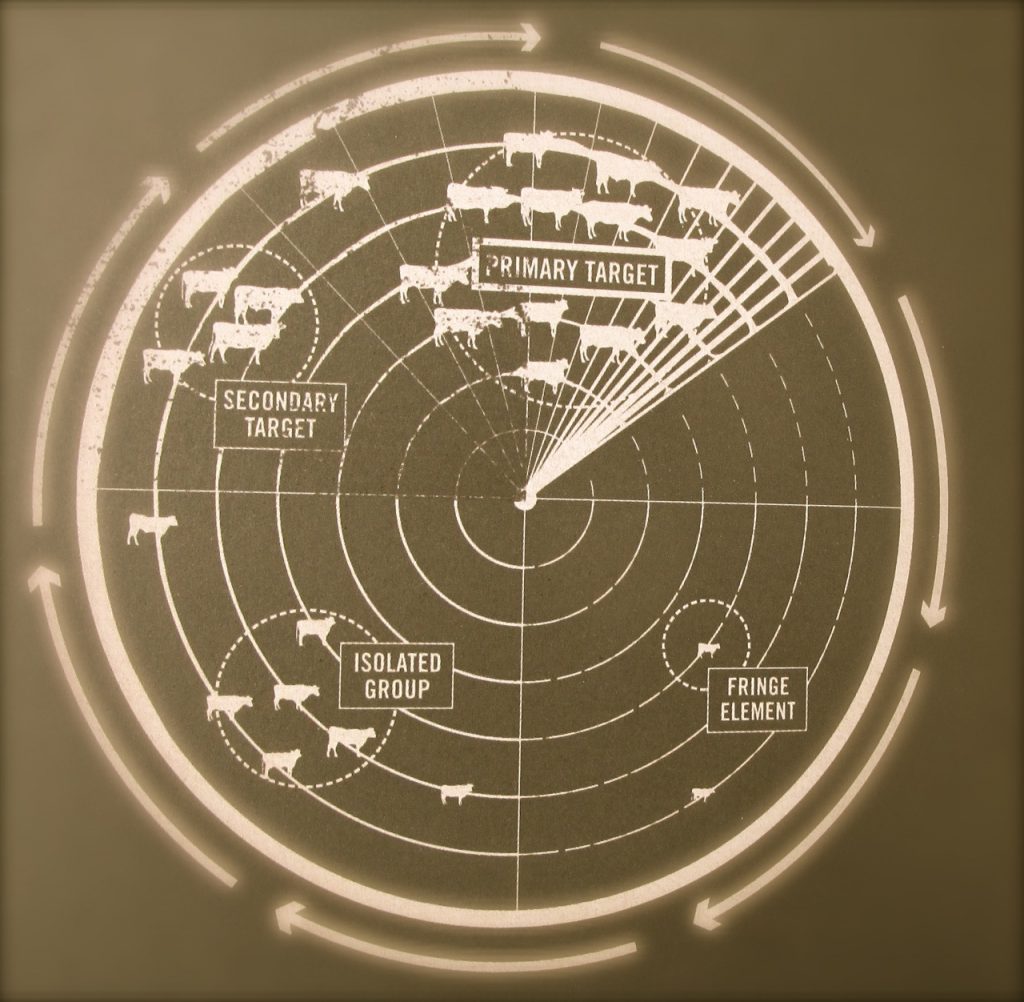

Therefore, the inflation-targeting policy is a coercive, exclusionary blackballing shock policy that ostracizes working class people socially from the human need to have security over their own shelter, food and other needs as captured Tax Herds. By placing more control over housing, employment, and business ownership into the hands of a crony capitalist class, which is dominated by an out-of-control Neo-Colonial Sect, the New Zealand Crown is deliberately facilitating an economic warfare paradigm. Therefore, the 35 year-old hidden state policy of ‘structural unemployment’ is a key component of the poverty crisis, itself a catastrophe borne from deliberate strategic sabotages of industry to inflict discretionary idleness.

The job destruction was designed to accumulate more power for the wealthy through exorbitant profits, or accelerated extraction of capital, as Wellington filmmaker Alister Barry has shown in his documentaries, Someone Else’s Country: The Story of the New Right Revolution in New Zealand and In a Land of Plenty: The Story of Unemployment in New Zealand.[37] The collective action of key Crony Capitalists, and political elites, private sector professionals and public sector technocrats (some of whom became crony capitalists in their own right) – created a Neo-Colonial Oligarchy.

The debt based-monetary and credit manufacturing system is integral to exacerbating the widening gap between the poorest and the richest.

As I have outlined, cartelized transnational private banking consortia, including the U.S. Federal Reserve, maintain structural alignments to ensure that actual cash is scarce. This structural scarcity of cash, set at approximately 3% of the quantity of any currency, compels governments, enterprises and whanau to ‘borrow’ the banking fraternities’ manufactured credit because most states, businesses and Tax Cattle cannot save enough to build a hospital, factory or a home, respectively.[38] Since Crony Neo-Colonial Capitalism’s hidden purpose is to make land scarce to as many Tax Cattle as possible,[39] global scale emancipatory moves to dismantle debt-based currencies, implement interest-free positive money economies and spearhead land redistribution are needed.[40]

Such asset sales were predicated on a corporatization of state trading entities, infrastructure and services, mass lay-offs of public sector workers, a stealthy form of flat universalized personal tax on most goods and services (GST), the introduction of ‘user pays’ fees, exorbitant private sector monopoly prices and widespread compliance fines. Thus, the public sector would be streamlined, while the general sales taxes, behavioural infringement fines, and monopoly tolls would create optimal conditions for corporate cronyism. In these pernicious ways, Tax Cattle have been tricked into building-out a corporatized technocratic dictatorship through performance targets, indicators and currency credits – that together provide incentives to enforce systems which riff off communism, fascism and other historical clichés of authoritarianism.

Ironically, we don’t recognize the slick corporatized technocracy as totalitarian because it is slickly marketed in the Make-Fetish World of advertising to mock, deceive and brainwash. All the while, a Roman-esque universal income tax collection system was maintained and backed by state coercion to fund infrastructure projects, corporate welfare bailouts and ‘national debt’ servicing of foreign privately-manufactured credit.

The state asset sales were designed to transfer wealth to Rich-Listers, enable extortionist pricing business models, and concentrate power. Rural and provincial communities were thrown into crisis because farm subsidies were suddenly removed first, hospitals and post offices were closed and state-owned enterprises were corporatized.

In short, New Zealand was mangled in the 1980s and 1990s.

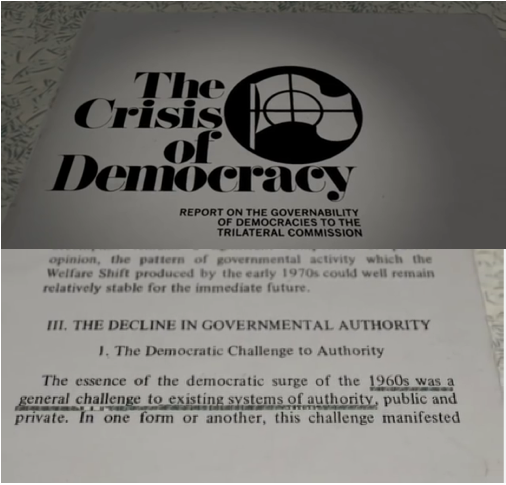

The impetus for this re-set of the New Zealand Realm and the rest of the world came from the then-North Atlantic Capitalist Class, who faced several major crises in the mid-to-late 1960s. These calamities were a structural crisis of Declining Profit Rates for undead transnational corporations, a Crisis of Democracy presented by the numerous captive 1960s Peoples’ Movements and demands from a Developmentalist Movement in ‘Third’ and ‘Second World’ countries for Western technologies in fair return for the resources supplied to rebuild Western Europe and Japan following WWII. To counter these crises, the North Atlantic Capitalist Class developed a ‘free market’ economic warfare framework to transform the world, as the documentary Requiem for an American Dream shows.[41]

This economic warfare framework, later identified by Canadian journalist Naomi Klein as the ‘Shock Doctrine’,[42] was driven from overseas, through a network of think-tanks. These think-tanks included the Mont Pèlerin Society, the Business Roundtable and the Tasman Institute, whom operated in alignment with a broader blueprint known as the ‘1980s Project’, that was work-shopped at a New York-based global policy-shaping think-tank, the Council on Foreign Relations, throughout the 1970s. [43]

The Council on Foreign Relations members, and their Anglo-Swiss counterparts, intended to re-invigorate the dominance of the ‘Trilateral World’ – comprising North America, Western Europe and Japan – by exploiting speed to capture control of political spaces through the collapse of time. Their modus operandi was to engineer sudden fast-moving events broad in scope to overtake the deliberative processes of the public state, overwhelm citizenries in their efforts to mobilize counter-forces and coerce the capitulation of public and private sector institutions.

To this end, key insiders at the Council on Foreign Relations planned the spread of ‘free markets’ by exploiting Chicago University professor Milton Friedman’s modus operandi of ‘speed, suddenness and scope’. These shock therapies were field-tested on Brazil in 1963, Indonesia in 1965-67, Chile and Uruguay in 1973 and Argentina in 1976, using US-backed military violence to destroy the Developmentalist Movement, as Klein details in her book, The Shock Doctrine. Another think-tank, the Trilateral Commission, was established in 1973 and tasked to formulate policies, strategies and tactics to deal with what was termed a Governance Crisis. The elite planners resolved to encourage political apathy, as this ‘governance crisis’ literature of this period makes evident.[44] From their perspective, there was a ‘Crisis of Democracy’ because there was too much participation from ‘below’.[45]

Strategic sabotage of industries ensued, as ‘Capital as Power’ theory could predict. As political economists Jonathan Nitzan and Shimshon Bichler showed in their book Capital as Power, dominant coalitions of monopoly capitalists ruin competing or captured enterprises that are accumulating capital at faster rates than their own cartels, or at times when broad-based wages and salaries are high enough that workers might develop self-determining communities.[46] Through such Deep State machinations, the world’s Tax Cattle were ‘disappeared’, terrorized and disenfranchised as the ‘free world’ spread Neo-Colonialism, which is track-laying vehicle to construct techno-feudal police superstates.[47]

Such emergent super-states are characterized by a displacement of democratic administrative systems with technocracy, which is a totalitarian form of government managed by technicians, engineers and scientists brainwashed to believe they are building unbiased governance infrastructure, when in fact technocracy transforms imperfect mechanisms for social control into a formidable scientific dictatorship for the benefit of unseen, super-rich oligarchies. In the West, the US-NATO military empire enforces regime changes to feed the excessive capital accumulation needs of super-rich neo-feudal capitalist coalitions.[48]

It is galling, therefore, to learn that then-Finance Minister Roger Douglas bragged at a private dinner in December 1986 that there would be a top strata of wealthy and in 25 years most New Zealanders would not be able to afford to live in NZ. Especially, since Douglas stated in the fourth installment of the 1996 documentary series, Revolution, that he and his cohort set out to destroy ‘privilege’.

Despite, repeating this fraudulent statement in a 2017 documentary, Trailblazers: The New Zealand Story and also in a Q+A Interview screened by TVNZ on 20 August 2019, Douglas and his con-conspirators remain at-large as un-convicted criminals for breaches of section 240 of the Crimes Act, which deals with crimes of deceit.

Thus, whole sectors of New Zealand society were coerced to submit to this Shock Doctrine framework following the initial ruse of a currency financial crisis, deliberately triggered by Labour Party shadow finance minister and Tasman Institute deputy-chair, Roger Douglas, when he ‘accidentally’ released a statement several weeks out from the 1984 election his intent to devalue the dollar if elected. This ruse depended on the absence of multi-institutional substantive investigations that modeled for power crimes.[52]

In his 1993 book, Unfinished Business, former finance minister Sir Roger Owen Douglas recalled his boast from 1989 to the Neo-Colonial Deep State that attended a ‘free market’ Mont Pèlerin Society conference in Christchurch, stating that his strategy in deploying economic shock therapy was to overwhelm numerous groups simultaneously.[53] In Unfinished Business, he reworked his 1989 speech entitled, “The Politics of Reform: The Art of the Possible”, in which Douglas bragged to members of the ‘free market’ Anglo-Swiss Mont Pèlerin Society, that his strategy to deploy ‘free market’ shock policies had been to cast himself as a fast-moving target, to gain New Zealanders’ submission.[54]

Here, Douglas was describing the modus operandi of Chicago-based ‘free market’ economics professor, Milton Friedman, who mentored his ‘Chicago Boys’ economic missionaries with a ritualistic mantra, “speed, suddenness and scope”. This mantra was the ‘key’ to ‘free market’ policy deployment – as Naomi Klein showed in her seminal 2007 book, The Shock Doctrine.[55] Friedman had made his first visit to New Zealand in 1981, the result of an invitation from Don Brash and a share brokerage, before he became Reserve Bank Governor.[56]

Many of 400 ‘free market reformers’ whom listened to Douglas brag at the Christchurch meeting of the Mont Pèlerin Society in 1989 about lacking a mandate to, in effect, deploy Friedman-style economic warfare policy shocks, comprised the core of Mont Pèlerin Society.[57] Among the Clergy of 400 Shock Doctrinaires were: the three New Zealand Members of the Mont Pèlerin Society – former ForestCorp and Electricorp chairman, Sir Alan Gibbs; former Treasury official, Electricorp Director and NZ Business Roundtable Executive Director Sir Roger Kerr; and National MP and future Health Minister, Simon Upton.

Also present were at the Christchurch meeting of the Mont Pèlerin Society in 1989:

Former Reserve Bank director, Telecom Chairman, NZ Business Roundtable Chairman, and member of the Tasman Institute, Sir Ronald Trotter; Chicago Boy and Tasman Institute member, John Fernyhough; former Reserve Bank official and State Services Commission chairman and Electricorp Director, Sir Roderick Deane; NZ Business Roundtabler and Lion Nathan brewing magnate, Sir Douglas Myers; NZ Business Roundtabler and merchant banker, Sir David Richwhite; Centre for Independent Studies member and former Reserve Bank and Landcorp official, Sir Peter Elworthy; NZ Business Roundtabler and property magnate Sir Michael Friedlander; NZ Business Roundtabler and Telecom chairman, Sir Peter Shirtcliffe; former economist and future ACT Party leader, Rodney Hide; future National Party Finance Minister, Ruth Richardson; then-Reserve Bank official Donald Brash; former Treasury official and CS First Boston merchant banker Stephen Jennnings; Centre for Independent Studies member, Bryce Wilkinson; and also Centre for Independent Studies member, former Treasury official and CS First Boston and Fay Richwhite merchant banker, Rob Cameron.

Two British members of the Mont Pèlerin Society, and its offshoot, the Institute of Economic Affairs, that attended meeting in 1989 were, Lord Bauer and Lord Harris of High Cross.

As Mont Pèlerin Society member, Simon Upton, told the New Zealand Herald in 1989:

“New Zealand is well situated to be a supplier of raw materials to richer neighbours, a home to well fed peasants who hopefully would not unsettle things for the outward looking elites.”[58] – Simon Upton, Mont Pèlerin Society

The corporate takeover of ‘New Zealand was the result of the ‘1980s Project’ – which was a multi-year initiative sponsored by the New York-based global policy-shaping think-tank, the Council on Foreign Relations. One objective in transforming New Zealand into a ‘Switzerland of the South Pacific’ was to make the nation an unaffordable place to live for most New Zealanders – including indigenous Māori – within a quarter of a century. To that end, the diabolical philosophy of oligarchism was adopted as unofficial corporate-state policy – which is the pursuit of extreme wealth through huge wealth transfers, a cruel system that produces mass poverty, dislocation and submission.

Coalitions of super-rich people re-grouped as a Neo-Colonial oligarchy, to use their enormous wealth to steer the political trajectory during this reset of New Zealand. Because oligarchs can only exist in societies with extreme economic equality, and because they thrive in crisis-ridden societies, and because their diabolical philosophy of oligarchism became corporate-state policy, New Zealand’s Rich-Lister oligarchy and their colluding foreign counterparts, are the root cause of the poverty crisis, along with the other crises that beset the country.

Structural Unemployment & the Restriction of Cash

Key Finding: Despite changes in social indicator definitions, the New Zealand Government continues to maintain its 35 year-old hidden structural unemployment policy.

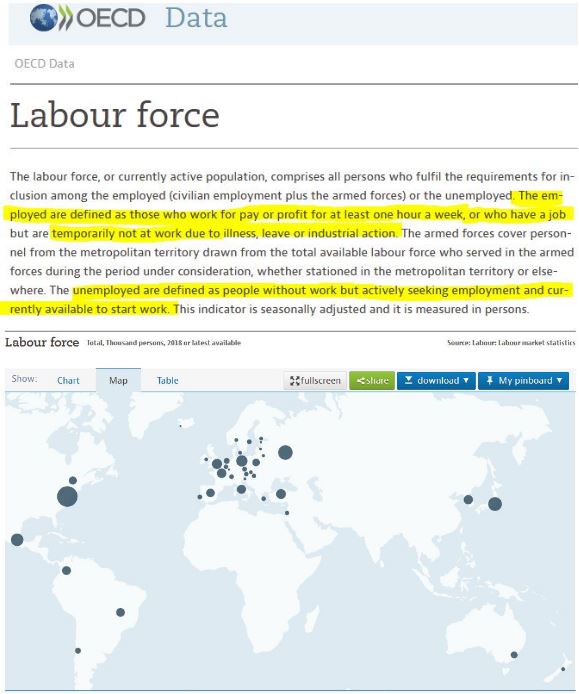

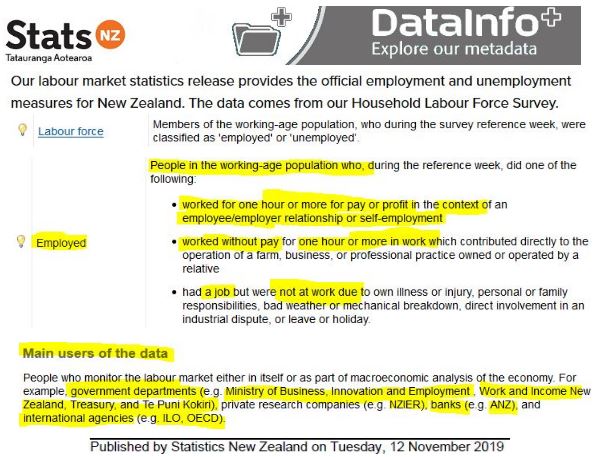

The Organisation for Economic Co-operation and Development (OECD) standard of counting one hour of work a week as being employed is used throughout the world. This low threshold allows governments to hide the true unemployment figures, and gets politicians, bankers and corporate lobby groups off the hook in maintaining structural unemployment as a hidden transmission mechanism for producing low wages and salaries.

During the Key Administration, the New Zealand Government adopted this OECD standard for counting the employed, with a threshold as low as one hour a week of work.

Under the Ardern Coalition Government, Statistics New Zealand’s definition of unemployment appeared to have been altered, and no longer mentions the problematic threshold of one hour a week of work counting as employed.

This Statistics New Zealand definition for counting unemployed people does not define precisely what it means by the phrase “no paid job”. No threshold, or parameters, or measures are stated.

However, a deeper look at how Statistics New Zealand counts its labour force data on its Data Info Plus webpage, shows the New Zealand Government still registers a person as employed if they report just one hour of paid work in a given sample week.

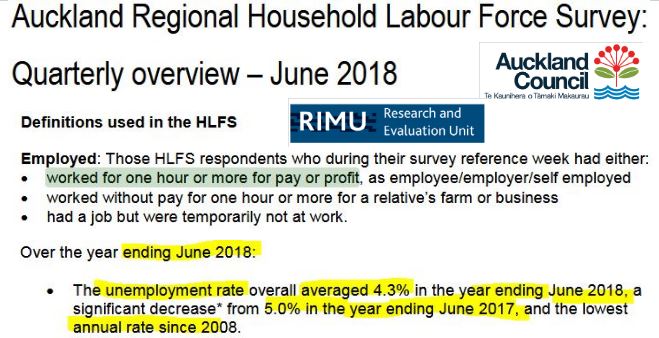

The OECD’s labour-force employment measure has also been used in the Auckland Councils Regional Household Labour Force Survey.

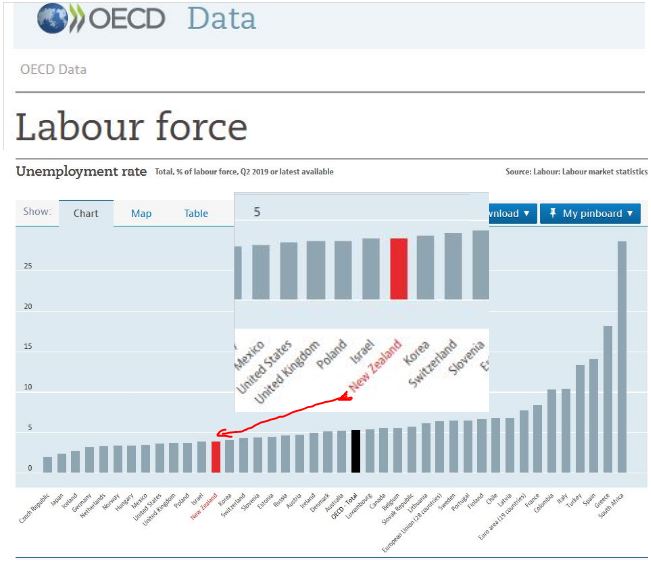

Yet, this 2019 OECD chart indicates that New Zealand Government is still using the Organisation for Economic Co-operation and Development standard of counting one hour of work a week as being employed. The OECD website still carries the one hour per week employment definition.

At the beginning of its formation, the Ardern Coalition Government set a target to reduce unemployment to 4% of the workforce. According to the Labour Party Maori Caucus, New Zealand’s unemployment rate dropped to 3.9% nationwide in 2019 from 4.7% in 2017 when the National Party were in government. The NZ Coalition Government appeared to have achieved this statistical goal by hiding the fudged figures, claiming to have created 92,000 jobs while avoiding mention of the ‘gig economy’, systemic insecure employment and without explaining why persistent unemployment exists.

Therefore, the current New Zealand Neo-Colonial Government administrates the still-operational broad-scope economic warfare policies that maintain structural unemployment. These economic warfare policies include the Reserve Bank’s restriction of the cash supply, in collusion with the international and domestic banking cartel to maintain unemployment. The banking cartel, which includes the Reserve Bank, keeps cash scroogie scarce to coerce people to borrow, controls the supplies of new loans, and makes poverty visible (which works as a psychological mechanism to undermine workers’ pay bargaining power).

The hidden state policy of structural unemployment that underpins persistent child poverty, which afflicts one third of New Zealand children – or 300,000 tamariki[49] can’t be undone by a tinkering to the Policy Targets Agreement (PTA) 2018.[50] The PTA is a mechanism of a debt-monetary and credit-manufacturing banking system characterized by a rivalrous international banking cartel managed by the Reserve Bank, whom works in collusion with the Treasury, to keep cash as a scarce resource so that households, businesses and government never earn enough to fund necessities and are forced to borrow into existence privately manufactured credit.

Embarrassingly, this debt-monetary and credit-manufacturing banking system was first formalized during the New Zealand Masonic Revolutionary War of 1860-72 and was designed to lure households, businesses and governments into debt by maintaining a structural scarcity of cash and a relative abundance of interest-bearing credit. The British Crown played a long-game of conquest when it lured Māori into its jurisdiction with the parallel construction of two materially different versions of the 1840 Treaty – for the purposes of conquest on paper.

The British Crown’s long-game of conquest involved gaining substantive sovereignty by driving ‘the natives’ – iwi by iwi and hapū by hapū – from Māori ancestral lands. A ‘wedge of war’ was driven into the ‘Native Estate’ by the stealthy hands of a secret brotherhood of Freemasons that bound the British Crown with its fraternal alter-ego – the Colonial Crown – as demonstrated in The Snoopman’s illustrated essay, “The Masonic New Zealand Wars: Freemasonry as a Secret Mechanism of Imperial Conquest During the ‘Native Troubles’ ”.[51]

By gaining a foothold to impose taxes, the British Crown, and its fraternal alter-ego Colonial Crown, spread a system of brainwashed social control based on artificial scarcities in land, cash and trade. These artificial scarcities were predicated on spreading devious systems of income-draining taxes, abundant credit and British law as witless settlers drained swamps, swallowed debt and valourized the Monarchy.

Therefore, the legacy, swindle and impacts of this debt-monetary and credit-manufacturing banking system – that gained formal standing during the Masonic New Zealand Wars – is a transmission mechanism for unnecessary, pernicious debt bondage that maintains the political power of banking oligarchs through their control over the life-blood of wealth accumulation: abundant credit and scarce cash.

Because the Children’s Commission reports on child poverty do not model for oligarchy, they therefore cannot sufficiently identify the phenomenon’s root cause: the diabolical philosophy of Oligarchism.

Political Kryptonite Issues

Key Finding: The strategic sabotage of industries inflicted a discretionary idleness, which included a hidden structural unemployment policy that is now 35 years-old.

NZ’s Neo-Colonial Crown maintains joblessness at around six percent of the workforce to weaken Tax Cattle pay-bargaining power via the structural coercion of visible poverty, as the documentary, In a Land of Plenty: The Story of Unemployment in New Zealand revealed.

Therefore, ‘free market’ economic shock therapies were themselves mechanisms of coercion, because all sectors of society were thrown into crisis – deliberately, stealthily and callously.[59]

Under this project, ‘free markets’ were promoted with propaganda that promised freedom and prosperity for all, or that wealth would ‘Trickle-Down’. The intention all along was to increase the wealth and power of the super-rich Tax Farmers, by waging economic warfare. Therefore, ‘Trickle-Down economics’ was a wryly-encoded joke that signified the rich Tax Farmers would control the ‘wealth tap’. Canadian journalist Naomi Klein later identified this globalized ‘free market’ economic warfare framework as the Shock Doctrine.[60]

To ensure the durability of this Global Neo-Colonial Project – otherwise known as ‘globalization’ – élite planners used a strategy known as new constitutionalism, which would lock-in changes and take them beyond the reach of indigenous and nation state populations.[61] Under a new constitutionalism framework, nation state sovereignty is transformed into a commercialized form of sovereign rule-making that occurs in an international arena, such as through so-called free-trade agreements.

The intention is to favour the property rights of super-rich Neo-Colonialists, whose wealth is protected in a state-sponsored, worldwide Financial Secrecy Haven Complex.[62] Ironically, within such secret spaces, the politically and economically powerful were conferred with commercialized sovereignty to create shadow selves beyond the reach of authorities, as the authors of Tax Havens: How Globalization Really Works compellingly showed. In short, globalization is the accumulation of sovereignty.

In his 1965 book – Neo-Colonialism: The Last Stage of Imperialism – former President of Ghana and friend of President John F. Kennedy, Kwame Nkrumah, wrote that a Neo-Colonial state has the outward appearance of international sovereignty, but because its economic resources and financial systems are controlled from the outside, the political apparatus takes external directions. Once a country is captured by Neo-Colonialists, a dynamic is set in motion that compels neighbouring ‘countries’ to adopt the Neo-Colonial framework.[63]

The documentary, The Spider’s Web: Britain’s Second Empire, show that when Britain ceased being a colonial power after WWII, the privately owned municipal City of London Corporation adapted to become a financial power by creating a web of secrecy jurisdictions where wealth could be hidden in offshore islands.[64] Via this Neo-Colonial system, wealth was captured from across the globe, so that control over former colonial jurisdictions could be regained and retained by stealth, and beyond public state scrutiny. Wall Street bankers set-up shop in London to exploit this offshore system and soon developed an American ‘Tax Haven’ system of financial secrecy jurisdictions including onshore states like Delaware, Nevada, Wyoming, South Dakota, and Montana and offshore ‘spidernet’ including Manhattan, the U.S. Virgin Islands, and Puerto Rico to compliment the U.S. Federal Reserve financial secrecy jurisdictions.

By 2011, the emergent Transnational Capitalist Class steering Neo-Colonial Capitalism had concentrated their power through highly-networked corporate board directorships and ownership stakes comprising a core of just 147 corporations.[64] Neo-Colonialists adhere to the diabolical philosophy of Oligarchism, which is the belief in the right to rule the world, the stealthy schooling of psychopaths and the pursuit of world domination. Their long-game is to reset the world on a trajectory of techno-feudal superstates, which are being constructed incrementally by the Neo-Colonialism framework that acts a track-laying vehicle. Nkrumah’s findings some 59 years ago shine valuable light on the impetus for the re-set of world in the 1980s – including New Zealand in 1984 – with the deployment of the ‘free market’ economic shock treatments, that was eventually named as the ideological construct – Neo-Liberalism.[65]

Exponents of this term such as academics, journalists and leaders of political movements, often make the mistake of assuming that because a ‘market economy’ framework was developed out of Neo-Liberal ideology, the subsequent impacts of ‘Neo-Liberalism’ must simply just be failures, flaws and faults. This assumption stems from an unwillingness to openly talk about the political conspiracy inherent to the construction of a comprehensive shock treatment program for worldwide deployment.

This ‘free market failures’ rhetoric is a fall-back position also stems from an ignorance of the ‘1980s Project’ economic warfare blueprint formulated at the Council on Foreign Relations (CFR) think-tank during the 1970s. Such critiques of ‘free market capitalism’ usually locate Neo-Liberalism as failures of an ideologically-driven economic framework whose proponents are either blinded by their fundamentalism, or greed, or those attributes merely colluding with hubris.

Yet, the critiques also acknowledge the robustness of the ‘Neo-Liberal’ system and its inbuilt defences to undermine its dismantlement. Rather ironically, the ongoing economic warfare that was designed into CFR’s ‘1980s Project’ blueprint is rendered invisible by the discourses on Neo-Liberalism because such critics also often fail to locate Neo-Liberal policies as Shock Doctrine economic warfare frameworks.

By overlooking, avoiding or downplaying the reset of the world economy that occurred with the deployment of the ‘1980s Project’ – and after field-testing the Shock Doctrine economic warfare in the 1960s and 1970s – Neo-Liberal discourses miss the bulls-eye. Such discourses fail to realize that the market development of an ideological construct that is designed to: reassert the economic, political, military and cultural dominance of the then-North Atlantic Capitalist Class; to suppress pressures for ‘too much democracy’; and to permanently resist its dismantlement – means that a well-resourced political conspiracy occurred.

This comprehension failure of the inherent conniving callousness to the ‘Neo-Liberal Project’ derives from a widespread belief that such phenomena occurs only through spontaneous, uncoordinated reactions to structural forces such as those mentioned earlier, that occurred in the mid-to-late 1960s – including the structural crisis of Declining Profit Rates for transnational corporations, the Crisis of Democracy presented by the 1960s Peoples’ Movements, and the Developmentalist Movement of Second and Third World countries whom demanded Western technologies as fair exchange for the harvesting of their resources.

Yet, resets to maintain power over economic, political, military and cultural resources require political conspiracies, or the activation of instrumentalist forces. The ideological construct, ‘Neo-Liberalism’, was never named as such. The reforms were, however, called ‘free market’ which matched the rhetoric that there would be ‘less government’ because commerce was going to be ‘de-regulated’, when in fact it was, and continues to be, re-regulated.

The exponents of ‘free markets’ did not talk about the networks of think-tanks that proliferated with capitalist class funding because that would have drawn attention to who was behind the genesis, incubation, and transplanting of ‘free market’ ideas. It would also have risked hinting that there were instrumentalist Deep State resets occurring simultaneously, since naming a well-resourced network of elites would have revealed linkages to dominant coalitions of capitalists, or oligarchies, at a time when big world-shaping events were current in mass memory. Much of the Establishment Media were either already captured through media mergers, or were overwhelmed by the cacophony of crises engineered by Deep State instrumentalist forces bending the Public State to its will.

The unveiling of such networks would have ruined the theatre of news, which is episodic by construct, and contextualizes such machinations as simply the results of a chaotic world undergoing organic or unpredictable political crises requiring pragmatic solutions resolved upon in circumstances deemed too complex to pinpoint a root-cause. This cacophony of crises renders the culprits as invisible as the ideologically-infused economic warfare frameworks under deployment. Therefore, Neo-Liberalism is more like a Formica finish that hides the shitty custom-wood materials of the cabinetry: Neo-Colonialism.

To sum up, a silent coup was orchestrated by Neo-Colonial Élites when they captured the Labour Government in 1984 to facilitate a sabotage of New Zealand, a corporate takeover of the economy and the implementation of a Neo-Colonial regime. Those Neo-Colonial Élites, whom were aligned with the Mont Pèlerin Society, the Business Roundtable, the Tasman Institute, the Trilateral Commission and the Council on Foreign Relations, inflicted mass lay-offs in the public and private sectors from the mid-1980s to the mid-1990s, as part of a broader ‘1980s Project’ blueprint to re-assert the dominance of the North Atlantic Capitalist Class.

To this callous, devious and nefarious end, successive New Zealand governments have stealthily maintained what is now a 35 year-old state policy of structural unemployment. Their plan was to forge a ‘Switzerland of the South Pacific Utopia’ for a wealthy top strata to enjoy extraordinary privilege, through the strategic sabotage of industry, the infliction of mass unemployment and the deployment of economic warfare policies intended to eventually drive most New Zealanders out of the country.

From mid-1984 onward, the Lange-Labour and then the Bolger-National governments pursued this secret state policy to keep the level of people out of work at around 6% of the labour force. Because huge pools of unemployed people create the visible spectacle of poverty, it works as a coercive mechanism to keep wages and salaries low to satisfy big businesses investors, as Alister Barry’s 2002 documentary, In a Land of Plenty: The Story of Unemployment in New Zealand revealed. The deployment of this hidden structural unemployment policy was first achieved by the NZ Government corporatizing and then privatizing the state sector.

To assist, the Reserve Bank worked in collusion with Treasury, Cabinet, and the Business Roundtable to inflict industrial-scale job destruction by maintaining high interest rates, ostensibly to bring down inflation rate. Amid such conditions, higher mortgage costs, rents and credit card bills – consumer spending across the economy fell. With plummeting sales, businesses were compelled to make workers redundant or go bankrupt fast.

Once the Reserve Bank gained the power to target inflation in 1989, the New Zealand central bank’s collusion with Treasury and the transnational banks was formalized as an experiment in central bank ‘independence’. Between them, the Reserve Bank, Treasury and the transnational banks set interest rates to stimulate or cool the economy, thereby maintaining conditions for persistent structural unemployment.

The Reserve Bank calibrates New Zealand’s wholesale ‘cash rate’ to the overnight inter-bank lending rate to adjust the supply of scarce ‘settlement cash’ resulting in an easing or tightening of monetary conditions, in conjunction with a monetary policy tax on deposits to discourage banks holding too much cash. In this way, the supply of credit shrinks or expands, and the fee for not withdrawing that supply – interest – fluctuates in price, thereby heating and cooling economic activity on the basis of the ‘loan’ approvals or declines, and their costs.

Interest rates are fees that transnational banking cartels charge for not withdrawing supply of credit funds. Bankers use interest rates as a transmission mechanism to signal threats and promises to state managers. Three examples of credit coercion show a clear pattern of international and domestic bankers issuing ‘ransom notes’ through the inter-bank lending rate as cues to the Reserve Bank and other state managers.

The first, shown here, was when the float of the New Zealand dollar on 4 March 1985 gave the international and domestic banking fraternities – euphemistically termed ‘speculators’ – the opportunity to send the Reserve Bank’s wholesale lending rate (the overnight inter-bank lending rate) shooting up to a Banana Republic rate of 265% on March 8. The speculative spikes averaged out to an all time high for the ‘cash rate’ at 67% for March 1985.

The spike in interest in this month was, in effect, a ‘price signal’ ransom note sent by international bankers to the Reserve Bank. In effect, the encoded message in this financial data was telegraphing to ‘move on to phase two of the shock therapies, by prolonging high interest rates to cause the strategic sabotage of industry through business down-sizing, closures and mass worker lay-offs’. By 29 March, the ‘cash rate’ had come down to 21.5%, and fluctuated between 20% and 30% through 1985-1987.

The second ‘ransom notes’ came when the ‘cash rate’ finally came down permanently below the 20% barrier after the October 1987 Sharemarket Crash because this collapse in stock prices caused a curtailment in spending and a 6% drop in the inflation at the end of 1987. The third ‘ransom note’ came when the ‘cash rate’ or wholesale ‘lending’ rate finally fell below 10% on 31 July 1991, which was the day after Finance Minister Ruth Richardson performed her ‘Mother of All Budgets’ speech in Parliament. By breaking through the 10% ‘barrier’, ‘the markets’ voted their approval for deep cuts to welfare payments and the passage of the Employment Contracts Act, that would drive down wages and, therefore, cost-side inflation. The deep cuts to welfare payments would ensure that Treasury could prioritize debt servicing to private ‘creditors’ that own the transnational banking cartels.

This threshold through the 10% barrier for wholesale credit costs demonstrated the precision with which the international banks – working as a price fixing cartel – could regulate the economic growth, inflict ‘discretionary idleness’ through ‘strategic sabotage of industry’ and signal that the new benchmark fee for continued supply of credit came with conditions attached. Therefore, the wholesale interest rate functions as a coercive fee charged for credit that restricts or stimulates economic activity to privilege transnational and domestic cartels, by keeping poverty visible enough to be a threat, but not enough to de-stabilize ruling class power structures.

This investigation has shown through the use of charts, statistics and other cited documentary sources – the relationship between the the inflation rate, the wholesale interest rate and the control of cash and credit supply, and how these economic indicators are actually manipulated to control the unemployment rate. The Snoopman has proven that a foreign and domestic banking cartel comprising international and local banks and the Reserve Bank of New Zealand collude to regulate the supply of credit while maintaining scarcity over the cash supply. This control of the currency supply ensures that the populace is coerced to borrow credit which is actually manufactured by banks at the time new loans are made. The banking cartel stealthily keeps cash scarce, and regulates the amount the of credit and the cost of borrowing.

By doing so, the banking cartel is able to control economic activity through the level of new loans granted and, in turn, the amount of new loans works to regulate the level of employment and unemployment by not only controlling interest rates. But also, because deposits with banks are invested in financial markets, this means that banks are charging interest on credit funds that are actually borrowed into existence. Therefore, banks make a windfall in profits by charging an extortionist fee that masquerades as a fair deal with the banal term ‘interest rate’.

And in the process, the international banking cartels suppress economic prosperity, financial freedom and the capacity for societies to develop with debt-free positive money. By maintaining a debt enslavement system that burdens populations with credit bills, loans and public debt, the foreign and domestic banking cartels ensure that the citizenry is controlled by these hidden transmission mechanisms of economic warfare.

Despite its ‘Wellbeing Budget’ rhetoric, the Ardern Coalition Government under reports unemployment by counting people as employed if they have just one hour of work in a given survey week – in accordance with the OECD employment measures. Because this Organisation for Economic Co-operation and Development (OECD) employment measure is used throughout the world, including New Zealand’s institutions such as the Ministry of Business, Innovation and Employment, the NZ Treasury, and the Ministry of Māori Development – Te Puni Kōkiri – as well as the revamped Social Welfare Department, Work and Income NZ, along with private research companies, including New Zealand Institute of Economic Research, and the banking cartel – the Rich-Lister Civil Oligarchy is let off the hook. Since oligarchies are coalitions of super-wealthy whom wield strategic control over enormous economic wealth, and whom can only exist in societies with huge disparities in wealth – this low threshold for counting people as employed hides the true of level of unemployment.

This 35 year-old hidden Neo-Colonial state policy of maintaining unemployment at around six percent is hidden because it is vicious, un-mandated economic warfare. Because oligarchs actually thrive in crisis-ridden societies – since their corporate cartels are able to extort super-profits by controlling markets, maintaining scarcities and fixing prices among other restraint of trade practices that suppress economic dynamism – New Zealand’s Rich-Listers are the major beneficiaries of this Deep State structural unemployment policy.

New Zealand’s Deep State maintains structural unemployment as a hidden transmission mechanism for producing low wages and salaries, so that New Zealand’s Rich-Listers and their foreign counterparts can ‘earn’ super-profits off a captive population of employed and unemployed Tax Slaves. Because most government workers who comprise the Public State are unaware of this structural unemployment policy, the NZ Deep State is able to keep its distance from this and other related political kryptonite issues, and therefore maintain its illegitimate power to inflict harm against the rest of New Zealand.