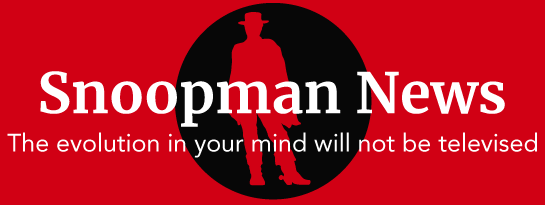

The governments of the United States, the United Kingdom, Canada, Germany, Switzerland, Australia, and New Zealand (and their respective financial authorities) have colluded with transnational banking cartels to reset the Western world’s financial systems during the next global financial crisis – with bail-ins.

If you haven’t heard about the impending bail-ins regime, it’s because you lack a finely attuned Stealth-o-Meter.

But, you have heard of bail-outs, wherein taxpayers around the world are ritually lumped with massive bills added to their country’s national debt to ‘save’ the global banking and financial cartels from bankruptcy.[i]

In the next financial crash,[ii] a portion of deposits will be confiscated overnight to save troubled banks (and other financial institutions). Under this secretive new bail-ins regime, peoples’ savings will be converted into stocks, by whatever fraction is deemed ‘necessary’, even though the share prices of embattled financial institutions will likely be plummeting on news of such interventions.[iii]

At Risk Zombie Bankers: European Banks with Bail-ins risks in 2015 – Moody’s and S&P Warn (Source: Goldseek.com)

At Risk Zombie Bankers: European Banks with Bail-ins risks in 2015 – Moody’s and S&P Warn (Source: Goldseek.com)

Major banks and other major financial institutions that are deemed systemically important and in high-risk of failure, will be closed without notice. Such financial institutions will be re-opened within 24 hours. However, savers will find that the status of a fraction of their savings has changed from deposits (that they can cash up at will), to bank capital. What savers will get in return are common stock shares.[iv]

This switch may sound fine, at a pinch.

Except, that if this bail-in has occurred amid general market turmoil, or when certain institutions have been the target of aggressive financial attacks (as occurred in 2008 during the Global Financial Crisis), then the share price of the bank in question will likely be ‘distressed’, especially when news spreads that a bail-in is occurring. In short, the deposits of savers will be used to recapitalize distressed banks and other financial institutions.

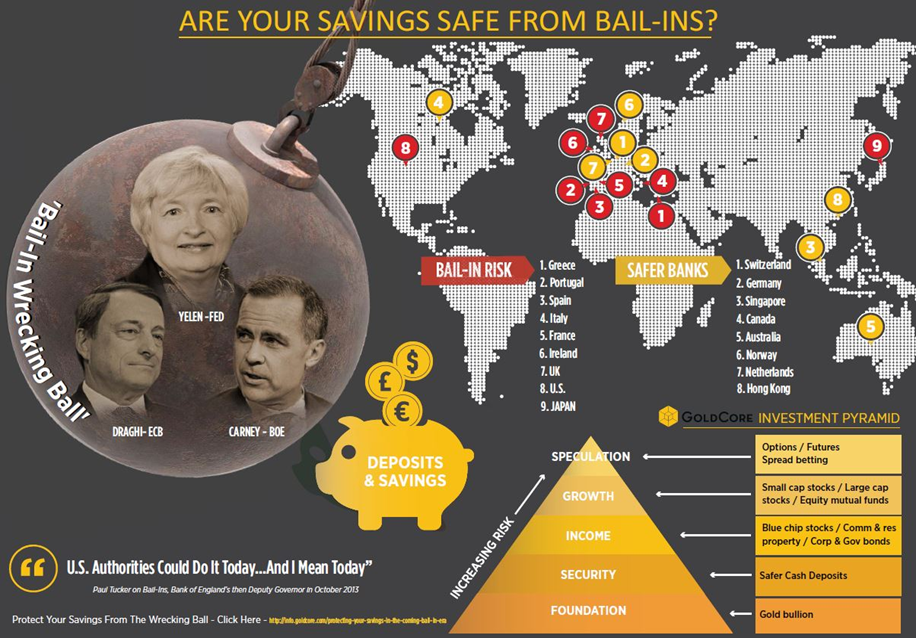

Lining up Scrooge’s Ducks: Deployment of the Great Bail-in Wrecking Ball. Graphic: Global Precious Metals.

Anatomy of a Bail-in Wrecking Ball

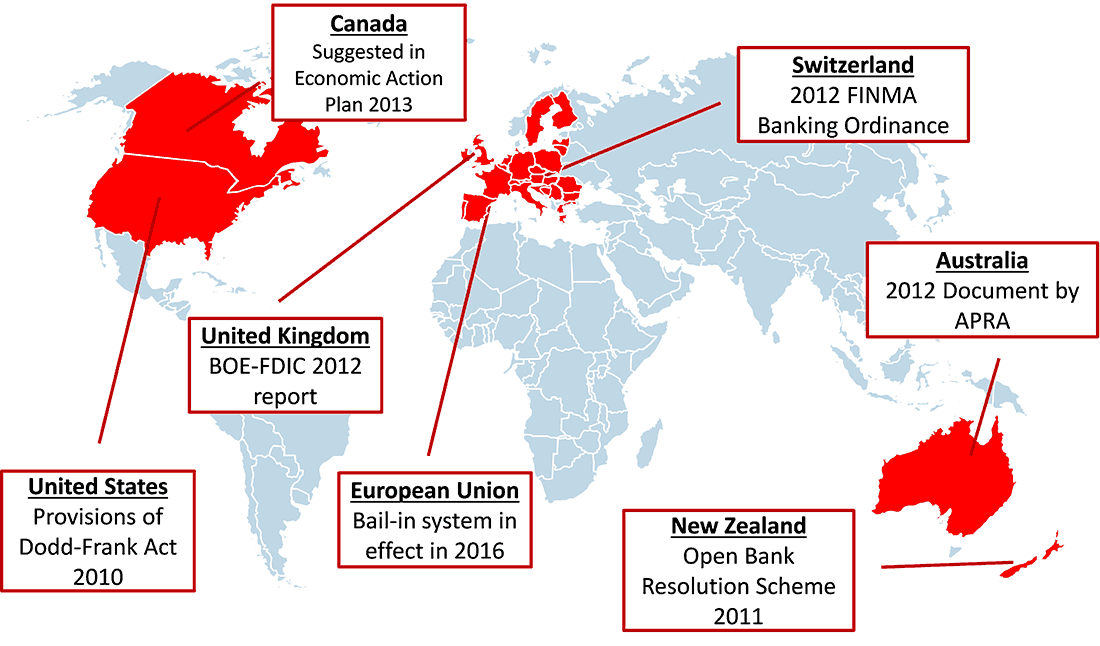

As can be seen from the above graphic, various jurisdictions throughout the Western Empire have been quietly putting in place this bail-in regime. Leading the regime change is Canada, the United States and its fraternal twin, the United Kingdom, Germany, Australia, New Zealand, Cyprus and the world’s most famous financial-secrecy haven state, Switzerland. The rest of the fragile super-state known as the European Union is expected to suck-up the bail-in regime by mid-2016, if not by now. According to the X22 Report, European jurisdictions were told in mid-June 2015 to get their bail-in frameworks implemented.[v]

Harmony in Banking: Europe told to get with the Bail-in Program

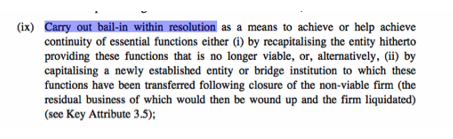

Therefore, the banksters’ mission creep has expanded from thieving the financial resources of so-called ordinary people cast as taxpayers, to ordinary people cast as consumers. This mission creep occurred at the 2009 G-20 Summit in Pittsburg, USA America. There, government representatives of the leading 20 industrialized nations evidently ‘asked’ the Financial Stability Board, which coordinates the world’s financial authorities and is based at the central bank of central banks, the Bank for International Settlements (BIS), to address systemic risks to the global financial system.[vi] While failing to confront the causes of the Global Financial Crisis, which has to do with the rapacious power of super-rich dynastic banking families, the Financial Stability Board came up with the bail-in regime to recapitalize the bankers’ banks as one of the ‘solutions’.[vii] The following year, at the 2010 Seoul G20 Summit, the G20 leaders re-endorsed a binding bail-in regime, and in 2011 the Financial Stability Board set out a blueprint requiring each jurisdiction to set-up a bail-in framework, euphemistically termed: ‘resolution authority’.[viii]

‘Resolution Authority’: G20 governments agree to Bail-in regime.

This bail-in regime was tested in the Cypriot banking crisis of 2013. In mid-2012, two of the largest local banks on the island of Cyprus became insolvent. The government of Cyprus began negotiating a bailout with the ‘troika’ institutions, the European Union, the European Central Bank and International Monetary Fund on June 25 2012. The public did not know about a bail-in provision, also known euphemistically as a ‘haircut’. [ix] On March 16 2013, Cypriots were told that 6.75% would be confiscated from savings accounts of less than €100.000 and 9.9% for accounts over €100.000. An unexpected and extended ‘bank holiday’ was announced. Widespread protests ensued while the Cypriots government held an emergency session to vote on the bail-out/bail-in bill. On March 25 2013, the government of Cyprus capitulated to the troika’s bail-in and depositors with over €100,000 in the Bank of Cyprus lost 40% of their money, while Laiki Bank savers with over €100,000 lost 60%.[x] Institutional investors such as financial institutions, the government, municipalities, municipal councils and other public entities, insurance companies were protected. In other words, it was middle class people whose savings were targeted.

Critics of the stealthy bail-in regime argue that Cyprus was a test. This would fit with observations from the Global Financial Crisis, wherein new norms were ‘anchored’ that signaled further enlargement as the regime restructured itself.[xi] Bail-ins essentially represent another incursion into Western households and are intended to be a liquidation of their capacity have enough resources to resist the far-reaching transformations that deepen the control of Private Banking Monopolies.[xii]

Haircut Test: The island of Cyprus worked as an experiment.

At a superficial level, this epic ‘savings snatch’ blueprint has been written because the bail-outs of 2008 that occurred in the midst of the engineered Global Financial Crisis[xiii] became too unpopular to try again. More importantly, the next global markets crash will likely see the world debt crisis explode. Amid this looming global sovereign debt crisis, where governments default on their ‘debt’, there simply won’t be any investors willing to take the guarantees of many governments that their tax-backed bailouts will be worth anything.[xiv] This means the value of many currencies will crash.

The key symptoms of impending currency collapse or ‘debt decay’ is the prolific speculative bubbles across numerous asset classes, as James Rickards pointed out in Currency Wars: The Making of the Next Global Crisis. When market booms bust and the value of assets plummet, banks and other financial institutions can quickly become insolvent because the assets on their books deflate in value. Audaciously, the major banks that comprise global banking cartels had by 2008 gotten used to coercing governments around the world to bail them out.[xv]

But in the next global financial crises, tax-backed bail-outs will not be feasible in economies where their currencies are crashing in value because there have been heavily expanded by debt and there simply won’t be enough taxpayers left standing to service the exponentially growing compound interest.

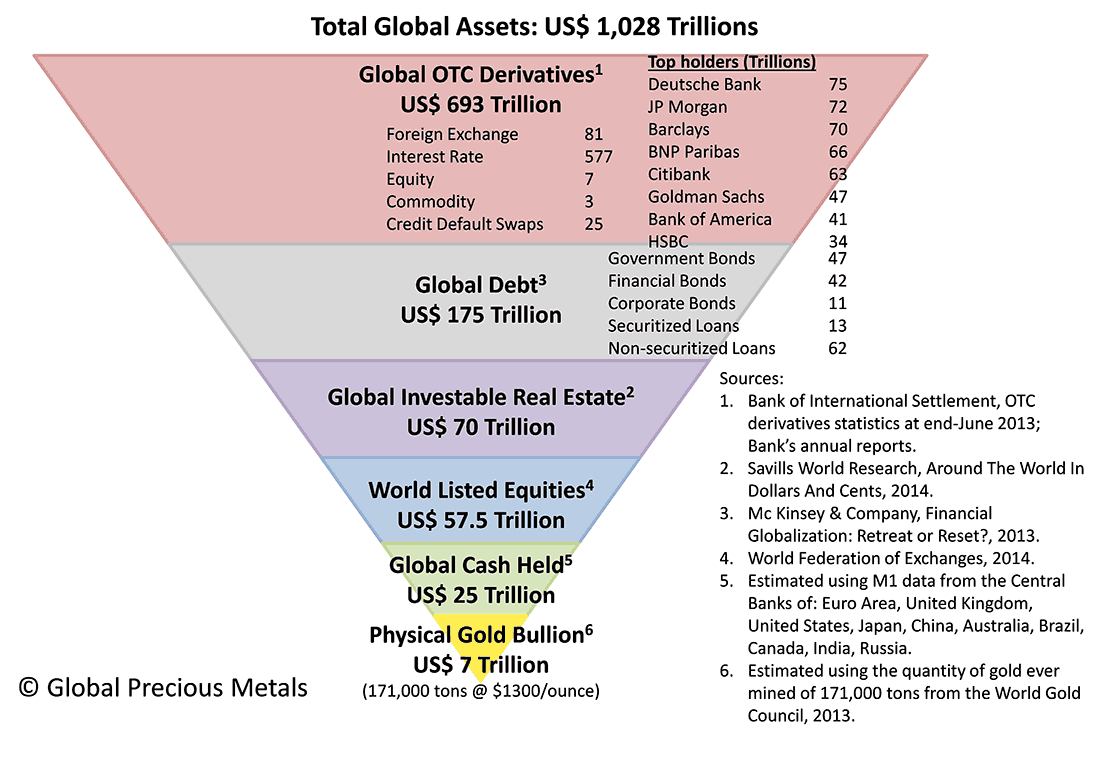

It turns out that savers’ deposits are considered ‘loans’, as established under British law in the 19th Century.[xvi] Banks and other financial institutions regard savers as creditors. In the new bail-in regime, speculative investors who hold derivatives will be paid out first.[xvii]

Derivatives are financial bets made on assets that investors do not own, but allow them to earn income off the underlying stocks, commodities and currencies. Financial derivatives will have super-superiority status over all other creditor claims, including common stocks, because they are key mechanisms of coercion for predatory financial cartels.[xviii]

The global derivatives bubble is estimated to be $1.5 trillion, which is approximately 21 times the size of the $70 trillion global annual production (or GDP).[xix]

Inverted Pyramid: Unregulated derivatives add instability to the casino.

Inverted Pyramid: Unregulated derivatives add instability to the casino.

Since the Global Financial Crisis of 2007 and 2008, the world’s financial system have become more vulnerable to the kinds of speculative, predatory and private strategies exploited by dominant capitalist coalitions when they engineered the Global Financial Crisis (as was shown in a thesis entitled, “It’s the Financial Oligarchy, Stupid”).[xx] One type of derivative known as credit default swaps, which are meant to work as a kind of insurance on a company’s debt, were actually used as coercive mechanisms to make the cost of insurance for debt of targeted firms so high, that their collapses became inevitable in 2008.

The global banking cartels make complex bets to destabilize targeted firms, industries and governments. In the resultant busts, global banks are able to scoop up businesses, homes and public assets at distressed prices.[xxi]

In a nutshell, the Great Bail-out Wrecking Ball will be accompanied by a Great Bail-in Wrecking Ball.[xxii] The deployment of a bail-in regime is an attempt by the Western financial-political oligarchies (or super-rich coalitions) and their banking elites to manage a controlled collapse, since the bursting of the massive derivatives and debt bubbles is inevitable.

The surface reason why most people haven’t heard of bail-ins is because people would prepare by withdrawing their savings, which would take the collapse beyond the control of the banking cartels.

=====================

Source References

[i] The Biggest Bank Heist Ever! | HD. IsuruFoundation Retrieved from https://www.youtube.com/watch?v=BuyrBRUsu9A

[ii] Ross Ashcroft. (2012). Four Horsemen http://truththeory.com/2013/09/21/four-horsemen-movie/;

[iii] Ellen Brown. (March 21, 2013) A Safe and a Shotgun or Publicly-owned Banks? The Battle of Cyprus. Retrieved from http://ellenbrown.com/2013/03/21/a-safe-and-a-shotgun-or-public-sector-banks-the-battle-of-cyprus/;

[iv] Ellen Brown. (December 1, 2014). New G20 Rules: Cyprus-style Bail-ins to Hit Depositors AND Pensioners http://ellenbrown.com/2014/12/01/new-rules-cyprus-style-bail-ins-to-hit-deposits-and-pensions/

[v] Global Precious Metals. (December 2014). A New Year ‘Bail-in’ Resolution. Retrieved from https://www.global-precious-metals.com/gpm-commentary-a-new-year-bail-in-resolution.php; X22 Report. EU Orders 11 Countries To Enact Bail-In Rules Within Two Months – Episode 684. Retrieved from http://x22report.com/eu-orders-11-countries-to-enact-bail-in-rules-within-two-months-episode-684/

[vi] Global Precious Metals. (December 2014). A New Year ‘Bail-in’ Resolution. Retrieved from https://www.global-precious-metals.com/gpm-commentary-a-new-year-bail-in-resolution.php

[vii] Ferguson, C. (Director). (2011). Inside Job [Motion picture]. United States: Sony Pictures Classics. Retrieved from http://documentarylovers.com/film/inside-job/

Andrew Gavin Marshall. (7 May 2014). Globalization’s ‘Game of Thrones’, Part 1: Dynastic Power in the Modern World. Retrieved from http://andrewgavinmarshall.com/2014/05/07/globalizations-game-of-thrones-part-1-dynastic-power-in-the-modern-world/; Andrew Gavin Marshall. (27 May 2014). Globalization’s Game of Thrones, Part 2: Managing the Wealth of the World’s Dynasties. Retrieved from http://andrewgavinmarshall.com/2014/05/27/globalizations-game-of-thrones-part-2-managing-the-wealth-of-the-worlds-dynasties/;Ellen Brown (March 27, 2013). It Can Happen Here: The Confiscation Scheme Planned for US and UK Depositors www.webofdebt.com/articles/confiscationscheme.php

[viii] Colin McKay (May 18, 2013). G20 Governments All Agreed To Cyprus-Style Theft Of Bank Deposits … In 2010. Global Research. Retrieved from http://www.globalresearch.ca/g20-governments-all-agreed-to-cyprus-style-theft-of-bank-deposits-in-2010/5335567

[ix] Ellen Brown (March 27, 2013). It Can Happen Here: The Confiscation Scheme Planned for US and UK Depositors www.webofdebt.com/articles/confiscationscheme.php; The Economic Collapse Blog. (March 22, 2013). Mass Panic In Cyprus: The Banks Are Collapsing and ATMs are Running Out Of Money Retrieved from http://www.globalresearch.ca/mass-panic-in-cyprus-the-banks-are-collapsing-and-atms-are-running-out-of-money/5328078

[x] Phoenix Capital Research (17 April 2015). Cyprus Provided a Template For the Coming Bank Holidays and Account Seizures. Retrieved from http://www.zerohedge.com/news/2015-04-17/cyprus-provided-template-coming-bank-holidays-and-account-seizures

[xi] Fuchs, D. & Graf, A. (2010, March). The financial crisis in discourse: Analyzing the framing of banks, financial markets and political responses. Paper presented at the meeting of the ECPR Joint Sessions, Munster, Germany. Retrieved from http://www.unimuenster.de/imperia/md/content/fuchs/publikationen/publikationenfuchs/konferenzpapiere/fuchs_graf_2010_crisis-in-discourse_m__nster.pdf

[xii] Snoopman. (1 August 2015). Almost Fully Operational: The Mega Cartel Death Star. Snoopman News. Retrieved from https://snoopman.net.nz/2015/08/01/almost-fully-operational-the-mega-cartel-death-star/; Mike Maloney. (2013). “The Biggest Scam In The History Of Mankind (Documentary) – Hidden Secrets of Money 4”. Retrieved from https://www.youtube.com/watch?v=iFDe5kUUyT0; Pan (2009). Money As Debt – Full Length Documentary. Retrieved from

https://www.youtube.com/watch?v=jqvKjsIxT_8; “The Secret Of Oz” – The Truth Behind The Modern Financial System, And The Money-Political Complex” at: http://www.zerohedge.com/article/secret-oz-truth-behind-modern-financial-system-and-money-political-complex

[xiii] Edwards, Steve (2012). It’s the financial oligarchy, stupid. Retrieved from http://hdl.handle.net/10292/5536

[xiv] Global Precious Metals. (December 2014). A New Year ‘Bail-in’ Resolution. Retrieved from https://www.global-precious-metals.com/gpm-commentary-a-new-year-bail-in-resolution.php

[xv] See Chapter 2. In: Edwards, Steve (2012). It’s the financial oligarchy, stupid. Retrieved from http://hdl.handle.net/10292/5536

[xvi] Paul Grignon (2009). Money As Debt – Full Length Documentary MoneyasDebt.net. Retrieved from

https://www.youtube.com/watch?v=jqvKjsIxT_8; Global Precious Metals. (December 2014). A New Year ‘Bail-in’ Resolution. Retrieved from https://www.global-precious-metals.com/gpm-commentary-a-new-year-bail-in-resolution.php; Dr Dalvinder Singh (2007). Banking Regulation of UK and US Financial Markets. London, UK: Ashgate Publishing. Retrieved from https://books.google.co.nz/books?id=bbEe7b6uEtUC&pg=PA83&lpg=PA83&dq=a+depositor+is+an+unsecured+creditor+of+the+bank+%26+cases&source=bl&ots=sz1VsR2Qrn&sig=yxgREMX75x3gpGlSy7d-e36ElyE&hl=en&sa=X&ei=OpFOUazgHeThiAKJyIHwAQ#v=onepage&q=a%20depositor%20is%20an%20unsecured%20creditor%20of%20the%20bank%20%26%20cases&f=false

[xvii] Ellen Brown. (April 9, 2013). Winner Takes All: The Super-priority Status of Derivatives. Retrieved from www.webofdebt.com/articles/baliin.php

[xviii] Ellen Brown. (December 1, 2014). New G20 Rules: Cyprus-style Bail-ins to Hit Depositors AND Pensioners. Retrieved from http://ellenbrown.com/2014/12/01/new-rules-cyprus-style-bail-ins-to-hit-deposits-and-pensions/; Ellen Brown. (April 9, 2013). Winner Takes All: The Super-priority Status of Derivatives. Retrieved from www.webofdebt.com/articles/baliin.php

[xix] Keith Fitz-Gerald (April 03, 2015). Take Profits in a $1.5 Quadrillion Bubble. http://totalwealthresearch.com/2015/04/take-profits-1-5-quadrillion-bubble/; IWB. (December 29 2014). The $1.5 Quadrillion Dollar Derivatives Crisis, & Growing. Retrieved from http://investmentwatchblog.com/the-1-5-quadrillion-dollar-derivatives-crisis-growing/; WashingtonsBlog (May 18, 2012). Top Derivatives Expert Estimates Size of the Global Derivatives Market at $1,200 Trillion Dollars … 20 Times Larger than the Global Economy. Retrieved from http://www.washingtonsblog.com/2012/05/top-derivatives-expert-finally-gives-a-credible-estimate-of-the-size-of-the-global-derivatives-market.html

[xx] Snoopman. (1 August 2015). Almost Fully Operational: The Mega Cartel Death Star. Snoopman News. https://snoopman.net.nz/2015/08/01/almost-fully-operational-the-mega-cartel-death-star/; Edwards, Steve (2012). It’s the financial oligarchy, stupid, Retrieved from http://hdl.handle.net/10292/5536

[xxi] “The Secret Of Oz” – The Truth Behind The Modern Financial System, And The Money-Political Complex” at: http://www.zerohedge.com/article/secret-oz-truth-behind-modern-financial-system-and-money-political-complex

[xxii] E.H./P.C. (April 7 2013). The Economist explains: What is a bail-in? Retrieved from http://www.economist.com/blogs/economist-explains/2013/04/economist-explains-2