By Snoopman, 18 November 2018

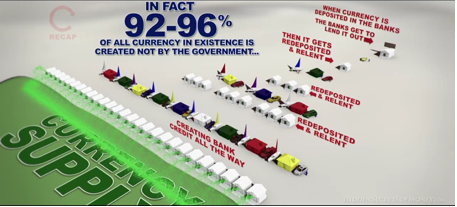

It turns out that commercial bank credit manufacturing is the single major source of currency expansion in New Zealand, as Gillian Lawrence explained in a Reserve Bank bulletin in 2008, entitled “The Reserve Bank, private sector banks and the creation of money and credit”.[1] Cash only constitutes about 1-3 per cent of the total, meaning the other 97-99 per cent is borrowed into existence as transaction specific credit.

Therefore, credit manufacturing underpins New Zealand’s debt-based currency system. Due to this bias that favours credit manufacturing, many New Zealanders are forced to compete for the scarce cash to pay conjured credit fraudulently marketed as ‘loans’. The competition for scarce “settlement cash” is intensified because the interest component is not created along with the principle amount of credit funds borrowed into existence. As previously stated, each generation is compelled to sell homes and businesses at ever higher values just to break even because of the ‘rent’ banks charge for their manufactured credit – interest! Even for New Zealanders who have no debts, the debt-based currency system still makes incursions into the wallet or purse – as the case may be. Those incursions occur through the universal personalized taxes on income, GST-laden purchases and property taxes (or rates) – that would otherwise be unnecessary in a positive money economy.[2]

The New Zealand state could print its own cash debt-free to fund necessary projects, instead of casting the captive population as Tax Herds. Instead, New Zealand’s debt-monetary system is characterized by private credit funding public debt, scarce ‘settlement’ cash, and a currency supply dominated by interest-bearing credit. How exactly the debt-based monetary and credit manufacturing system was imposed on New Zealand when it was forged as a British Masonic State during the Masonic New Zealand Wars.

The debt-based currency is ‘borrowed into existence’ with the manufactured credit ‘loaned’ by global commercial banking consortiums to the New Zealand Treasury through purchases of the New Zealand Government’s securities and bonds.[3] This means that every time the Treasury holds an auction to tender its bond and security IOUs to international banks, financial houses and hedge funds, the Neo-Colonial Government is, in effect, posting New Zealanders as tax-indentured hostages. Meanwhile, big firms post their bonded-Tax COWS (or, Corporate Owned Wage Slaves), as revenue-earning hostages. In other words, a debt-based currency system works to stabilize the present and future for the ruling cliques, since the Tax Herds’ time is wasted with a hidden form of debt enslavement while working to re-build the hi-tech fencing systems of empire, and its toll-booths and tax shelters.

The banking industry, which is dominated by transnational consortiums, maintains this structural scarcity over cash, with the active participation of the New Zealand Crown through the Reserve Bank and the Treasury. In other words, the Crown is actively involved in the supervision of a cartel that restrains trade through the restriction of supply of an essential resource: cash.

This limitation of debt-free cash ensures that many of New Zealand’s Tax Herds will ‘borrow’ because their pay is kept low. This limitation of scarce cash works hand-in-glove with the Crown’s hidden policy to maintain a low-wage and salary economy, termed: structural unemployment. Because interest is the fee for supplying manufactured credit, rather than the ‘price of money’ as many Tax Cattle believe, the banking industry’s windfall profits accumulated off the interest collections is extortionist.

– | –

[1] Gillian Lawrence. (March 2008). The Reserve Bank, private sector banks and the creation of money and credit. Reserve Bank of New Zealand: Bulletin, Vol. 71, No. 1.

[2] An overview of the functions of money, and how money and credit are created in the NZ economy, examining the roles of the Reserve Bank and private sector banks http://www.interest.co.nz/opinion/77033/overview-functions-money-and-how-money-and-credit-are-created-nz-economy-examining; How Banks Create Money. http://positivemoney.org/how-money-works/how-banks-create-money/

[3] International investment bank consortiums and private equity firms buy NZ’s corporate bonds.

=====

The following short articles focus on the hidden financial, economic, political and cultural transmission mechanisms for social control over New Zealand.

In the first article – Credit Manufacturing in Neo-Colonial New Zealand – it is shown that the banking industry, which is dominated by transnational consortia, maintains a structural scarcity over ‘settlement’ cash, in order to coerce families, enterprises and public institutions to compete for credit funds that are borrowed into existence.

The fourth article – Neo-Colonial New Zealand: The stealthy forging of a ‘Switzerland of the South Pacific’ Utopia [A backgrounder] – delves into the ‘Who, How and Why Big Picture’ of the corporate takeover of New Zealand – deeper than anyone has gone in 1500 words. Neo-Colonialism is revealed as the track-laying vehicle for the totalitarian endgame – techno-feudal super-states. One reset to achieve this hegemonic Globalized World Order Project was the silent coup of 1984 in New Zealand, which on the surface is a small jurisdiction, but with a large resource-rich maritime territory.

The four primers:

Credit Manufacturing in Neo-Colonial New Zealand at: https://snoopman.net.nz/2018/11/18/credit-manufacturing-in-new-zealand/

Manufactured ‘loans’ drive residential property boom at: https://snoopman.net.nz/2018/11/18/manufactured-loans-drive-residential-property-boom/

Magical Secrets of Credit at: https://snoopman.net.nz/2018/11/18/magical-secrets-of-credit-revealed/

Neo-Colonial New Zealand: The stealthy forging of a ‘Switzerland of the South Pacific’ Utopia [A backgrounder] at: https://snoopman.net.nz/2018/11/18/neo-colonial-new-zealand-the-stealthy-forging-of-a-switzerland-of-the-south-pacific-utopia-a-backgrounder/