The dirty secret of banking is bank ‘loans’ are manufactured credit. By maintaining an artificial scarcity of cash and an abundance of privately manufactured credit, the cartelized banking industry forces households, enterprises and governments into debt. This hidden debt bondage game makes land scarce to as many Tax Cattle as possible.

By The Snoopman

The Dirty Secrets of Banking

Ex-Wall Street and London banker and former NZ PM, John Key, once sarcastically said there was “no magical fairy with a printing press at the end of the NZ garden” and that it was “a foreign pixie that we have to borrow from.”

New Zealand’s prime minister did not explain why exactly the country’s ‘sovereign’ government had to borrow from a foreign pixie. Nor did he disclose the foreign pixie’s identity and how exactly borrowing from a foreign pixie works. And Fairfax Media’s Stuff newspaper article, John Key reveals plan for asset sales, of September 6th 2012 did not explain either.

New Zealanders have been tricked to think that banks simply loan out the deposits of other savers. However, banks use most of the money they receive to buy interest-bearing treasury securities, corporate bonds and other financial instruments.

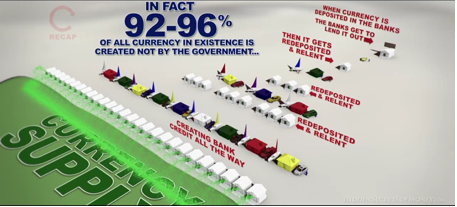

It turns out that commercial bank credit manufacturing is the single major source of currency expansion in New Zealand, as Gillian Lawrence explained in a Reserve Bank bulletin in 2008, entitled “The Reserve Bank, private sector banks and the creation of money and credit”.[1]

“By far the largest share of money – 80 percent or more, depending on the measure – is created by private sector institutions. For simplicity, we use ‘bank’ to refer to any institution that creates money or credit.”

Cash only constitutes about 1-3 per cent of the total, meaning the other 97-99 per cent is borrowed into existence as transaction specific credit.[2] Indeed, the dirty secret of banking is that bank ‘loans’ are actually manufactured credit funds borrowed into existence.[3]

As Mack Ott of the privately owned St. Louis Federal Reserve pointed out in 1982, “Credit is not money, but the promise of future money to the lender in return for the current temporary use of purchasing power – goods or money – extended to the borrower”.[4] Through their structural alignments, the world’s largely unseen dynastic bankers, through their transnational banking empires ensure that actual cash is scarce. This scarcity compels families and businesses and governments to ‘borrow’ the bankers’ manufactured credit to build homes, enterprises or hospitals, respectively, and to compete for scarce cash to ‘repay’ the privately conjured credit.[5]

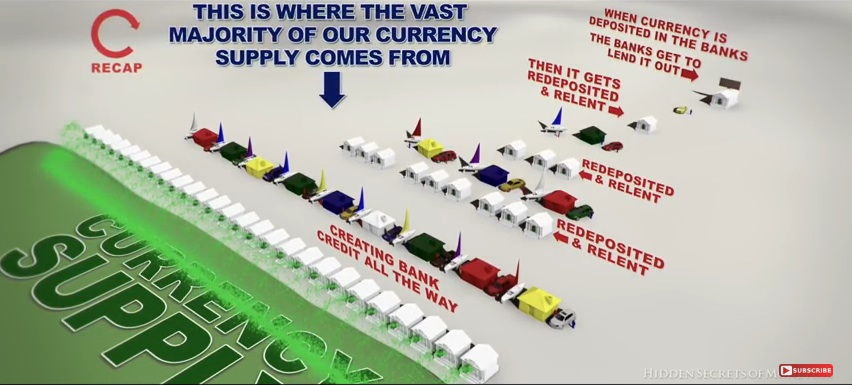

When new ‘loans’ are made, the manufactured credit funds are deposited into the cheque accounts of ‘borrowers’. Each time the proceeds from the sale of property are re-deposited, the banks have new funds that add to the deposit base to make new ‘loans’. In other words, banks need only hold reserves that equate to a fraction of the actual deposit claims on their books in a fractional reserve banking system. In addition to earning profits off income-generating financial instruments, banks build up reserves by using some of the proceeds from the interest they charge for ‘loans’.[6] In this way, interest is not “the price of money” – since no money that previously existed is lent. Rather, interest represents an extortionist rent on the amount of funds fraudulently marketed as ‘loans’.[7]

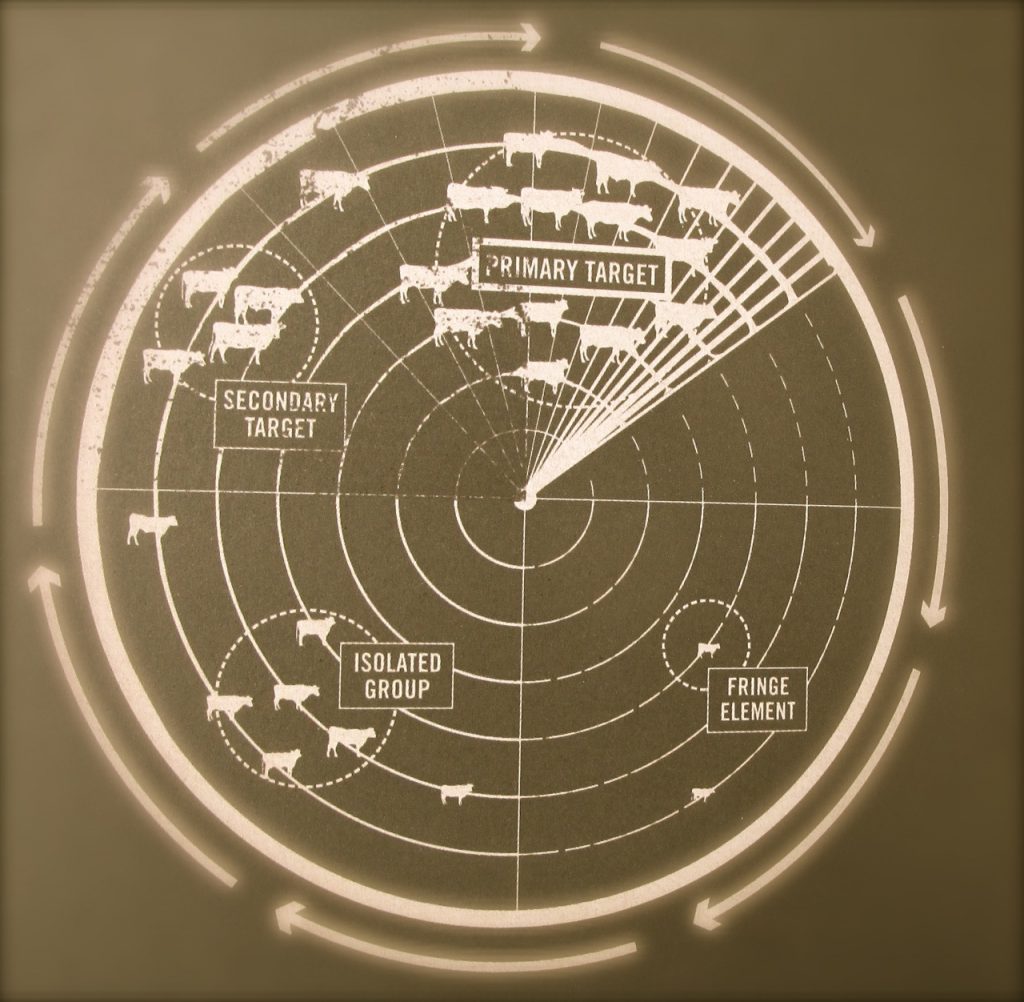

Therefore, each generation are cast as ‘borrowers’ who are compelled to sell their homes and businesses at ever higher values just to break even because of the ‘rent’ banks charge for their manufactured credit, as English economist Michael Rowbotham stated in his book, The Grip of Death: A Study of Modern Money, Debt Slavery and Destructive Economics. Despite central banks’ ability to manufacture and obliterate “unlimited supplies of money and credit,” as former chairman of Federal Reserve Alan Greenspan put it,[8] most credit is created by commercial banks through this ‘multiplier effect’ of ballooning credit bubbles. Therefore, debt-based currency systems are mechanisms of present and future social control, since the Global Tax Herds’ time, creativity and resources are wasted, as investor Mike Maloney states in his documentary series, The Biggest Scam in the History of Mankind. [9]

During the last 500 years of Colonial Empire building by the European Maritime Powers, the credit revolution rose as the primary instrument of expansion, as Professor Carroll Quigley sketched in The Evolution of Civilization: An Introduction to Historical Analysis.[10] Credit was harnessed to rework slavery by funding wage and salary Tax Slaves, and financing the rise of the machines. Now, the chip revolution is poised to ‘collect’ all other instruments of expansion that have been exploited throughout history.[11]Therefore, C.O.W.S. work witlessly to build-out the new hi-tech fencing systems, big data maps for new conquests and chip-scanning toll-booths of corporatized Global Tax Farms.

The artificial scarcity of cash and abundance of privately manufactured credit, supports Crony Neo-Colonial Capitalism’s hidden purpose of making land scarce to as many Tax Cattle as possible.[12]

Therefore, New Zealanders have been cast as brainwashed Tax Herds.

Key Finding: The dirty secret of banking is bank ‘loans’ are manufactured credit. By maintaining an artificial scarcity of cash and an abundance of privately manufactured credit, the cartelized banking industry forces households, enterprises and governments into debt. This debt bondage game serves a hidden purpose of making land scarce to as many Tax Cattle as possible.

—– | —–

* We have depicted former NZ PM Ex-Wall Street & London banker, and current ANZ Bank chair, John Key, reading the Daily Prophet and carrying a ‘Money Tree Wand’, since he once sarcastically said there is “no magical fairy with a printing press at the end of the NZ garden” and that it was “a foreign pixie that we have to borrow from” to keep the economy ‘solvent’ while justifying selling off more tax-funded, state-owned assets. As Prime Minister, John Key did not ever once fully disclose the cartelized nature of New Zealand’s banking industry, its hidden mechanisms of debt bondage and the conspiracy between the NZ Crown, the Reserve Bank and transnational banks to entrap New Zealanders in a state permanent financial enslavement.

Related Primers on Credit Manufacturing:

Credit Manufacturing in Neo-Colonial New Zealand

Manufactured ‘loans’ drive residential property boom

Neo-Colonial New Zealand: The stealthy forging of a ‘Switzerland of the South Pacific’ Utopia [A backgrounder]

In-depth exposé:

Structural Unemployment as an Economic Warfare Tool in Neo-Colonial New Zealand

Referenced Sources:

[1] Gillian Lawrence. (March 2008). The Reserve Bank, private sector banks and the creation of money and credit. Reserve Bank of New Zealand: Bulletin, Vol. 71, No. 1.

[2] Rowbotham, M. (1998). The Grip of Death: A Study of Modern Money, Debt Slavery and Destructive Economics, p. 4, 26. Charlbury, England: Jon Carpenter.

[3] Mike Maloney. (2013). The Biggest Scam in the History of the World – Mike Maloney Ep 4. Retrieved from: https://www.youtube.com/watch?v=iFDe5kUUyT0; Ross Ashcroft. (2012). Four Horsemen; The Global Financial Crisis Renegade Films. Retrieved from: https://www.youtube.com/watch?v=5fbvquHSPJU

[4] Ott, M. (1982, May). Money, credit and velocity. Review, Federal Reserve Bank of St. Louis, 21-34.

[5] Bill Still. (2009). “The Secret Of Oz” – The Truth Behind The Modern Financial System, And The Money-Political Complex” at: http://www.zerohedge.com/article/secret-oz-truth-behind-modern-financial-system-and-money-political-complex; Paul Grignon (2009). Money As Debt. [Full Length Documentary]. Retrieved from

https://www.youtube.com/watch?v=jqvKjsIxT_8;

[6] Rowbothman. (1998: 26). See also: An overview of the functions of money, and how money and credit are created in the NZ economy, examining the roles of the Reserve Bank and private sector banks. http://www.interest.co.nz/opinion/77033/overview-functions-money-and-how-money-and-credit-are-created-nz-economy-examining

[7] Ott, M. (1982, May). Money, credit and velocity. Review, Federal Reserve Bank of St. Louis, p. 25.

[8] Greenspan. (1998: 247). As cited in: Allen, R. E. (1999). Financial crises and recession in the global economy, p. 87. Cheltenham, Glos, UK: Edward Elgar.

[9] Mike Maloney. (2013). The Biggest Scam in the History of the World – Mike Maloney Ep 4. Retrieved from: https://www.youtube.com/watch?v=iFDe5kUUyT0; Ross Ashcroft. (2012). Four Horsemen; The Global Financial Crisi Renegade Films. Retrieved from: https://www.youtube.com/watch?v=5fbvquHSPJU

[10] Quigley, Carroll (1961). The Evolution of Civilization: An Introduction to Historical Analysis. Liberty Fund Inc. (1979 Ed.) Indianapolis.

[11] Katherine Albrecht and Liz McIntyre (2006). Spychips: How Major Corporations and Government Plan to Track Your Every Purchase and Watch Your Every Move. USA: Penguin; Patrick Wood. (2015). Technocracy Rising: The Trojan Horse of Global Transformation. USA: Coherent Publishing.

[12] Hutchinson, F. (1998). What Everyone Really Wants To Know About Money. Charlbury, England: Jon Carpenter; Stefan Molyneux. (2010). Human Farming: The Story of Your Enslavement https://www.youtube.com/watch?v=Xbp6umQT58A