IMF Riots, Bail-ins & the Number 13

By Steve ‘Snoopman’ Edwards

Currency Wars, a Global Debt Crisis and a Reset Looming

The world’s tax herds are largely oblivious to an epic looming reset of the world economy.

A silent war has been waged between the world’s central banks, major bank corporations and other private and public institutions, such as the the International Monetary Fund (IMF), using currencies as a weapon, across the world since 2010. The author of Currency Wars: The Making of the Next Global Crisis, James Rickards states that the Federal Reserve opted to ‘print’ money during the last Global Financial Crises in an attempt to avert a collapse in the wealth of the American super-rich.

Between December 1 2007 and November 10 2011, the combined support of the Federal Reserve, the Treasury and the Federal Deposit Insurance Corporation through loans, asset purchases and guarantees to financial institutions (including other central banks) and support of capital markets was a total cumulative sum of $46.613 trillion (an equivalent value of just over three quarters of the world’s total annual economic output).[1] In other words, this massive inflation in the US currency was done to avoid a deflationary spiral from the highs of over-valued assets, commodities and consumer goods in the Western Banking World.

In his Currency Wars, Rickards argued that the U.S. Federal Reserves’ game of massive electronic currency ‘printing’ was a strategy to play a game of ‘tug of war’ and be the last central bank standing. The key symptoms of impending currency collapse or ‘debt decay’ is the prolific speculative bubbles across numerous asset classes.

In July 2016, Rickards produced an alert wherein he predicted the launch of a temporary world currency on Friday 30 September 2016 at about 4pm.[2] This would coincide with the International Monetary Fund’s (IMF) scheduled revised basket of currencies for midnight September 30 2016.[3]

At this time, the Chinese currency, the yuan or renminbi, which is indebted to the tune of $30 trillion, will be added to the IMF ‘basket of currencies’ that comprise its own currency known as Special Drawing Rights (SDRs).[4] It is this Special Drawing Rights (SDRs) currency that Rickards says the IMF will use to bailout countries, and indirectly, Western banks that have blown speculative ‘loan’ bubbles in the expectation that they will be rescued and gain state assets under the euphemism of ‘austerity measures’.[5] When this happens, Rickards says, the United States dollar will lose its prestige as the main currency for trading oil, Americans will lose the perk of cheap gasoline, currency speculators will bet against the US dollar, and the over-inflated US stock markets will crash.

The IMF currency would be an interim step, amid the pre-requisite spectacle of an intense global financial crisis, to justify a permanent global digital currency intended to kill the anonymity of transactions, facilitate more efficient tax farming and centralize control in a global bank with a global government to enforce the regime. This is the meaning of a reset that financial elites sometimes refer to, without defining the term.

Numerous non-establishment financial market observers such as Mike Maloney, Jeff Berwick, Nomi Prins, Gerald Celente, Max Keiser, Stacey Herbert, Tyler Durden, Paul Craig Roberts, Michael Hudson and Martin Armstrong predict a world sovereign debt crisis, which happens when investors collectively lose faith in a governments’ capacity to meet national ‘debt’ payments.

This kind of financial crisis which would see governments defaulting on the ‘payments’ of their national ‘debt’, that in total stands at $61 trillion, amid a broader debt bubble of $200 trillion that includes corporate debt and consumer ‘borrowing’.[6] Given that nine years ago, the US public debt was $8.9 trillion and has more than doubled to $19.4 trillion today, this exponential growth in ‘debt’ cannot be sustained, particularly because the compounding interest component is not created with the manufacturing of credit that commercial and central banks fraudulently market as ‘loans’.[7]

In a ‘rich’ country such as the ‘United States’ with 100 million poor people amid heightened racial tension, this reset will likely trigger ‘IMF riots’.[8] Notoriously, the IMF provides emergency loans to countries that have been victimized by economic shock treatments schemed up by the world’s western banking fraternity, including the World Bank Group, as Canadian journalist Naomi Klein showed in her 2007 book, The Shock Doctrine.

American sleuth Greg Palast interviewed a former World Bank chief economist Joseph Stiglitz who divulged the callous shock policies of the IMF, including “Step-Three-and-a-Half: The IMF Riot”. The IMF actually anticipates “social unrest” to result from governments implementing its vicious ‘economic shock treatments’ such as privatizing state assets, loosening capital market controls, and allowing market-based pricing, a euphemism for price hikes on essentials.[9] These ‘free market structural adjustments’ – performed to benefit old-money and looting aspirants – create job destruction or structural unemployment, facilitate super-profits through plundering countries recast as Neo-Colonial vassal states, and construct systemic poverty traps.

It gets worse.

Bail-ins

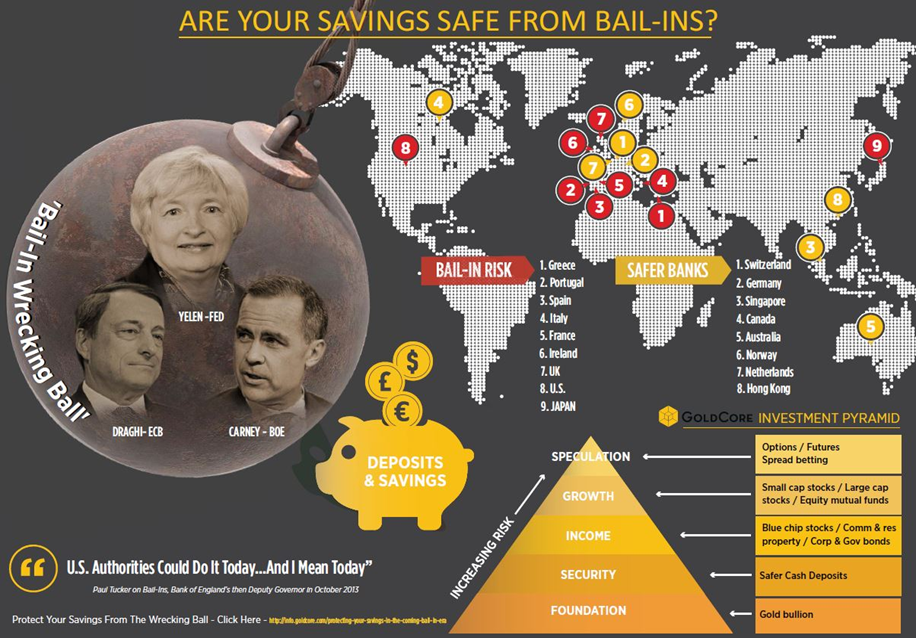

The governments of the United States, the United Kingdom, Canada, Australia, New Zealand[10] and those still in the unstable regional hybrid super-state – the European Union – have colluded with transnational banking cartels to reset the Western world’s financial systems during the looming global debt crisis – with bail-ins.[11]

We are all familiar with the systemic fraud of bail-outs, wherein taxpayers around the world are ritually lumped with massive bills added to their country’s national debt to ‘save’ the global banks and their fraternal associates from the oblivion of bankruptcy, poverty and a loss of oligarchic power as coalitions of super-rich tax-averse people.

In the next financial crash, a portion of deposits will be confiscated overnight to save troubled banks (and other financial institutions). Under this secretive new bail-ins regime, peoples’ savings will be converted into common stock shares, by whatever fraction is deemed ‘necessary’, even though the share prices of embattled financial institutions will likely be plummeting on news of such interventions.

Clearly, the stealthily implemented bail-ins regime shows that the bankers of the Western banking system envisage a bigger financial crisis than the Global Financial Crisis of 2007-2008. When market booms bust and the value of assets plummet, banks and other financial institutions can quickly become insolvent because the assets on their books deflate in value. In a bail-ins scenario, which was field-tested in Cyprus in 2013, savers’ savings will be used by bankers to re-capitalize their banks, while the capital of the super-rich oligarchs’ that own the global banks are protected in their private bank trust accounts of the world’s tax haven complex.

At a superficial level, this epic ‘savings snatch’ blueprint has been written because the bail-outs of 2008 that occurred in the midst of the engineered Global Financial Crisis became too unpopular to try again. But in the next global financial crises, tax-backed bail-outs will not be feasible in economies where their currencies are crashing in value because they have been heavily expanded by debt. There simply will not be any investors willing to take the guarantees of many governments that their tax-backed bailouts will be worth anything standing to service the exponentially growing compound interest.

That said, a bail-in in a major economy like Germany and the Deutsche Bank would likely create systemic banking runs. These scenarios are the calculus of financial and economic warfare, game theory and the Shock Doctrine, or the job of think-tanks and key insiders schooled in numerology.

The Ever-Present Number 13

In the book, 13 Bankers, investigated the Global Financial Crisis and its causes, Simon Johnson and James Kwak note the curious appearance of the number in events embedded in Wall Street’s activities. However, they do not explore why exactly this number recurs.[12]

The IMF’s current managing director Christine Lagarde signalled the arcane application of numerology to events when she addressed her audience with a smirk at the National Press Club in January 2014, located on the 13th floor of the National Press Building in Washington D.C. Lagarde prefaced her little occult lecture on the “magic seven” saying that she does what she is told. Libertarian investor and founder of the Dollar Vigilante financial news blog, Jeff Berwick, noted this and other strange communications from elites and the structures of power after a rabbi, Johnathan Cahn, wrote a book called The Harbinger: The Ancient Mystery that holds the Secret of America’s Future. Berwick and Cahn believe that key insiders among the top of the world’s power structures and the super-rich are using a Judaic calendar system to construct major events as they steer the world along a course toward their endgame.[13] James Corbett of the Corbett Report expresses some skeptism of this view.

I found the recurrence of the number 13 and its multiples encoded into the Global Financial Crisis and bank bailouts, while researching my thesis “It’s the Financial Oligarchy, Stupid”.

Embedded in the construction of events are codified communications, including the use of the number 13, that appear on the surface as banal details, while they concurrently facilitate inter-elite collusion. Intriguingly, the number 13 featured throughout the news coverage of the Global Financial Crisis of 2007-2008, such as: (1) the BBC announcing on the evening of September 13 that the United Kingdom’s fifth largest retail bank, Northern Rock, had sought a bailout from Bank of England; (2) a private lunch between twelve bankers and the United States’ central bank, the Federal Reserve (making a combination of 13 financial institutions), on the 13th floor of the New York Federal Reserve the week that Wall Street’s fifth largest investment bank, Bear Stearns, suffered a bank-run, (and conspicuously, its CEO was excluded); (3) on October 13 2008, thirteen American financial institutions met to agree upon the first of the bailout packages following the passage of the $700 billion bailout bill; (4) and thirteen bankers were summoned to meet the US president at the White House in late February 2009 at a time when ‘the American people’ were angered at news of high executive pay packages following the system-wide bailout of Wall Street.

The phenomena of 13 also appears as an artefact of crises-past, such as when 13 banks were summoned by the New York Federal Reserve to save a major hedge fund, Long Term Capital Management, in 1998, with $130 billion in debt and $1.3 trillion in outstanding derivatives, and Lawrence Summers, the deputy secretary of the Treasury, reportedly rang the head of the US Commodity Futures Trading Commission (CFTC), Brooksley Born and claimed that there were thirteen bankers in his office saying that her concept paper on privately traded Over The Counter (OTC) derivatives would trigger “the worst financial crisis since World War II”. Thirteen has an occult significance among the ‘fraternity’ of Anglo-American oligarchic-elite network, to whom this number symbolizes unity and love, as weird as it sounds.[14] Because the use of the number 13 works as a way for individuals and institutions to encode events to signify that key players are advancing ‘the game’, untrustworthy insiders could be marked by some variant of this number. This occurred to the investment bank, Bear Stearns, when it was extended an emergency loan of $13 billion from the Federal Reserve on its last Friday of business, March 14 2008.[15]

To sum-up, the major banks that comprise global banking cartels had by 2008 gotten used to coercing governments around the world to bail them out.[16] But, this massive rort of bankers expecting taxpayers to re-capitalize their banks is only part of a bigger game being played.

The Great Bail-out Wrecking Ball will be accompanied by a Great Bail-in Wrecking Ball. The deployment of a bail-in regime is intended as an attempt by the Western financial-political oligarchies (or super-rich coalitions) and their banking elites to manage a controlled collapse, since the bursting of the massive derivatives and debt bubbles is inevitable.

The surface reason why most people haven’t heard of bail-ins is because tax herds would prepare by withdrawing their savings, which would take the collapse beyond the control of the banking cartels. The merger of China’s currency into the International Monetary Fund’s Special Drawing Rights currency is an admission of its own over-indebtedness, now at an equivalent of $30 trillion.

As the financial-political oligarchy advanced the game together in the looming Great Sovereign Debt Crisis, expect to see the number 13 make a starring appearance and its multiples in supporting actor roles.

A reset is coming amid converging crises, with occult themes to overwhelm the tax herds.

==========

Steve ‘Snoopman’ Edwards researched a thesis on the Global Financial Crisis and Bank Bailouts of 2007-2008. “It’s the Financial Oligarchy, Stupid” showed that once the financial crisis started, the US and UK financial authorities colluded with the major banks to steer the crisis to create a spectacle of catastrophe so that their respective governments would approve system-wide, tax-payer funded bailouts. He is currently writing a book, growing food and edits TV news for kicks.

==========

Source References:

[1] Felkerson, J. (2011). “$29,000,000,000,000: A detailed look at the Fed’s bailout by funding facility andrecipient”. p. 31032. Retrieved from http://www.levyinstitute.org/pubs/wp_698.pdf; United States Government Accountability Office. (2011). Federal Reserve System: Opportunities exist to strengthen policies and processes for managing emergency assistance, 131, 205. (Report No. GAO-11-696). Retrieved from http://www.gao.gov/new.items/d11696.pdf; Prins, N. & Ugrin, K. (2011, October). Bailout tally report, p.2-3. Retrieved from Nomi Prins website: http://www.nomiprins.com/reports/

[2] James Rickards (July 2016). D-Day for the U.S. Dollar. Retrieved from http://pro.agorafinancial.com/AWN_dollarreset_0716/EAWNS8CO/

[3] James Rickards. (30 August 2016). New World Money. Retrieved from http://dailyreckoning.com/new-world-money-update/

[4] China is setting up the menu for Global Financial Order by Ariel Noyola Rodríguez http://www.voltairenet.org/article193200.html; Lingling Wei .China Rallies Around Yuan as IMF Mulls Reserve-Currency Inclusion. Retrieved from http://www.wsj.com/articles/china-rallies-around-yuan-as-imf-mulls-reserve-currency-inclusion-1434366682

[5] Pilger, J. & Lowry, A. (2001). The New Rulers of the World, Carlton Television, Pinkus, Karen. “Nothing from Nothing: Alchemy and the Economic Crisis.” World Picture 2; Klein, N. (2007). The Shock Doctrine: The Rise of Disaster Capitalism. Camberwell, Australia: Penguin Books.

[6] The broader debt bubble of $200 trillion is comprised of corporate, consumer and government debt. Matthew Phillips. (22 February 2016). The World’s Debt is Alarmingly High. But is it Contagious? Retrieved from http://www.bloomberg.com/news/articles/2016-02-22/the-world-s-debt-is-alarmingly-high-but-is-it-contagious; World Debt Clock. Retrieved from www.nationaldebtclocks.org/

[7] Mike Maloney. (2013). “The Biggest Scam In The History Of Mankind (Documentary) – Hidden Secrets of Money 4”. Retrieved from https://www.youtube.com/watch?v=iFDe5kUUyT0

[8] Addison Wiggin. (1 October 2014). One World, One Bank, One Currency. Retrieved from http://dailyreckoning.com/one-world-one-bank-one-currency/;

[9] Greg Palast. (10 October 2001). The Globalizer Who Came In From the Cold. Retrieved from http://www.gregpalast.com/the-globalizer-who-came-in-from-the-cold/

[10] Kiwis could face Cyprus-style trim. Retrieved from http://www.stuff.co.nz/business/money/8446573/Kiwis-could-face-Cyprus-style-trim

[11] Snoopman. (26 October 2015). The Great Financial Wrecking Ball: How Western banks plan to confiscate savers’ deposits. Retrieved from https://snoopman.net.nz/2015/10/26/the-great-financial-wrecking-ball-how-western-banks-plan-to-confiscate-savers-deposits/; New G20 Rules: Cyprus-style Bail-ins to Hit Depositors AND Pensioners. Retrieved from http://ellenbrown.com/2014/12/01/new-rules-cyprus-style-bail-ins-to-hit-deposits-and-pensions/

[12] Johnson, S. & Kwak, J. (2010). 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown. New York, NY: Pantheon Books.

[13] Jeff Berwick (25 June 2016). The Magic Number 7: Brexit Collapse Falls Exactly On Shemitah Datehttps://dollarvigilante.com/blog/2016/06/25/magic-number-7-brexit-collapse-falls-exactly-shemitah-date.html; SilverDoctors (20 February 2015). Does this Seven Year Cycle of Economic Crashes Predict the Date of the Global Financial Collapse? Retrieved from https://www.youtube.com/watch?v=46vjrA0tHmA#t=130; SGT Report. Jeff Berwick articles. http://sgtreport.com/tag/shemitah/; James Corbett. (2 September 2015). Interview 1083 – Berwick and Corbett Debate the Shemitahhttps://www.corbettreport.com/interview-1083-berwick-and-corbett-debate-the-shemitah/

[14] Aleister Crowley. (1986). Liber 777, xxv; “An Essay Upon Numbers”. In: Israel Regardie (Ed.). (1994). 777 and Other Qabalistic Writings of Aleister Crowley, p.29. York Beach, Maine; USA: Samuel Wesier Inc.; W. Wynn Westcott. (1911). Numbers: Their Occult Power and Mystic Virtues, p.109iligarchy advanced the game together.

[15] Edwards, Steve (2012). It’s the financial oligarchy, stupid. Retrieved from http://hdl.handle.net/10292/5536

[16] Ferguson, C. (Director). (2011). Inside Job [Motion picture]. United States: Sony Pictures Classics. Retrieved from http://documentarylovers.com/film/inside-job/; The Biggest Bank Heist Ever! | HD. IsuruFoundation. Retrieved from https://www.youtube.com/watch?v=BuyrBRUsu9A