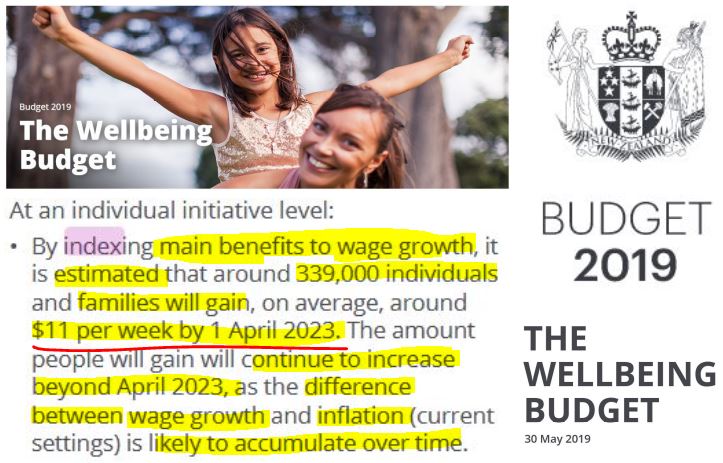

The NZ Government’s planned pegging of welfare benefits to wage increases from April 2020 hides a sleight of hand. The spin that accompanied the Ardern Coalition Government’s Wellbeing Budget made it seem like beneficiaries were getting increases to redress the deep cuts to welfare inflicted in 1991. However, the Ministry of Social Development models indicate that indexing main benefits to wage growth, may mean 339,000 individuals and families will gain an average of $11 per week by April 1st 2023, or April Fool’s day, in three years time. This investigation finds that successive Crown administrations since the Lange-Labour Government in 1984 have overseen the Reserve Bank’s stealthy management of a low-wage economy, by maintaining a level of persistent unemployment. The visible poverty created by low wages weakens workers’ wage bargaining power, while it reduces labour costs for big employers whom are rewarded with maximum profits.

The Snoopman shows through the use of charts, statistics and other cited documentary sources – the relationship between the inflation rate, the wholesale interest rate and the control of cash and credit supply, and how these economic indicators are actually manipulated to control the unemployment rate to produce a low wage economy in which the rich and super-rich thrive. He concludes that unless there is a sustained, serious grassroots education campaign that exposes the Shock Doctrine economic warfare paradigm that continues to be inflicted on New Zealanders, the country’s Tax Herds will not comprehend the need to move to paradigm shifting solutions.

The Snoopman, 19 January 2020

Managing Poverty, Unemployment & Wages: The Reserve Bank Connection

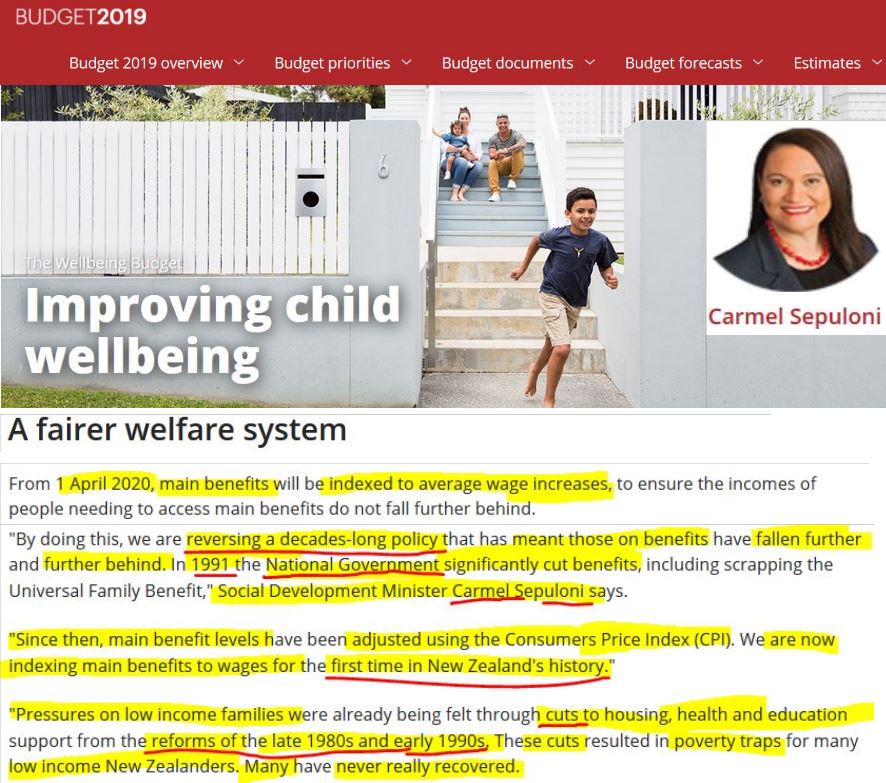

The Reserve Bank of New Zealand is stealthily gaining the capacity to indirectly set the adjustments to benefits with an indexing system linked to wage levels. This new Indexing Welfare to Wages regime is due to ‘go live’ in April 2020.

This indexing of benefits payments to wage level increases may sound positive, especially since in recent times minimum wage levels in New Zealand have risen following a multi-year grassroots-led Living Wage Campaign that forged a groundswell of institutional, public and political support. But the indexing is projected to only increase benefits for 339,000 individuals and families by an average of $11 per week by April 1st 2023.

Even if the indexing is managed by the Ministry of Social of Development, the Reserve Bank of New Zealand and the Government will still collude and bend like wild flowers in a strong breeze to the will of powerful transnational banking interests. These interests use the financial markets to ‘vote’ for their policy interests and have the power, resources and skills to inflict pain on the entire economy with financial and economic warfare shocks, as Canadian journalist Naomi Klein’s 2007 book, The Shock Doctrine, and the documentary based on it, shows more generally.

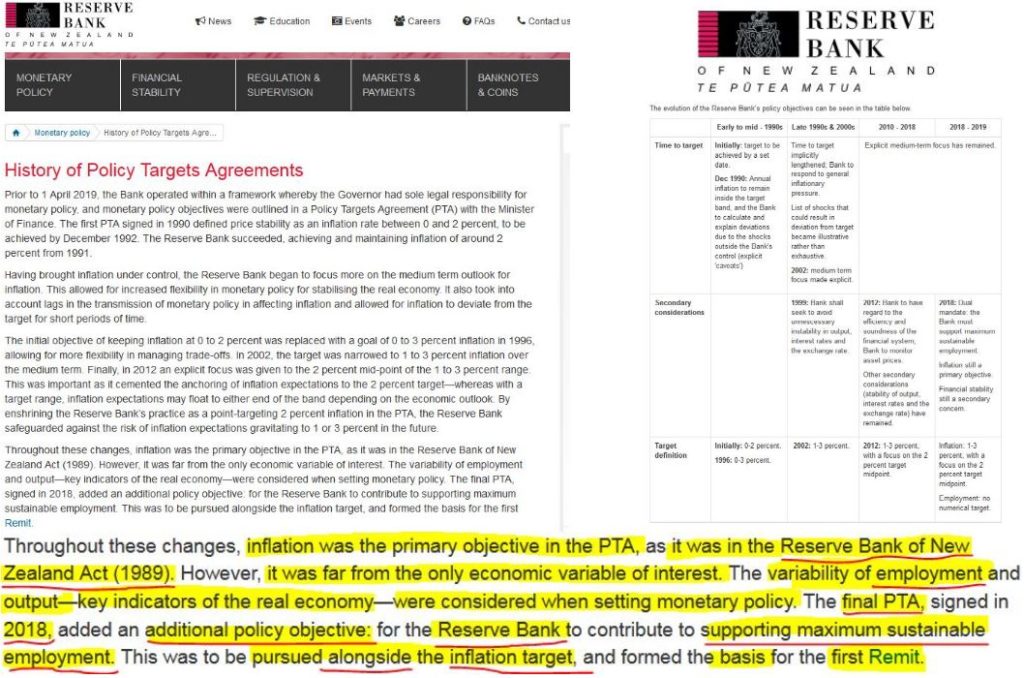

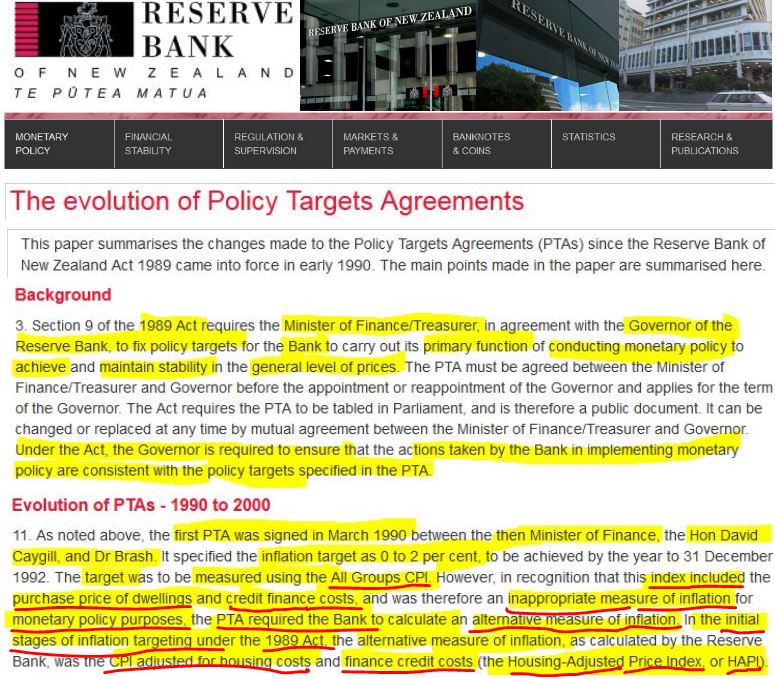

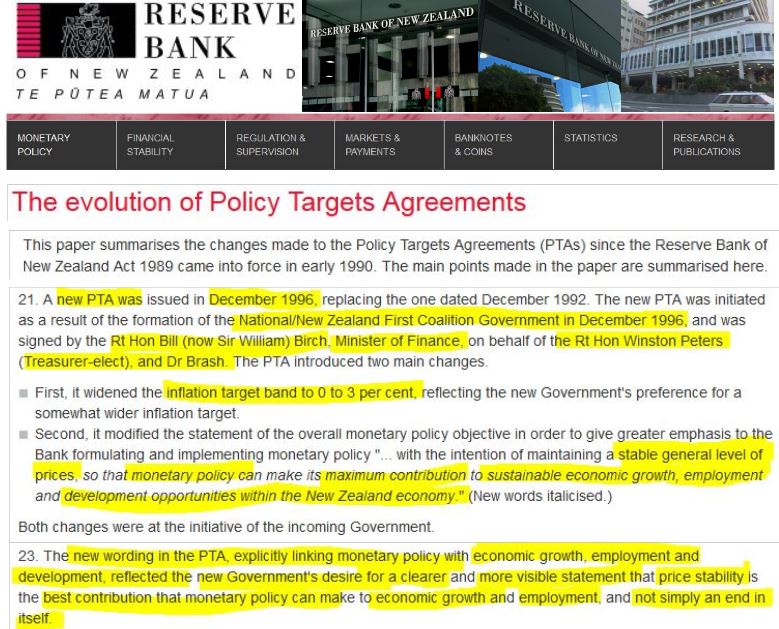

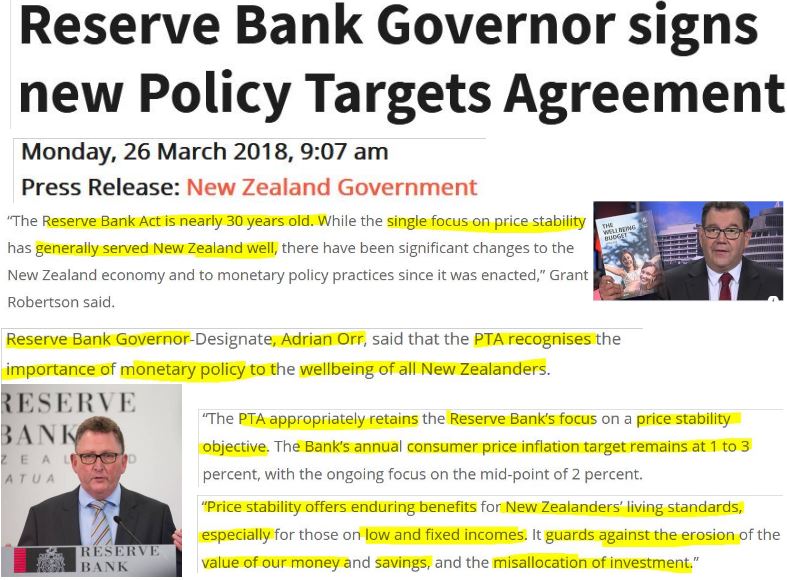

Moreover, successive New Zealand governments since 1984 have colluded with the Reserve Bank, the Treasury and the banking industry to keep a fraction of the population out of work to maintain a low wage economy that delivers big profits for large firms. Since 1990, the main hidden mechanism that successive Governments have used to maintain persistent unemployment are an inflation targeting range called Policy Target Agreements (PTAs), that are reached between the Minister of Finance, who is head of the Treasury, and the Governor of the Reserve Bank.

On March 26th 2018, the Ardern Coalition Government signed a new Policy Target Agreement (PTA) with the Reserve Bank. This new PTA is window dressing, because it fails to dismantle the debt-based monetary that maintains a scarcity over actual cash and an abundance of interest-bearing credit. This means the working class can never earn enough cash to meet their needs, including buying a home, without going into debt. The hidden intent of the Neo-Feudal debt-based monetary system is to coerce households to borrow, keep the working class poor so that they cannot develop real wealth through enterprises, and to exclude as many Tax Slaves as possible from gaining access to land – lest we develop resilient self-determining communities.

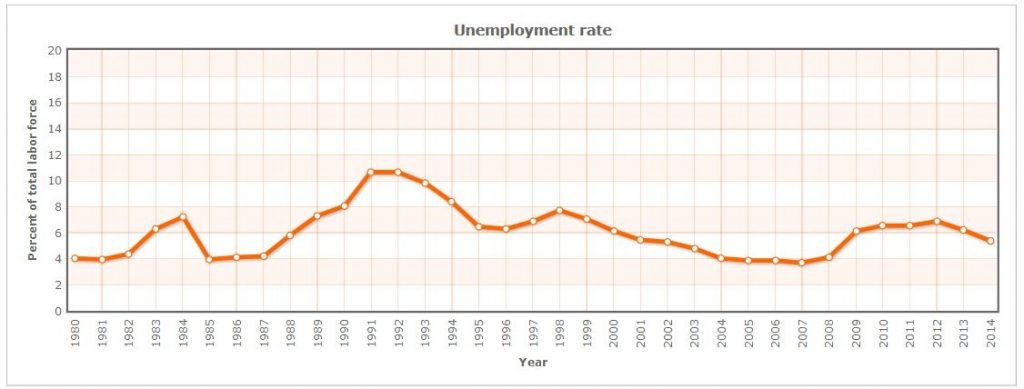

In fact, the Reserve Bank, together with the international and domestic banking cartel, maintain New Zealand’s low wage economy status by keeping unemployment at an average of around 6% of the Tax Herd workforce. The visible poverty produced by this malicious economic warfare policy actually works as a mechanism of coercion to keep wages and salaries low.

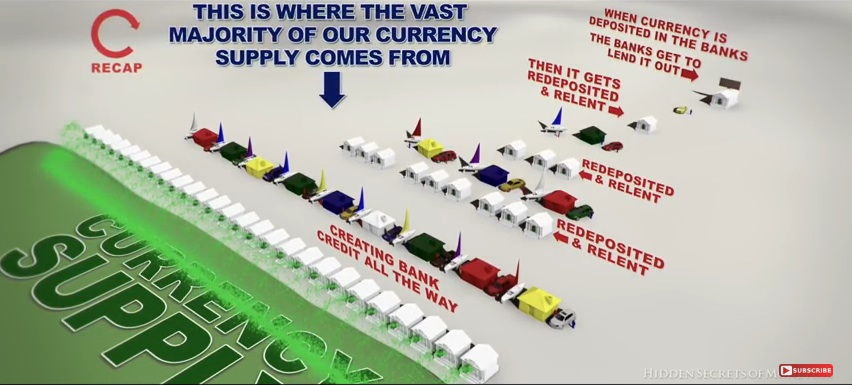

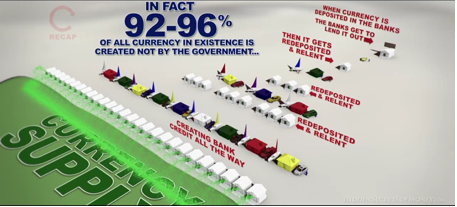

The banking system maintains unemployment by controlling the supply of credit in a cash-scarce economy. The Reserve Bank’s role is to provide oversight for the banking cartel, by facilitating a credit monetary system, known as fractional reserved banking, to keep cash scarce and as many as people as possible in debt. The purpose of the Reserve Bank facilitating a credit-abundant banking cartel amid cash scarcity is to coerce households, businesses and local and central government to borrow funds into existence, from which banks make windfall profits off the manufactured credit.

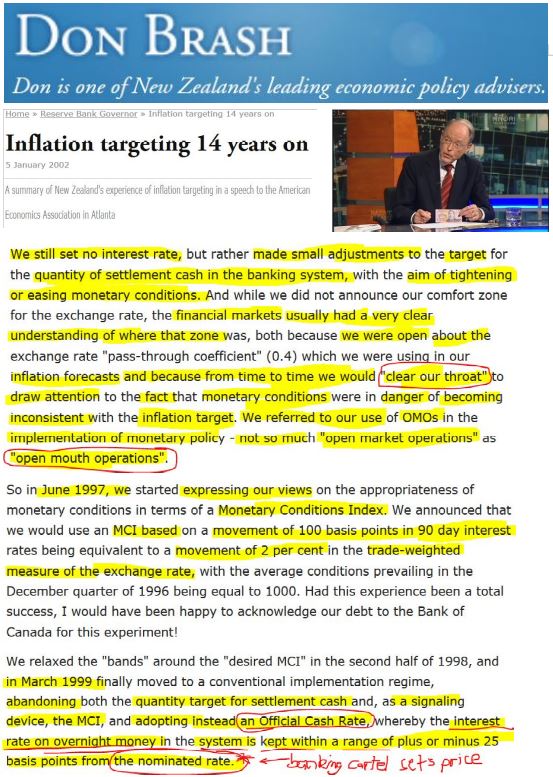

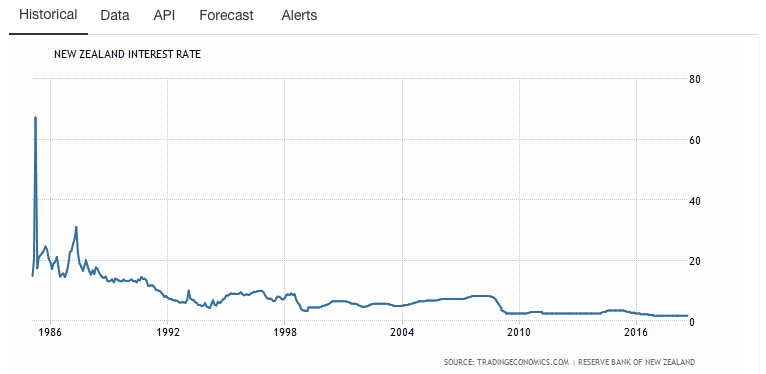

By setting the wholesale ‘lending’ rate, euphemistically called the Official Cash Rate (OCR), the Reserve Bank structurally regulates the level of new loans and, therefore, job creation or job destruction. If the Reserve Bank sets (or threatens to set) a rising wholesale ‘lending’ rate, the banking system will follow suit to raise retail ‘lending’ rates, meaning many potential borrowers won’t be able to afford the higher interest payments, and therefore will fail to qualify for the ‘loans’.

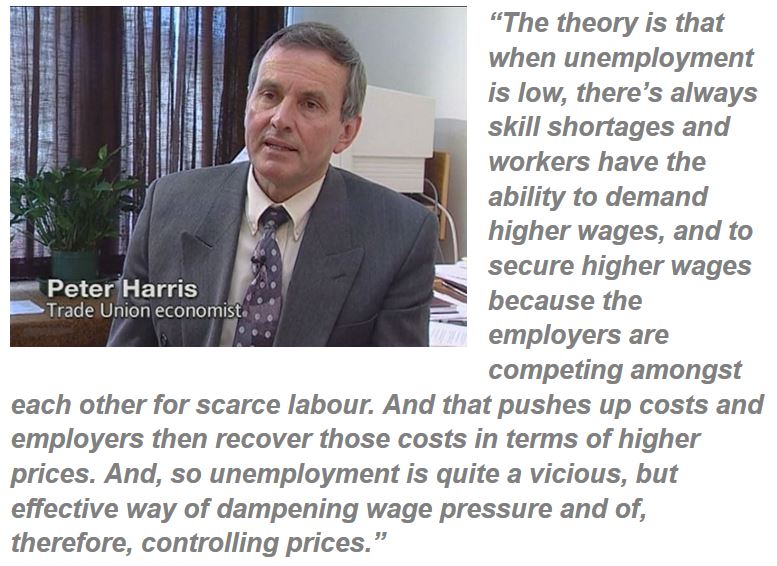

Less new ‘loans’ means less economic activity and less new jobs, and therefore rising unemployment and lower pressure on wage growth, since workers’ pay bargaining power is reduced amid more unemployed tax slaves seeking work. Wages are a major component of cost to employers and are not included in the Consumer Price Index, which measures the general inflation rate on a ‘basket’ of goods and services that households purchase. However, wages (and salaries) are tracked by the Reserve Bank to adjust the OCR if necessary and therefore cause the cartelized banking industry to make alterations to interest rates on ‘lending’.

In this way, the Reserve Bank sets an inflation target – known euphemistically as a Policy Target Agreement (PTA) – through its Official Cash Rate. The international and domestic banking cartel operating in the Realm of New Zealand mirrors this OCR, with their nightly Inter-Bank Lending Rate to settle transactions. In other words, the Reserve Bank oversees the maintenance of unemployment at a level low enough to keep wage costs down to suit Big Business Beneficiaries, while ensuring joblessness is never high enough to trigger outright rebellion, or mutiny, upon the Neo-Feudal system ‘from below’.

Because the Reserve Bank’s inflation-targeting policy works by setting the interest rate, directly or indirectly, for wholesale credit supplied to the economy from international and domestic banks, labour cost focused inflation-tageting is a key policy component for maintaining structural unemployment.

The overt purpose of controlling interest rates is to stimulate or cool ‘lending’ relative to economic activity so that cost-side inflation stays within an agreed target of 1 to 3%. The covert purpose is to manage a Shock Doctrine policy that The Snoopman calls asymmetric inflation, which encourages asset price inflation by supplying cheap credit to fund a landlord vulture culture on house flipping, an uneven commercial and infrastructure boom for the top 1% and a Tax Herd-funded expansion of the National Security State. This, in turn, produces crony capitalist class cohesion – as long as the vampiric prosperity for the rich and super-rich continues to siphon wealth upward off the host Tax Herd population and keeps landless Māori from gaining co-sovereign power arrangements.

The Neo-Feudal Crown, the Reserve Bank and Treasury inflicted a hidden structural unemployment policy in the 1980s and 1990s to drive down cost-side inflation. Supporting persistent unemployment burdens the working class – which includes the so-called middle class who need to work to survive – with unnecessary tax costs, which the rich and super-rich can avoid the tax burden with tax shelters. Persistent unemployment also inflicts personal well-being issues, inter-generational poverty and wider social problems that are better understood that the inner workings of the white supremacist Neo-Feudal Super-Rich Oligarchy and their servant Ruling Class – need I say?

In this epic strategic sabotage of industry, between 1987 and 1995, tens of thousands of New Zealanders lost their jobs. In the public sector, 62,100 people were sacked by the state, while in the private sector, manufacturing employment dropped by 30%.xvi

Where the Labour Government had hit the National’s core constituency first, the farming sector with the sudden shall fall in tariffs on imported produce, the new National Finance Minister Ruth Richardson wasted no time attacking the sacred cows that the Labour Government would not kill – welfare reform and employment contracts.

State Hemline & Trouser Alteration Welfare Services?

Yet, a Stuff News article headlined, “Budget NZ 2019: Benefits will follow wage growth in historic change” reported Social Development Minister Carmel Sepuloni spinning that “Since [1991], main benefit levels have been adjusted using the Consumers Price Index (CPI). We are now indexing main benefits to wages for the first time in New Zealand’s history.”iii

Beneficiaries were supposed to believe, evidently, that this apparent ‘hemline and trouser alteration’ was some kind of amazing invention.

But, is this merely a ‘hemline or trouser alteration’, or is this a major transference of power hidden by technocratic mechanisms?

Modelling by the Ministry of Social Development indicates that by indexing main benefits to wage growth, it is estimated that around 339,000 individuals and families will gain, on average, around $11 per week by April 1st 2023, or April Fool’s day in three years time!

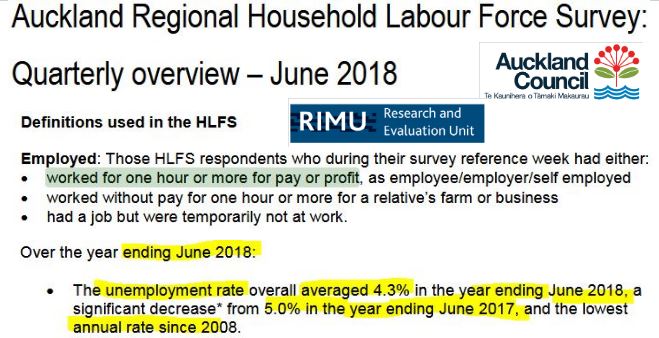

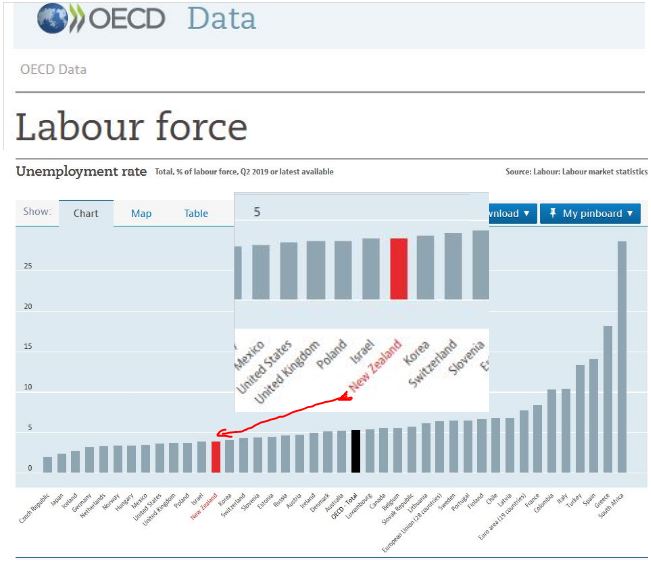

Moreover, what Fairfax Media’s Stuff News failed to ‘scoop’ then and now is that the government and councils still hide the real level of unemployment by applying the OECD standard for counting just one hour a week as employment in their Household Labour Force Surveys.

In the past five years the Key, English and Ardern Government’s have bragged that the unemployment rate has been dropping. The national unemployment figure is said to be currently 4%. However, in 2014 the New Zealand Government adopted the Organisation for Economic Co-operation and Development’s (OECD) 36-member country measure of counting as little as one hour a week as being employed. (Ironically, the OECD’s headquarters is located at Château de la Muette, Paris, which was built by Henri James de Rothschild of the Rothschild Dynasty, whom historian Niall Ferguson termed as ‘The World’s Banker’ from 1849 to 1999).

The N.Z. Government, therefore, hides the true figure behind statistical smoke and mirrors as a forms of screening actions to contrive ignorance about the root cause: its ongoing structural unemployment policy.

Because New Zealand’s central and local governments fudge the real level of unemployment in their Household Labour Force surveys, these Tax Herd-funded, elected governance bodies fraudulently construct employment statistics that make it seem that unemployment is declining.iv

This OECD’s employment threshold standard figure fudging is a screening action that sets up later unwitting misdeeds, such as high

Māori and Pacific Island poverty, incarceration, and suicide rates.

The screening actions are intentional, whether institutionally, or individually, and are performed with an ideological blinkering mask, to avoid looking, and therefore very effectively sponsors subsequent unwitting misdeeds, as David Luban discussed in his 2007 book, Legal Ethics and Human Dignity, and modelled for his paper “Contrived Ignorance”, published in The Georgetown Law Journal in 1999.ii In this case, the screening actions manifest as a ‘failure’ to count unemployment phenomena correctly, the avoidance of supplying full disclosure about the hidden structural unemployment policy and therefore why teethering welfare to wages is another screening action. In this way, inbuilt contrived ignorance screening actions ‘fail to see’ the Government-sponsored economic warfare Shock Doctrine paradigm set-ups more unwitting misdeeds that manifest as various crises in a crisis-ridden society.

Reserve Bank Cartel Management Services

🎯

The Reserve Bank Connection »»

At present, the Reserve Bank indirectly influences the level of wages by maintaining unemployment at a level averaging six percent of the workforce since 1983,i through setting the wholesale interest rate, called the Official Cash Rate (OCR), to the banking system. The banking system mirrors the Official Cash Rate (OCR) as a wholesale Inter-Bank Lending Rate to settle transactions among one another, which influences interest rates in the economy and therefore the amount of new loans created.ii By regulating the cost of credit, or interest, the Reserve Bank and the cartelized banking industry are able to vary the level of new loans created, based on the affordability of interest payments, and therefore the level of job creation or destruction.

By indirectly regulating the level of unemployment, the Reserve bank colludes with the banking industry to keep wages low to deliver bigger profits to large businesses, as well as control inflation, since labour costs are a major component in cost-side inflation.

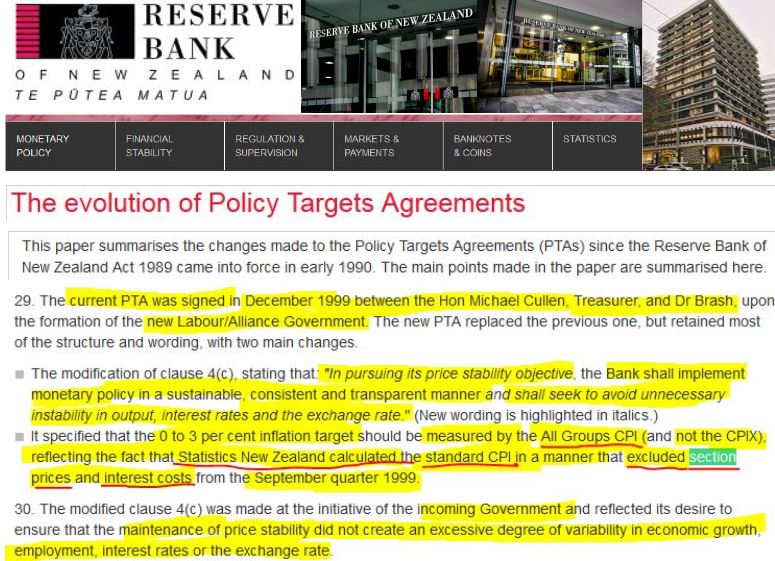

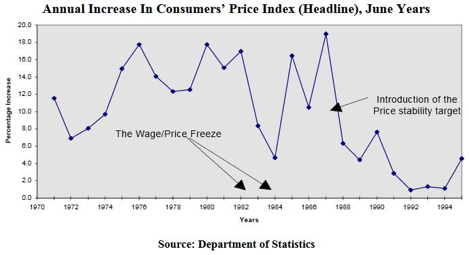

The first Policy Target Agreement explicitly set forth an inflation-targeting goal of keeping the general prices of goods, as measured by the Consumer Price Index, between 0-2% and was legislated in the 1989 Reserve Bank Act.

In 1989-1990, the Policy Target Agreement regime was sold to the public as a necessary move to get control of inflation, without saying that the Reserve Bank had colluded with the banking cartel it oversees, to maintain high interest rates in the 1980s in order to scuttle jobs en masse. Widespread job destruction was exploited as a vicious means to drive down cost-side inflation, while the rich could still make wealth amid a share-market and commercial property boom.

The Reserve Bank’s original Policy Target Agreement reached with the Crown in March 1990, included a CPI that counted housing and finance credit costs, and was called the Housing Adjusted Price Index (HAPI). But this was deemed inappropriate for monetary policy because houses were to be recast as investments. The bankers’ planned a house-flipping vulture-culture that required rising land prices be counted in asset portfolios. This Monopoly Board move meant that the interest costs of finance needed to be disappeared from the standard ‘retail’ Consumer Price Index, since credit was to be considered ‘capital’ by house-market investors.

In this way, land and finance costs were taken out of equation in general inflation measures calculated by the Reserve Bank, when New Zealand’s central bank set its inflation targets to meet its Policy Target Agreements in the mid-to late 1990s. Therefore, at a time when workers were being coerced to leave collective union agreements and were moved to individualized employment contracts with the imposition of lower wages, and while deep cuts to benefit payments were inflicted across the welfare system — the Reserve Bank removed two key components for tracking inflation costs hitting the working class, while the capitalist class enjoyed rising land prices and access to cheaper credit.

This National-New Zealand First brokered Policy Target Agreement of December 1996 shows the political awareness of the link between inflation targeting, unemployment levels and economic activity — in its explicit wording.

The Crown-Reserve Bank machinations continued into the late 1990s. Under the Shipley National Government, Statistics New Zealand began using a CPI that excluded section prices and interest costs from its measure of general inflation in the September Quarter of 1999.

From the December 1999 quarter onward, the Clark Labour Government set the Reserve Bank an inflation target of 0 to 3 percent, that measured with All Groups CPI which counted section prices and interest costs.

Meanwhile, the Clark Labour Government failed to direct Stats NZ to include these crucial living costs.

In this way, the Clark Labour Government gained a more accurate picture of general inflation across the economy, and therefore constructed an asymmetric information gap with which to escalate the Shock Doctrine economic warfare paradigm. Naturally, the Clark Labour Government neglected to inform households, unions and poverty advocacy groups that they would be essentially flying blind about the real inflation rate if they continued to rely on Stats NZ’s new standard CPI inflation measure.

In these ways, the Neo-Feudal Crown, Reserve Bank and Treasury continued to inflict this hidden structural unemployment policy in the 1990s to maintain low general inflation. This persistent structural unemployment policy continues today, despite tweaks to the revamped Policy Target Agreement (a sanitized name that hides it vicious purpose). Therefore, persistent structural unemployment was established through mass public and private job destruction.

To recap, the Reserve Bank’s inflation-targeting policy works by setting the interest rate, directly or indirectly, for wholesale credit supplied to the economy from international and domestic banks and is a key policy component for maintaining structural unemployment. Despite the revamped Policy Target Agreement allegedly seeking to achieve maximum sustainable employment, it’s ultimate goal is still to reward the Neo-Feudal Capitalist Class with cheap abundant credit to expand the wealth gap, while the working class are subjected to low wage economy rewards and disciplined with the tax burdens of a crisis-ridden society (while the super-rich thrive above).

The supply of cheap credit to fund a landlord vulture culture house flipping continues because the Ardern Labour Party capitulated to pressure from the Neo-Feudal Capitalist Class, and backed off from expanding the existing thin sliver of a capital gains tax regime.

Because New Zealand’s central bank sets its Official Cash Rate (OCR) to influence the supply of credit in an economy where cash is kept scarce, households, businesses, and governments never have enough cash to buy the things they need.

In turn, this credit availability determines job growth or decline, and therefore, the level of unemployment, which varies workers’ pay bargaining power, since labour force empowerment is determined by job supply and demand. Visible signs of poverty such as homelessness, food banks and poorly maintained houses, undermine worker confidence to demand higher wages.

This unseemly technocratic trickery gets worse.

Conjured Credit, Rigged Interest Rates & other Banker Cartel Shitfuckery

The Reserve Bank and the banking industry, which is dominated by transnational consortia, maintains a structural scarcity over ‘settlement’ cash, in order to coerce families, enterprises and public institutions to compete for credit funds that are borrowed into existence. The scarcity of actual cash relative to credit borrowed into existence produces hugely competitive structural forces as ‘borrowing’ households, businesses and local and central governments compete for the scarce cash to service the principal payments.

Additionally, this competitive struggle is amplified by the search for cash to service payments on the interest, which are really the fees charged by banking cartels to not withdraw supply of credit. When the penny drops that the interest component of a loan is not created when the electronic credit funds are manufactured with computer keyboard strokes, the scramble for cash to repay ‘loans’ amid widespread foreclosures during a market crash – becomes much more comprehensible as panic selling.

[The Biggest Scam in the History of Mankind, Mike Maloney].

Therefore, the primary driver of compounding property prices are the machinations of the cartelized international banking industry, whom all have commercial and retail banks in their global operations. The international and domestic banking industry maintains a structural scarcity over cash, with the active participation of the New Zealand Crown through the Reserve Bank and the Treasury. Cash only constitutes about 1 to 3 per cent of the total, meaning the other 97-99 per cent of the currency supply is borrowed into existence as transaction specific credit.v Indeed, the dirty secret of banking is that bank ‘loans’ are actually manufactured credit funds borrowed into existence,vi and this manufactured credit is the single major source of currency expansion in New Zealand, as senior economic analyst at the Reserve Bank of New Zealand, Gillian Lawrence, explained in a Reserve Bank bulletin in 2008, entitled “The Reserve Bank, private sector banks and the creation of money and credit”.vii Lawrence stated:

“By far the largest share of money – 80 percent or more, depending on the measure – is created by private sector institutions. For simplicity, we use ‘bank’ to refer to any institution that creates money or credit.”viii

In this way, interest is not “the price of money” – since no money that previously existed is lent. Rather, interest represents a rent or the fee for supplying manufactured credit fraudulently marketed as ‘loans’. Therefore, the banking industry’s windfall profits accumulated off the interest collections is extortionist.ix Particularly, as many New Zealanders are forced to compete in a low-wage economy for the scarce cash to ‘repay’ the conjured credit. This competition is intensified because the interest component is not created along with the principle amount of credit funds borrowed into existence.

[The Biggest Scam in the History of Mankind, Mike Maloney].

Consequently, each generation is compelled to sell homes and businesses at ever higher values just to break even because of the interest. In other words, the Crown is actively involved in the supervision of a cartel that restrains trade through the restriction of supply of an essential resource – cash. This restriction on the cash supply would otherwise be unnecessary in a de-cartelized, positive money economy where profit-autistic banks were dismantled, cash became abundant, and interest-free public credit was supplied for needed projects. To successfully transition to such a de-cartelized, positive money economy, New Zealand culture would need to become adult about valuing savings pools, cooperative time-banking systems exchangeable between communities and spearheading indigenous-led land reform to construct self-determining communities.x

Statistics NZ – The Business Mafia’s Minder of Numbers

Stuff News (and other Establishment and Independent Media outlets) also failed to report that land, including the value of residential sections, as well as credit finance costs was taken out of the Consumer Price Index (CPI) used by Statistics New Zealand during the 1990s – as mentioned above.

Since rising land prices and credit finance costs for mortgages and rents are the major components of the Great New Zealand Housing Bubble, its removal from the general inflation measure, the CPI, by Statistics NZ in September 1999, meant that unions representing Tax Herds in wage rounds were not factoring in these costs of living.

During the Key Administration, the New Zealand Government adopted the OECD standard for counting the employed, with a threshold as low as one hour a week of work – as stated above.

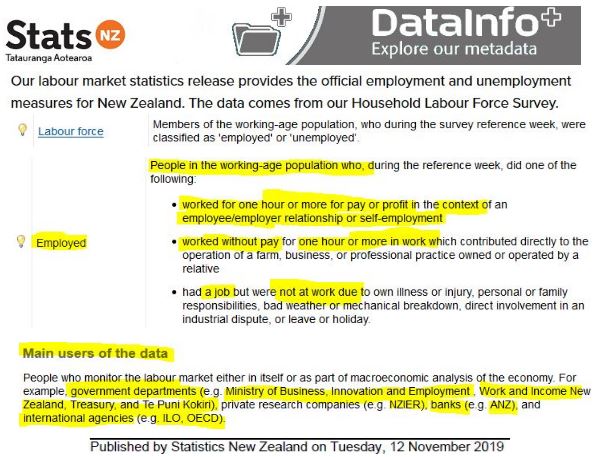

Under the Ardern Coalition Government, Statistics New Zealand’s definition of unemployment appeared to have been altered, and no longer mentions the problematic threshold of one hour a week of work counting as employed.

This Statistics New Zealand definition for counting unemployed people does not define precisely what it means by the phrase “no paid job”. No threshold, or parameters, or measures are stated.

However, a deeper look at how Statistics New Zealand counts its labour force data on its Data Info Plus webpage, shows the New Zealand Government still registers a person as employed if they report just one hour of paid work in a given sample week.

Even the recent raising of hard-won minimum wage levels have not clawed back losses in real income values as a result of rising costs of living due to sky-rocketing property prices fuelled by the Global Credit Boom, which began in 1991. Therefore, merely indexing benefit levels to wage levels is window-dressing to mask the underlying fact that working and unemployed Tax Slaves have been effectively cast as mannequins frozen in awkward poses with expressionless faces, fixedly looking wide-eyed toward a hopeless horizon blocked off by banker credit-financed skyscrapers, infrastructure road-and-railworks and dumb billboards.

In other words, over the past 20 years successive NZ governments have excluded rising land prices and finance credit costs, therefore, two major components of rocketing rents and moolah-munching mortgages from the CPI. In turn, this rocketing cost of living component has been excluded from alterations to beneficiaries’ ‘benefits’ and in wage-bargaining rounds, while transnational Big Business Beneficiaries have enjoyed extortionist profits in a moated Neo-Feudal Realm on the backs of exploited Tax Slave workers. Like a regular mafia, the Big Business Beneficiaries, as well as the Political and Technocratic Elite, know that Tax Slave workers are too meek to mutiny from their protection racketeering, even as we toil unwittingly to build-out the new enclosures, or hi-tech fencing systems that track our every move.

Since racketeering is the deceptive practice of offering solutions to problems created through concealed means to extort money, assets or pecuniary stake in enterprises, this indexing of welfare to wages is essentially a Neo-Feudal Monopoly game move that outsources solutions to low benefit entitlement levels to a central bank whose specialty is the stealthy experimental management of a low-wage economy.

Because the economy has been redesigned with in-built vulnerabilities that breach the boundaries of every household, while all industries are small and cartelized, and there’s only two degrees of separation at most between everyone, no one wants to lose a pinky. For one thing, it’s makes seeking a new job awkward, especially at the hand-shaking moment.

Benefits Indexed to Wages Indexed to Unemployment Indexed to OCR

Now, New Zealand’s Tax Slaves, which includes beneficiaries who pay tax too, are told that welfare benefits will be indexed to wage levels – which sounds like an improvement.

Except, that the Government is avoiding acknowledging its Reserve Bank keeps wages and salaries suppressed through the banking system by maintaining a universal scarcity of cash and also indirectly controls the supply of credit through the Official Cash Rate.

These monetary controls are hidden mechanisms of social control to ensure that economic dynamism does not flow into the hands of the dirt poor and working poor of the working class (which includes the lower cohorts of the so-called middle class).

Furthermore, the NZ Government plays a contrived ignorance game that its Reserve Bank maintains this universal cash scarcity and controls over credit supply as a hidden mechanisms to keep the official unemployment rate at around 6% of the Tax Slave workforce. The expansion in credit since the beginning of the Global Credit Boom in 1991 has fuelled sky-rocketing property prices. Consequently, the value of asset portfolios of the rich and super-rich have out-paced growth of real wages (which have declined).

In the documentary, In a Land of Plenty: The Story of Unemployment in New Zealand, trade union economist Peter Harris (1976-1999) explained the emphasis to control inflation, or rising costs, in order to protect the asset portfolio’s of the rich this way:

“I would see that stable prices is part of your regime for entrenching property rights. Because you can ascribe property rights, but if the value of that property is unstable, the rights themselves are unstable. So, price stability has to be seen as part of the policy agenda that is directed at defining and entrenching property rights and an exchange mechanism of those rights. That’s what we call ‘a market’.”

Naturally, the New Zealand Reserve Bank, Treasury, the successive governments have failed to fully disclose to the New Zealand public that a covert strategy of economic warfare had been embarked upon – supposedly to ‘combat’ high inflation. While it is true that the wealthy hate high general inflation – because it attacks the monetary value of their investments and increases costs to their businesses – the wealthy will tolerate it if they are making super-returns elsewhere, such as in property and stock market speculating. When it is seen that between 1984 and 1987, the pace of capital accumulation for investors and speculators was rapid and reflected in the share-market price index, which grew 140 percent – it becomes clear that the rich and super-rich are only ever happy when their gains outpace the general inflation rate.

It gets worser.

Capital Gains Tax Capitulation & the ‘Pacific Reset’

Ironically, in late April 2019, the Ardern Labour Party capitulated to expanding the minimal capital gains tax regime, especially on house flipping – claiming they lacked a mandate from the Coalition Government. NZ First vetoed an expanded capital gains tax regime.xi

There’s more to this capitulation on the capital gains tax than meets the eye.

In his February 9th 2019 One News editorial piece “Labour’s capital gains tax push is political Russian roulette”, political commentator John Armstrong outlined the massive difficulty that the Ardern Labour Coalition Government would have in getting any measure of a capital gains tax introduced into law and that it was “pretty much mission impossible”.

A comprehensive capital gains tax regime – especially on house-flipping – would have popped the house market price bubble, which would have shrunk credit availability amid falling house prices and caused panic selling, and snowballed into diving economic activity and stalled the commercial and infrastructure boom and crashed the economy.

This capitulation on the basis of a claimed lack of democratic democratic mandate is also strange, because the Ardern Coalition Government skited about its ‘Well-being Budget’ in May 2019, which failed to emphasize an extra $1 billion annual spend for the military.xii Then, on June 11 2019, the Ardern Coalition Government recommitted to a $20 billion military upgrade that the Key Administration had started in 2014, without a mandate.

Fascinatingly, NZ First’s Ron Mark, who is the Defence Minister, claimed this recommittment was part of a ‘Pacific Reset’, which appeared to be code for a pivot away from China’s influence and back into the orbit of the US-NATO military empire.xiii In other words, NZ First appears to be a broker for Neo-Feudal Capitalist Coalitions and the Globalist-focused National Security State.

Indeed, an independent security expert and former US defence and intelligence policy analyst, Dr Paul Buchanan, told The Spin-Off:

“[New Zealand is] not encumbered by … the political oversight of the military in the way that the other Anglophone nations are. The military pretty much decides where it’s going to go over the next 10 to 20 years.”

It turns out that N.Z.’s Deputy Prime Minister Winston Peters spoke of a “Pacific Reset” in a speech at the Australian think-tank, the Lowy Institute on March 1st 2018. He spoke of “a dizzying array of social and environmental problems, and one attracting an increasing number of external actors and interests”. Peters stated that “Australia and New Zealand … have never since 1945 needed each other more”.

Peters also finished his speech at the Lowy Institute repeating his key point so that it was not lost on his audience: “There has never been a time since 1945 when Australia and New Zealand need to work together more closely in the Pacific.”

Therefore, NZ First is more like a puppet-whipping policy unit working for largely unseen puppet-masters, that disciplines the wayward puppets of the ‘Ardern Theatre Company’, whom in turn specialize in fashioning window-dressing policies.

Following Peters speech, the Lowy Institute stated:

“we argued in the New Zealand International Review in March 2017, ‘changes and developments within the region’ – specifically, the growing influence of external actors, including China, resulting in an increasingly contested neighbourhood, and the emergence of a paradigm shift in Pacific diplomacy which is reshaping the regional order – ‘call for consideration of a New Zealand policy reset’.”

Six days after Peter’s speech the Lowy Institute published a follow-up opinion piece “New Zealand’s Pacific sea change”, noting that the Australian institute had published a white paper, without actually stating its title – “New Zealand’s pacific policies – time for a reset?”

This begs the question – who is calling the shots on New Zealand’s political trajectory?

NZ as a ‘Switzerland of the South Pacific’ Utopia

The Crown’s complicity in maintaining the 35 year-old economic warfare framework since mid-1984 – when the incoming Lange-Labour Government was politically captured amid an orchestrated financial crisis – remains an unacknowledged fact of successive New Zealand Governments. Before the Reserve Bank adopted its inflation targetting regime in 1989 with the Reserve Bank Act, it drove down inflation by keeping interest rates at around 20 to 30% to inflict a strategic sabotage of industries to destroy consumer demand, jobs and businesses – as Alister Barry’s 2002 documentary, In a Land of Plenty: The Story of Unemployment in New Zealand shows.xiv

During the mid-1980s, inflation was high, at 16% per annum in 1985 and peaked at 19% in June 1987 and then dropped by 6% in two months at the end of 1987 following the October 1987 Sharemarket Crash.xv Yet, between 1984 and 1987, the pace of capital accumulation for investors and speculators was rapid and this wealth accumulation was reflected in the share-market price index, which grew 140 percent, thereby outpacing the general inflation rate. This rapid asset-side inflation meant the rich and super-rich could accumulate wealth faster than the cost-side inflation rate that etched away at purchasing power.[16]

Meanwhile, from mid-1984 through to the October 1987 Sharemarket Crash, the Reserve Bank kept the wholesale lending rate, as measured by 30 day bank bill yields at between 20% to 30% per annum most of the time, with short periods where it dipped below 20%. In this epic strategic sabotage of industry, between 1987 and 1995, tens of thousands of New Zealanders lost their jobs – as mentioned above.xvi Former Reserve Bank director Suzanne Snively (1985-1992),xvii stated in Alister Barry’s 2002 documentary, In a Land of Plenty – The Story of Unemployment in New Zealand:

“It was a manageable thing for the Reserve Bank to initially use employment and unemployment as a way to get wages down. It was easier that any other means of getting inflation down. So they used it.”xviii

This capture of the public state was orchestrated for the purposes of facilitating a hostile corporate takeover of the New Zealand economy, so it could be transformed into a ‘Switzerland of the South Pacific’ Utopia.

‘Free market’ economic shock therapiesxix – which included mass lay-offs in the public and private sectors, deep cuts to public services in the provinces and individualized employments contracts – were implemented with callous rapidity. The shock treatments were, therefore, mechanisms of coercion, because all sectors of society were thrown into crisis through strategic sabotage of industries.

This economic warfare reset to make New Zealand into a ‘Switzerland of the South Pacific’ Utopia for centimillionaires, billionaires and transnational corporations was part of a broader reset called the ‘1980’s Project’. This was a blueprint to transform the world with Neo-Colonial ‘market economies’ designed at the New York-based think tank, the Council on Foreign Relations, that was chaired by Chase Manhattan bank chairman, David Rockefeller, from 1970 to 1985.xx

Brazenly, Lange Labour Government Finance Minister Roger Douglas, who was falsely credited with being the ‘architect’ of the economic shock therapies, bragged in a private dinner conversation in December 1986 that the idea behind the ‘free market’ reforms was to transform New Zealand into a Switzerland of the South Pacific. Douglas said a top strata of super-wealthy would rule and in 25 years time, most New Zealanders – including indigenous Māori – would not be able to afford to live in N.Z.

Where the Labour Government had hit the National’s core constituency the farming sector with sudden shock cutting tariffs on imported produce first, the new National Finance Minister Ruth Richardson wasted no time attacking the sacred cows that the Labour Government would not kill – welfare reform and employment contracts. When Finance Minister Ruth Richardson delivered her ‘Mother of All Budgets’ speech in the Parliamentary-debating chamber in 30 July 1991, she stipulated deep cuts to welfare payments, that were written prior to the election by Treasury and National’s shadow Minister of Finance, Ruth Richardson.

The unemployment benefit was cut from $144 to $130 a week. Minister of Social Welfare, Jenny Shipley, explained the logic that the government needed to “create the gap between work and welfare”. Significantly, the ‘30 day Bank Yields’ finally fell below 10% one day before Finance Minister Ruth Richardson performed her ‘Mother of All Budgets’ Hosting Posting Ritual in the Parliament on 30 July 1991. This ‘permanent’ penetration through the 10% threshold demonstrated ‘the market’ voted approval for deep cuts to welfare payments, the end of the state’s home-ownership support programmes, and the passage of the Employment Contracts Act, which was designed to drive down wages and therefore cost-side inflation.

To this end, pro-corporate groups such as the Employers and Manufacturers Association exist to lobby to keep wages and salaries suppressed.[36] Furthermore, the infliction of this Shock Doctrine economic warfare policy upon New Zealand was driven from overseas, through a network of think-tanks – as The Snoopman shows in “Neo-Colonial New Zealand: The stealthy forging of a ‘Switzerland of the South Pacific’ Utopia”. These included the New York-based Council on Foreign Relations, the Pan-Atlantic-Japan Trilateral Commission, the Pan-Atlantic Bilderberg Foundation, the Ango-Swiss Mont Pèlerin Society, the Australasian Tasman Institute, the N.Z. Centre for Independent Studies and the New Zealand Business Round-Table (now re-branded The New Zealand Institute following exposure of its machinations).

Because the inflation-targeting policy works as a hidden mechanism of transmission for reproducing persistent structural unemployment, its continued role as an economic warfare policy tool requires a contrived ignorance across New Zealand’s institutionally racist Pākehā-dominated Ruling Class institutions. N.Z.’s unemployment rate – which has averaged 6% from 1983 to 2014 – had had been only 1% in 1971 before the Oil Price Shocks were inflicted by what The Snoopman has identified as a Rockefeller-Kissinger-Bilderberger Nexus in his investigation, “Neo-Colonial New Zealand: The stealthy forging of a ‘Switzerland of the South Pacific’ Utopia”.

The Oil Price Shocks made New Zealand vulnerable to the corporate siege in mid-1984, that set the Realm on an economic warfare trajectory that produced a housing crisis in a city deemed to have attained the status of a Global City: Auckland.

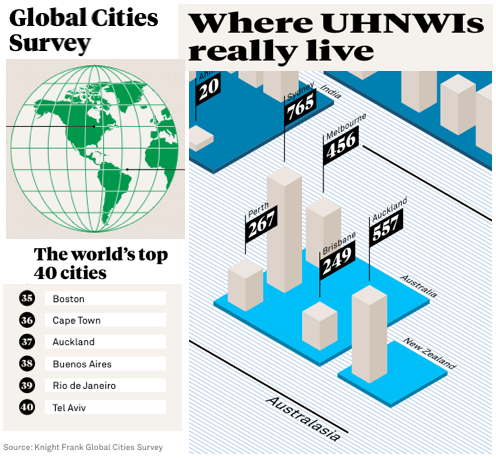

The purpose of forging Global Cities is to support the huge geographically dispersed transnational corporations, such as Fletcher Building Limited, that require jurisdictions to facilitate high capital mobility, organize public debt-funded infrastructure, and accommodate large pools of excess labour – as Saskia Sassen outlined in “The Global City: introducing a Concept” (along with other academics).liii

To this end, the Neo-Feudal institutions and individuals behind the corporate siege of New Zealand rammed through policies, processes and protocols to create structural growth pressures so that Auckland City would eventually attain Global City status. By 2015, Auckland City became ranked as a ‘Global City’ in 37th place in a Top 40 Global Cities Survey that cast Auckland as a safe-haven for 557 Ultra High Net-Worth Individuals with investible wealth of $30 million or more, as published in Frank Knight Capital Management’s Wealth Report.liv

By August 2016, the ‘City of Sails’ recorded a jump in average house prices to $1,000,000 from $500,000 ten years earlier, which meant that house prices had grown at an exponential rate of 7% per year over a decade. Applying the doubling time concept at the 7% annual growth rate – and with all factors staying constant – Auckland’s average house price was set to double again in just 5 years, reaching $2m in August 2021, and $8m in May 2025 – if all other factors had remained constant – as The Snoopman explained in his referenced primer, “In a Land of Shock Therapies: Part 1 – New Zealand as a Crisis-Ridden Theme Park”.

Without embarrassment, shame or honesty, in the past five years the NZ Government has bragged that the unemployment rate has been dropping and the national figure said to be currently 4%. Because the New Zealand Government continues to use the OECD employment measure that counts as little as one hour a week as employment, and continues to exclude land prices from the Consumer Price Index which is used by the Government to measure the inflationary rises in the cost of living, and because the Crown avoids fessing up to its history of Government-sponsored economic warfare, New Zealand’s Ruling Class public and private sector institutions are able to maintain the over-arching Neo-Feudal economic warfare framework while making just enough policy tweaks to stave off out-right rebellion.

Therefore, the adjusted Policy Target Agreement which still includes its inflation-targeting remains a coercive, exclusionary blackballing shock policy that ostracizes working class people socially from the human need to have security over their own shelter, food and other needs because they remain captured Tax Herds. By placing more control over the welfare system, employment, housing and business ownership into the hands of a Crony Neo-Feudal Capitalist Class, which is dominated by an out-of-control Neo-Feudal banking industry, the New Zealand Crown is deliberately facilitating a stealthy economic warfare paradigm. Therefore, the 35 year-old hidden state policy of ‘structural unemployment’ is a key component of the poverty crisis, itself a catastrophe borne from deliberate strategic sabotages of industry to inflict discretionary idleness.

Unseen Puppet-Masters and the Ardern Theatre Company

To sum up, the Reserve Bank has maintained unemployment at this average of 6% since 1983 by controlling the price of credit through the 30-Day Bank Yields on Treasury securities and subsequently Official Cash Rate for state credit, knowing that this rate is mirrored by the banking industry in their wholesale lending rate to one another to settle transactions.

In turn, this wholesale lending rate determines the price of retail ‘borrowing’ and therefore these interest rate levels control the amount of new loans, business growth or decline and economic activity and, therefore, employment and unemployment levels.

By gaining the capacity to index welfare to wage increases, the banking industry is gaining a stealthy transmission mechanism to vote for its policy preferences through the financial markets. As this investigation has outlined, the market voted for its policy preferences through the whole credit rates, drove interest rates downward through the 20% and the 10% barriers, when inflation came down amid widespread unemployment and policy shocks to gain control over workers and beneficiaries.

Therefore, the Ardern Coalition Government is abdicating responsibility for setting welfare benefit increases to the very institution responsible for inflicting shock therapies to the working class and welfare recipients: the Reserve Bank.

For its reprehensible part, the Reserve Bank of New Zealand manage a debt-based monetary system on behalf of a cartelized banking industry in cahoots with Treasury, whose boss is the Minister of Finance, whom is currently, Grant Murray Robertson. The revamped Policy Target Agreement, which includes indexing welfare to wage, represents a new incursion into households because its expands the financializaton of daily life that has occurred since the 1984 Neo-Feudal siege of the economy when the Lange-Labour Government won power.

While it sounds positive to peg welfare to wages, New Zealand’s central bank has the capacity to indirectly control wage levels through its all important Official Cash Rate (OCR). This official lending rate is an interest rate preference range to the banking system, which determines new loan creation based on whether loan applicants can meet varying costs of loans set by the interest payments. Because the credit supply influences economic expansion or contraction, and job creation or destruction, the Reserve Bank’s Official Cash Rate works as a hidden mechanism of social control. Therefore, the Ardern Coalition Government’s move to peg benefits to wages is, in fact, a defacto outsourcing responsibility for welfare to the banking sector, whom maintain a structural scarcity of cash to coerce households, businesses and even the central government to borrow credit funds manufactured into existence.

In the short term, beneficiaries may well get a slight increase in entitlements due to the minimum wage levels increasing after a successful multi-year grassroots campaign. However, in the long-term, this transference of power by stealth to the country’s central bank, which wittingly oversees a cartelized banking industry, does not bode well for the country’s most vulnerable. Even if the indexing is managed by the Ministry of Social of Development, the cartelized banking industry still has the power to inflict disruptions to financial markets to bend the Reserve Bank of New Zealand and the Government to its will.

Therefore, the Ardern Coalition Government appear to be making ‘hemline and trouser alterations’ to benefit levels, when in fact this move represents an accumulation of power to the banking sector over the welfare portfolio. Indeed, this technocratic mechanism is a continuation of the Neo-Feudalist shock treatment system.

Meanwhile, the cartelized banking industry, investors and the National Security State set their own policies and are not subject to democratic structural adjustments. Additionally, pro-corporate groups such as the Employers and Manufacturers Association exist to lobby to keep wages and salaries suppressed.[36]

This investigation has shown through the use of charts, statistics and other cited documentary sources – the relationship between the the inflation rate, the wholesale interest rate and the control of cash and credit supply, and how these economic indicators are actually manipulated to control the unemployment rate. The Snoopman has proven that a foreign and domestic banking cartel comprising international and local banks and the Reserve Bank of New Zealand collude to regulate the supply of credit while maintaining scarcity over the cash supply. This control of the currency supply ensures that the populace is coerced to borrow credit, which is actually manufactured by banks at the time new loans are made. The banking cartel stealthily keeps cash scarce, and regulates the amount the of credit and the cost of ‘borrowing’.

The reward for the Neo-Colonial Capitalists working cohesively as colluding cartels across all industries, is access to cheap credit, which fuels residential and commercial and rural property speculation and drives up assets values for the super-rich. By controlling these twin drivers of inflation on the cost-side and asset portfolio side, the rich and super-rich are able to keep production costs down – while enjoying excessive wealth accumulation. Therefore, the core viscous hidden mechanism of social control that maintains persistent unemployment – the control of cash and credit supply – happens through the setting of the wholesale interest rate via the Reserve Bank’s Official Cash Rate (OCR). This OCR is the fee charged buying the N.Z. dollar currency in Treasury bills (or bonds and securities). In turn, the banking cartel colludes in this price-fixing by matching its wholesale overnight Interbank Lending Rate to the OCR, and in this way, the retail interest rates throughout the banking system are broadly determined.

This interest rate on wholesale credit in New Zealand currency in turn regulates the level of new ‘loans’ made, since the affordability of credit funds is determined by the retail interest rate that banks charge for ‘loans’. Therefore, the Reserve Bank of New Zealand, Treasury and the banking industry collude to restrict the supply of actual cash so that families, businesses, and even local and central government are forced to borrow manufactured credit, pay extortionist fees termed ‘interest’ and suffer heavy taxes – that are used to service public debt to pay private interests.

Despite its ‘Wellbeing Budget’ rhetoric, the Ardern Coalition Government under reports unemployment by counting people as employed if they have just one hour of work in a given survey week – in accordance with the OECD employment measures. Because this Organisation for Economic Co-operation and Development (OECD) employment measure is used throughout the world in 36 countries, including New Zealand’s institutions such as the Ministry of Business, Innovation and Employment, the NZ Treasury, and the Ministry of Māori Development – Te Puni Kōkiri – as well as the revamped Social Welfare Department, Work and Income NZ, along with private research companies, including New Zealand Institute of Economic Research, and the cartelized banking industry – the Rich-Lister Civil Oligarchy is let off the hook.

Since oligarchies are coalitions of super-wealthy whom wield strategic control over enormous economic resources, and whom can only exist in societies with huge disparities in wealth – this low threshold for counting people as employed hides the true of level of unemployment. This 35 year-old hidden Neo-Colonial state policy of maintaining unemployment at around six percent is hidden because it is a vicious, un-mandated economic warfare policy. Because oligarchs actually thrive in crisis-ridden societies – since their corporate cartels are able to extort super-profits by controlling markets, maintaining scarcities and fixing prices, among other restraint of trade practices that suppress economic dynamism – New Zealand’s Rich-Listers are the major beneficiaries of this Deep State structural unemployment policy.

New Zealand’s Deep State maintains structural unemployment as a hidden transmission mechanism for producing low wages and salaries, so that New Zealand’s Rich-Listers and their foreign counterparts can ‘earn’ super-profits off a captive population of employed and unemployed Tax Slaves. Because most government workers whom comprise the visible government institutions of the Public State are unaware of this structural unemployment policy, the N.Z. Deep State is able to keep its distance from this and other related political kryptonite issues, and therefore maintain its illegitimate power to inflict harm against the rest of New Zealand.

The ‘Ardern Theatre Company’ maintains a contrived ignorance about these machinations and pretends it is working for the people. It is frittering away its ‘political capital’ by doing just enough to avoid mutiny from below, to satisfy the insatiable appetite for wealth, power and ego addictions from above.

It is bad enough that workers continue to get screwed by bankers restricting the supply of actual cash, controlling the supply of credit while charging interest on manufactured ‘loans’ and using these hidden mechanisms to keep wages as low as possible, while sky-rocketing land prices have been excluded from the Consumer Price Index (CPI). This inaccurate CPI measure of inflation has been used by unions in pay-bargaining rounds, with many union delegations unaware that this component has been absent from cost of living statistics since September 1999. It is worse that the Reserve Bank and the cartelized banking industry will gain the power to peg benefit rises (or declines) to wage movements.

Hardly anyone will know that bankers have gained the power to experiment with welfare since the central bank’s capacity to influence wage movements through adjustments to the credit supply are also little known. In effect, the Reserve Bank is in the process of setting up a front-company in ‘hemline or trouser alterations’ as a back-door route to screw beneficiaries.

Unless there is a sustained, serious grassroots education campaign that exposes the Shock Doctrine economic warfare paradigm that continues to be inflicted on New Zealanders, the country’s Tax Herds will not comprehend the need to move to paradigm shifting solutions to forge self reliant, self-determining resourced communities with access to land.

—– |—– —– |—– —– |—– —– |—– —– |—– —– |—–—– |—– —– |—–

See also: Discretionary Idleness: Structural Unemployment as an Economic Warfare Tool in Neo-Colonial New Zealand at:

Discretionary Idleness: Structural Unemployment as a Shock Doctrine Economic Warfare Tool in Neo-Colonial New Zealand

Neo-Colonial New Zealand: The stealthy forging of a ‘Switzerland of the South Pacific’ Utopia [A backgrounder]

Watch: In a Land of Plenty – The Story of Unemployment in New Zealand. Alister Barry (2002).

Budget 2019 surprise: Boost for beneficiaries from next April

David Luban. (2007). Legal Ethics and Human Dignity. Cambridge Studies in Philosophy and Law. https://static1.squarespace.com/static/58d6b5ff86e6c087a92f8f89/t/593dfef59de4bbf286f362c8/1497235211718/David+Luban+Legal+Ethics+and+Human+Dignity+Cambridge+Studies+in+Philosophy+and+Law++2007.pdf; David Luban. (1999). “Contrived ignorance”. The Georgetown Law Journal. https://scholarship.law.georgetown.edu/cgi/viewcontent.cgi?article=2765&context=facpub

i Trading Economics. New Zealand Unemployment Rate 1985-2018 | Data | Chart | Calendar. https://tradingeconomics.com/new-zealand/unemployment-rate

ii Snoopman. (November 19, 2018). Discretionary Idleness: Structural Unemployment as an Economic Warfare Tool in Neo-Colonial New Zealand at: https://snoopman.net.nz/2018/11/19/structural-unemployment-as-an-economic-warfare-tool-in-neo-colonial-new-zealand/

iii Henry Cooke. (May 30 2019). Budget NZ 2019: Benefits will follow wage growth in historic change. https://www.stuff.co.nz/business/budget/113093347/budget-nz-2019-benefits-will-follow-wage-growth-in-historic-change

iv Snoopman. (November 19, 2018). Discretionary Idleness: Structural Unemployment as an Economic Warfare Tool in Neo-Colonial New Zealand at: https://snoopman.net.nz/2018/11/19/structural-unemployment-as-an-economic-warfare-tool-in-neo-colonial-new-zealand/

v The Snoopman. (November 18, 2018). Secrets of Magical Credit Revealed: The Rigged System. https://snoopman.net.nz/2018/11/18/secrets-of-magical-credit-revealed/

vi Mike Maloney. (2013). The Biggest Scam in the History of the World – Mike Maloney Ep 4. Retrieved from: https://www.youtube.com/watch?v=iFDe5kUUyT0; Ross Ashcroft. (2012). Four Horsemen; The Global Financial Crisis Renegade Films. Retrieved from: https://www.youtube.com/watch?v=5fbvquHSPJU

vii Gillian Lawrence. (March 2008). The Reserve Bank, private sector banks and the creation of money and credit. Reserve Bank of New Zealand: Bulletin, Vol. 71, No. 1. https://www.interest.co.nz/opinion/77033/overview-functions-money-and-how-money-and-credit-are-created-nz-economy-examining

viii Gillian Lawrence. (March 2008). The Reserve Bank, private sector banks and the creation of money and credit. Reserve Bank of New Zealand: Bulletin, Vol. 71, No. 1. https://www.rbnz.govt.nz/-/media/ReserveBank/Files/Publications/Bulletins/2008/2008mar71-1lawrence.pdf

[9] Dr. Don Brash. (5 January 2002). Inflation targeting 14 years on. Retrieved from https://www.rbnz.govt.nz/research-and-publications/speeches/2002/speech2002-01-05

ix Ott, M. (1982, May). Money, credit and velocity. Review, Federal Reserve Bank of St. Louis, p. 25.

x Positive Money. (n.d.). How Banks Create Money. https://positivemoney.org/what-we-do/magic-money-tree/

xi Political Roundup: A capital gains tax is dead, so what will Labour do about inequality now? – NZ Herald. https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12224810; John Roughan. (22 Apr, 2019). Political capital needs to be spent. https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12223853; Dan Satherley & Lisa Owen (22 July 2017). Jacinda Ardern defends Labour’s plan to borrow billions. https://www.newshub.co.nz/home/politics/2017/07/jacinda-ardern-defends-labour-s-plan-to-borrow-billions.html?fbclid=IwAR1io-eZ41sfsvDLwP8sTFlY1-GGBRTCUt_zKdD3W8SxHdnLYFGeIVXx6yc

xii Budget 2019 surprise: Boost for beneficiaries from next April https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12235576

xiii Defence capability plan 2019 – The Ministry of Defence https://defence.govt.nz/assets/Uploads/Defence-Capability-Plan-2019.pdf; $2.3b NZDF plane deal to ‘strengthen Pacific Reset’; The Defence Force $20b spending plan includes a commitment to ‘space-based activities’ https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12239146

xiv Barry, Alister. (2002). In a Land of Plenty. [Motion Picture]. Vanguard Films. Retrieved from http://www.nzonscreen.com/title/in-a-land-of-plenty-2002 [In 5-part video segments]

xv The cumulative inflation rate from 1967 to 1984 was 520%. Tyler Cowen. (Sept 1991). The Reserve Bank of New Zealand Policy Reforms and Institutional Structure, p. 9. New Zealand Business Roundtable. https://nzinitiative.org.nz/dmsdocument/179-the-reserve-bank-of-new-zealand; Kelsey. (1995). The New Zealand Experiment.

xvi Steven Stillman, Malathi Velamuri and Andrew Aitken. (July 2008). The Long-Run Impact of New Zealand’s Structural Reform on Local Communities, p. 5. Motu Working Paper 08-11. Motu Economic and Public Policy Research. http://motu-www.motu.org.nz/wpapers/08_11.pdf

xvii Suzanne Snively is currently a director of TINZ Governance. Retrieved from http://www.transparency.org.nz/Governance

xviii Barry, Alister. (2002). In a Land of Plenty. [Motion Picture]. Vanguard Films. Retrieved from http://www.nzonscreen.com/title/in-a-land-of-plenty-2002 [In 5-part video segments]; See also: Barry, Alistair. (1995). Someone Else’s Country. [Motion Picture]. Vanguard Films. Retrieved from http://www.nzonscreen.com/title/someone-elses-country-1996

xix Klein (2007). The Shock Doctrine; Whitecross & Winterbottom. (2009). The Shock Doctrine. [Motion picture]. A Renegade Pictures/Revolution Films Production. Retrieved fromhttps://www.youtube.com/watch?v=v6yceBTf_Vs

xx Neo-Colonial New Zealand: The stealthy forging of a ‘Switzerland of the South Pacific’ Utopia [A backgrounder] at: https://snoopman.net.nz/2018/11/18/neo-colonial-new-zealand-the-stealthy-forging-of-a-switzerland-of-the-south-pacific-utopia-a-backgrounder/